Dairy Market Blog

[vc_row][vc_column][vc_column_text]Supplies slowing or falling – but still some way to go towards balance

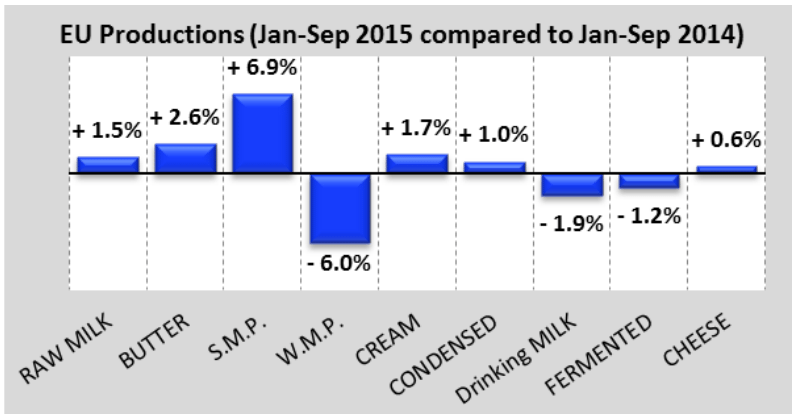

Output in the EU continues to grow at moderate level (+1.5% Jan-Sept), mainly due to strong uplifts in mid-tier countries such as Ireland (+9.9%), the Netherlands (+4.6% for the period, and +11.4% for October alone), Poland (+2.2%) and the UK (+1.5%).

Growth in the bigger countries (Germany and France) is modest or negative. In fact week ending 15th November was down 0.5% in France (though 2.5% above the last 5-year average). Cow culls in France (suckler and dairy) are up over 10% compared to Sept 14.

In Germany, production is growing by 1.5% for the week ending 9th Nov compared to the same week last year, but down on the previous week. The overall picture in Germany for the year to September suggests production back by 0.5%.

Most of the other countries’ production is static or down. With the exception of Ireland, other EU member states that are growing production are doing this more slowly than in earlier months. SMP and butter production have benefited most from the increased output, with WMP falling back dramatically.[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_column_text] Source: EU MMO[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]Global milk production for the period has risen only 1.1%, slightly slower than previous month, but significantly driven by EU output growth.

Source: EU MMO[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]Global milk production for the period has risen only 1.1%, slightly slower than previous month, but significantly driven by EU output growth.

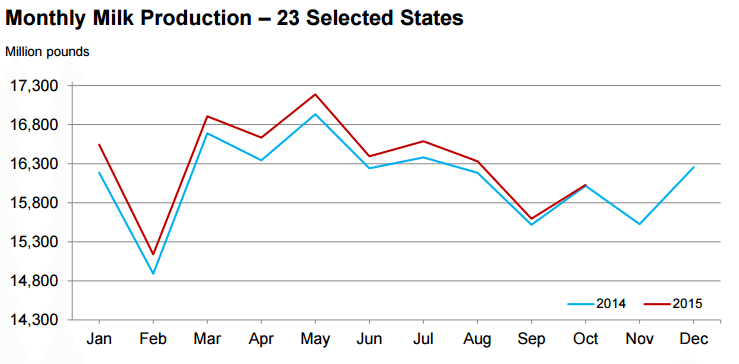

US output was only 0.1% up for October 15. Cow numbers are down 1000 at national level compared with September 15 – though up on Oct 14 by 32,000, and there was a very small decrease in per-cow yield. This reflects continued drought in California, where increasing acreage is being diverted from dairy towards nut farming (less demanding on water resources).[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_column_text] Source: USDA/NASS[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]The USDA/WASDE 10th November report reduces the milk production forecast for 2015 to 1.3% up and for 2016 to 2% up because the dairy herd is expected to decline more rapidly from its second-quarter peak and growth in milk per cow in 2015 remains slower than expected.

