Dairy Prices Lift Further, Auguring for Improved Milk Prices – O’leary

IFA National Dairy Committee Chairman Sean O’Leary today (Friday) said EU dairy commodity prices continued to lift in the last week, as reported by the EU Milk Market Observatory and spot quotes from the main Dutch, German and French organisations.

He said this is further evidence that the pull back in supply, which has been happening in recent months was persuading buyers to buy now that milk is getting scarcer and products can only get dearer. This, he said, should encourage co-ops to build on their June decision to hold their base milk prices, and to soon set about returning improved market returns as promptly as possible.

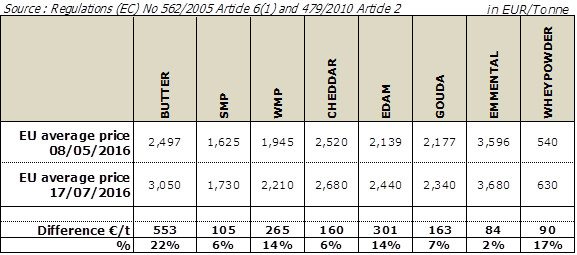

“This week in the EU MMO quotes, the average EU butter price has breached the €3000/t ceiling at €3050/t and SMP is now over €30/t above intervention at €1730/t. WMP, all the main commodity cheeses including Cheddar and whey powder are also further on the up. These are very significant increases in the last 10 weeks, with butter up 22% and even problematic SMP up 6% over that period,” Mr O’Leary said.

“By our calculations, these improved prices would return, for an Irish product mix, a gross 29.2c/l before deduction of processing costs, which could yield a farmer price of 24.2c/l + VAT (25.5c/l incl. VAT).

“Spot quotes, which indicate market trends, are also well up in the last week, with average Kempten (Germany), PZ (Netherlands) and Agrimer (France) quotes up €53/t for butter, €15/t for SMP, and €10/t for whey powder compared to the previous week,” he said.

“Global dairy prices are also rising, with Oceania and US quotes all up in recent days,” he added.

“It is clear that we are witnessing a long overdue recovery after more than two years of a market slump in global dairy prices. Dairy farmers will need both the financial fillip of improved milk prices to replenish their badly stressed cash flow, and the confidence boost that these will bring with them,” he said.

“It is essential that co-ops would now take stock of the outlook for dairy markets over the coming months. Bearing in mind their suppliers’ cash flow situations, they must build on their June price decisions by budgeting into the coming months for the promptest possible return back to farmers of the now significant commodity price improvements,” he concluded.