Source: USDA/NASS[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]The USDA/WASDE 10th November report reduces the milk production forecast for 2015 to 1.3% up and for 2016 to 2% up because the dairy herd is expected to decline more rapidly from its second-quarter peak and growth in milk per cow in 2015 remains slower than expected.

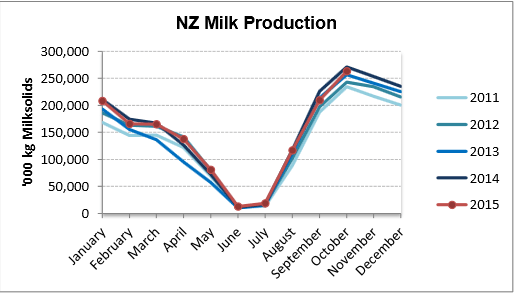

NZ production was down again in October, but only by 2.7%, not quite as steep a fall back as for September, which was down 7.2% on Sept 2014. Cow cullings are slightly back according to the NZ Meat Board. For the week ending Oct 31st a total of 8,258 cows were slaughtered, down 24.3% on the same week last year. The NZ Meat Board figures include the weekly kill from the combined beef and dairy herd.[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

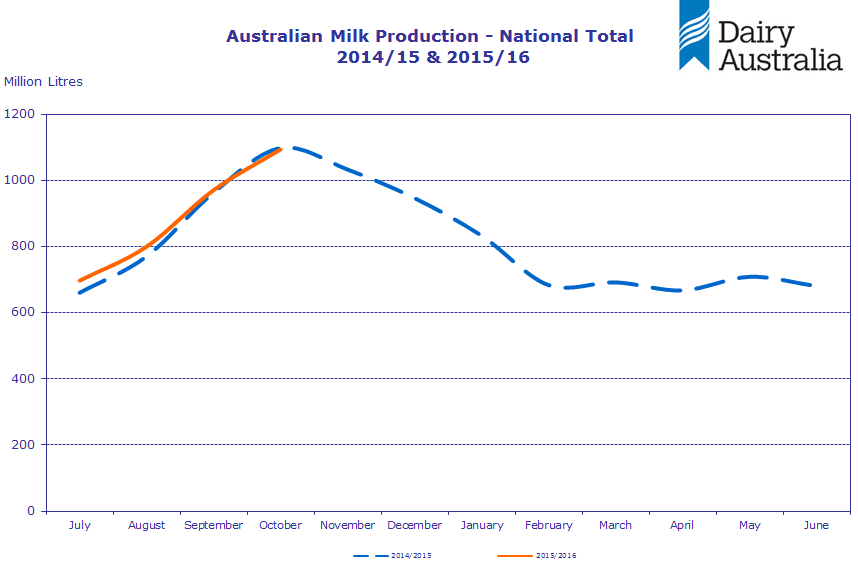

Source: DCANZ[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]Australian output was down 0.4% in October, the first time this season production fell below previous year level.

El Nino is creating serious moisture deficiencies in most Australian regions. Parts of Western Australia, South Australia, Victoria, New South Wales and Tasmania were impacted, with records set in Victoria and Tasmania.

By September, 50% of Victoria was affected by severe rainfall deficiencies at the 14-month timescale, according to the Bureau of Meteorology, with serious deficiencies also impacting parts of Tasmania, South Australia, and Western Australia. El Niño continues to strengthen, and is expected to peak around the end of the year, weakening rapidly into the first quarter of 2016.[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_column_text] Source: Dairy Australia[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]Stocks continue to build

Source: Dairy Australia[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]Stocks continue to build

Stocks have been building due to higher output over recent months and sluggish demand.

However, SMP intervention buy in have reduced to a trickle in the last month, and intervention stock to mid-November amounts to 23,638t.

Quantities of butter going to APS have reduced significantly in the last month. Total intake since Sept 2014 (Russian ban) is 156,000t, but with significant movement in and out, current (mid Nov) stock stands at around 85,000t. FCStone expect end of year stocks to fall to below 80,000t.

SMP APS, both old and new regime, have been used less in recent weeks, though Ireland has just returned to utilising the scheme with 288 tonnes put in w/e 22nd Nov . Total offered under both schemes 59,010t. Old regime stock stands at about 25,000t, while new regime offerings (and as none have exited yet, stock) amount to 3,154t. Current total SMP APS stock is 28,000t approx. FC Stone expect the old regime SMP stock to end the year at around 25,000t.

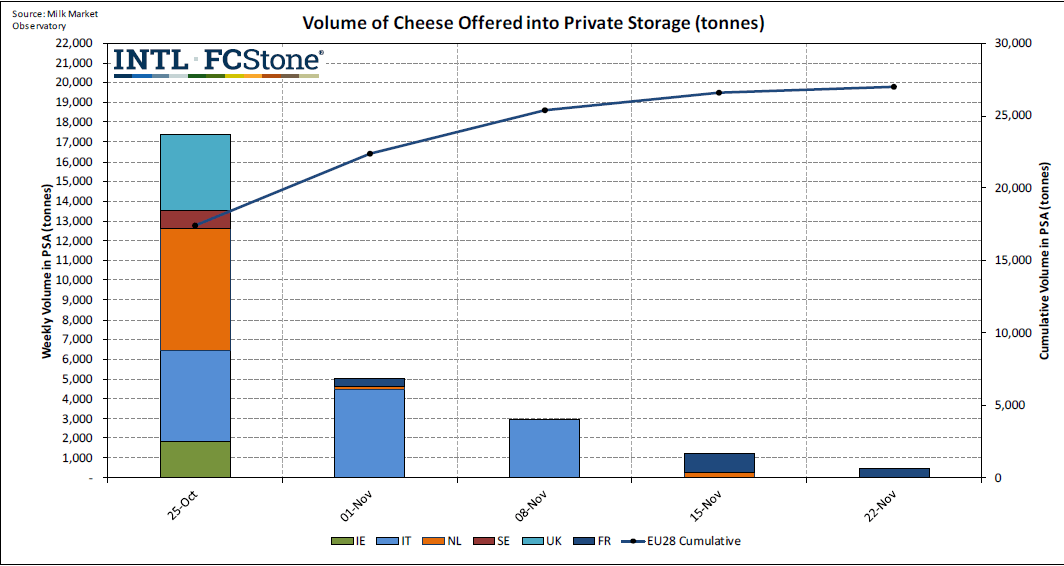

Cheese volumes into APS dropped again, with a total of 411 tonnes of cheese was offered in last week, down 63% on the 1,197 tonnes offered a week earlier. France was again the largest contributor with 396 tonnes (90%), with the Netherlands the only other contributor, offering 45 tonnes. The cumulative volume now stands at 27,005 tonnes, of which Italy is the largest contributor with 12,015 tonnes (44%), followed by the Netherlands with 6,631 tonnes (25%).

Ireland, Italy, Sweden and the UK have reached their maximum admissible volume. France has currently offered just 8% of its maximum admissible volume, while the Netherlands has reached 81% of the 8156 tonne cap.

The provision which obliges member states to make available what quantities they have not used after 3 months will kick in when the three months have expired, which might allow Ireland to utilise the scheme further.[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_column_text] Source: FCStone based on EU MMO[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]US SMP stocks are reported by CLAL at 96,000t for September 15 and at 81,000t for butter for October 15.

Source: FCStone based on EU MMO[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]US SMP stocks are reported by CLAL at 96,000t for September 15 and at 81,000t for butter for October 15.

Anecdotal reports of significant quantities of stocks, especially of SMP, from New Zealand and elsewhere tally with reports of “distress” price sales of powder, especially on African markets.

Demand rising in run up to Christmas

Thanksgiving and Christmas are events that are always good for dairy consumption in the Western World. In 2015/16, a further 3 positive events will cram into the same 6 month period, namely New Year, Easter and an early Ramadan.

There is already some evidence on UK spot milk prices that the pre-Christmas period is raising them to 20-21ppl (around 30c/l).

The factors restraining demand continue to apply: low oil prices, continuation of the Russian ban, and lower involvement of China. Chinese SMP imports, while they appear to be picking up in recent months, remain below previous year level.

Meanwhile, Mexico has now emerged as a bigger importer of SMP than China, buying 12% more than the previous year, 148,400t in the year to August 2015. Malaysia has overtaken Indonesia to become the third major importer of powder, up 24% to 96,800t for the year to July.

On the other hand, Algerian imports were down 17% in the first 6 months of the year, and the most recent powder tender, which was expected to buy 30-40,000t only purchased less than 20,000t – the effect of lower oil revenue.

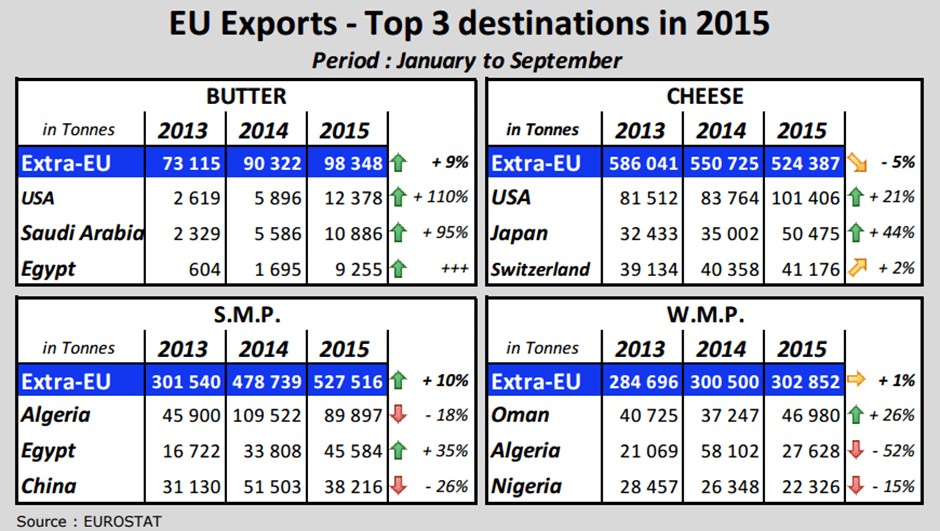

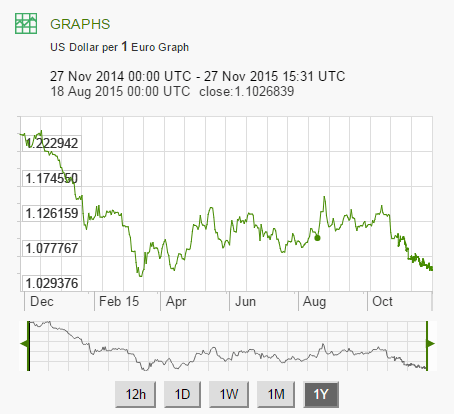

Demand for EU butter and SMP on third countries was up massively (9 and 10% increase in exports respectively), with WMP demand only up marginally at 1%. Cheese exports were down 5%. The competitiveness of our exports was strongly supported by a weak Euro (see below).[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_column_text] Source: EU MMO[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]Currency weakness continues to work in our favour

Source: EU MMO[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]Currency weakness continues to work in our favour

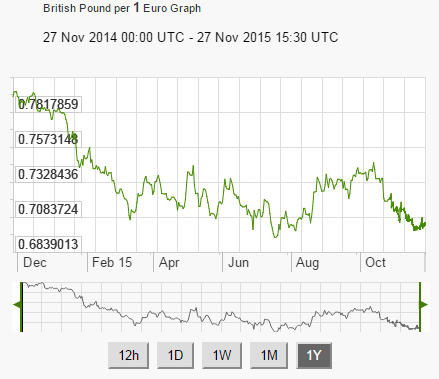

The refugee crisis, the terrorist attacks in Paris and security situation in Belgium seem to have overtaken the concerns over Greece in the factors that keep the Euro relatively weak.

The prospect of the in-out referendum in the UK, which is to happen before 2017 and could lead to Brexit will potentially also remain influential. While the UK is not part of the Eurozone, uncertainty over its continued membership of the EU would be seen as destabilising for the currency.

The weak Euro against both Sterling and the US$ – as well as lower prices – has helped massively increase EU dairy exports.[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]Global dairy prices – GDT’s third negative auction

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]Global dairy prices – GDT’s third negative auction

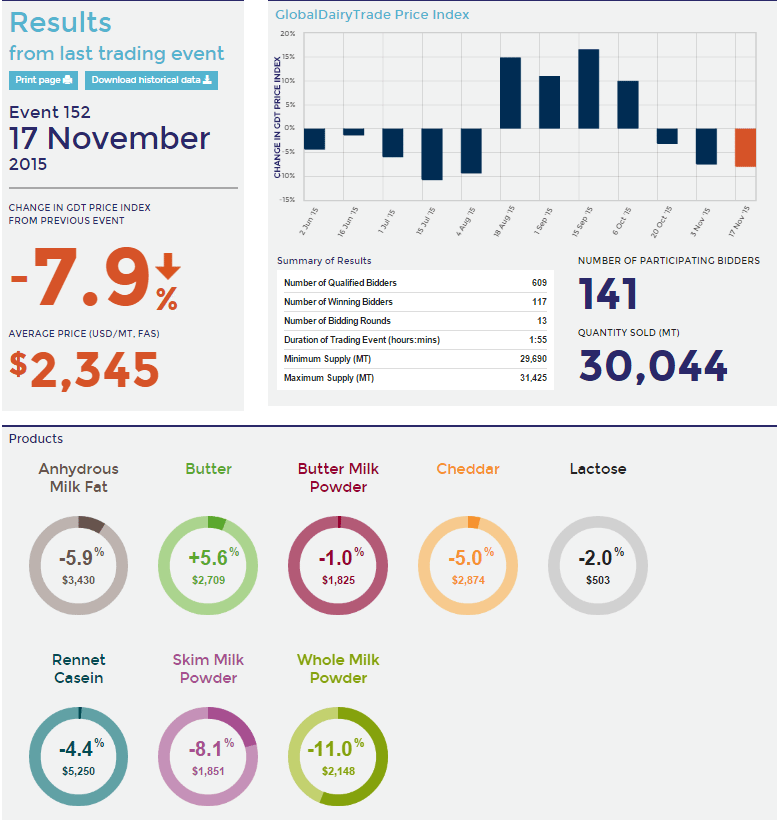

GDT is not necessarily representative of “real” trade, and many have pointed out that it is open to volume manipulation by sellers, especially Fonterra.

However, it remains one of the few price discovery mechanisms based on actual trade of products, and the only one whose results become known by all in real time. It therefore has huge impact on market sentiment for buyers, sellers and commentators alike.

The 17th November auction saw a weighted average price index fall of 7.9%, with only butter rallying by 5.6%. The most influential product in tonnage remains WMP, whose price fell 11%, with second most important SMP which fell by 8.1%.[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_column_text] Source: GDT[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]The next auction is due on Tuesday 1st December, and its likely outcome is unclear. A week ago, WMP NZ futures were picking up on the basis of expected lower output. However, reports of lower culls in recent days, and the expected end of El Nino in Spring (their Autumn) has led to a slight dip in future contracts for the December 15 to May 16 period.

Source: GDT[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]The next auction is due on Tuesday 1st December, and its likely outcome is unclear. A week ago, WMP NZ futures were picking up on the basis of expected lower output. However, reports of lower culls in recent days, and the expected end of El Nino in Spring (their Autumn) has led to a slight dip in future contracts for the December 15 to May 16 period.

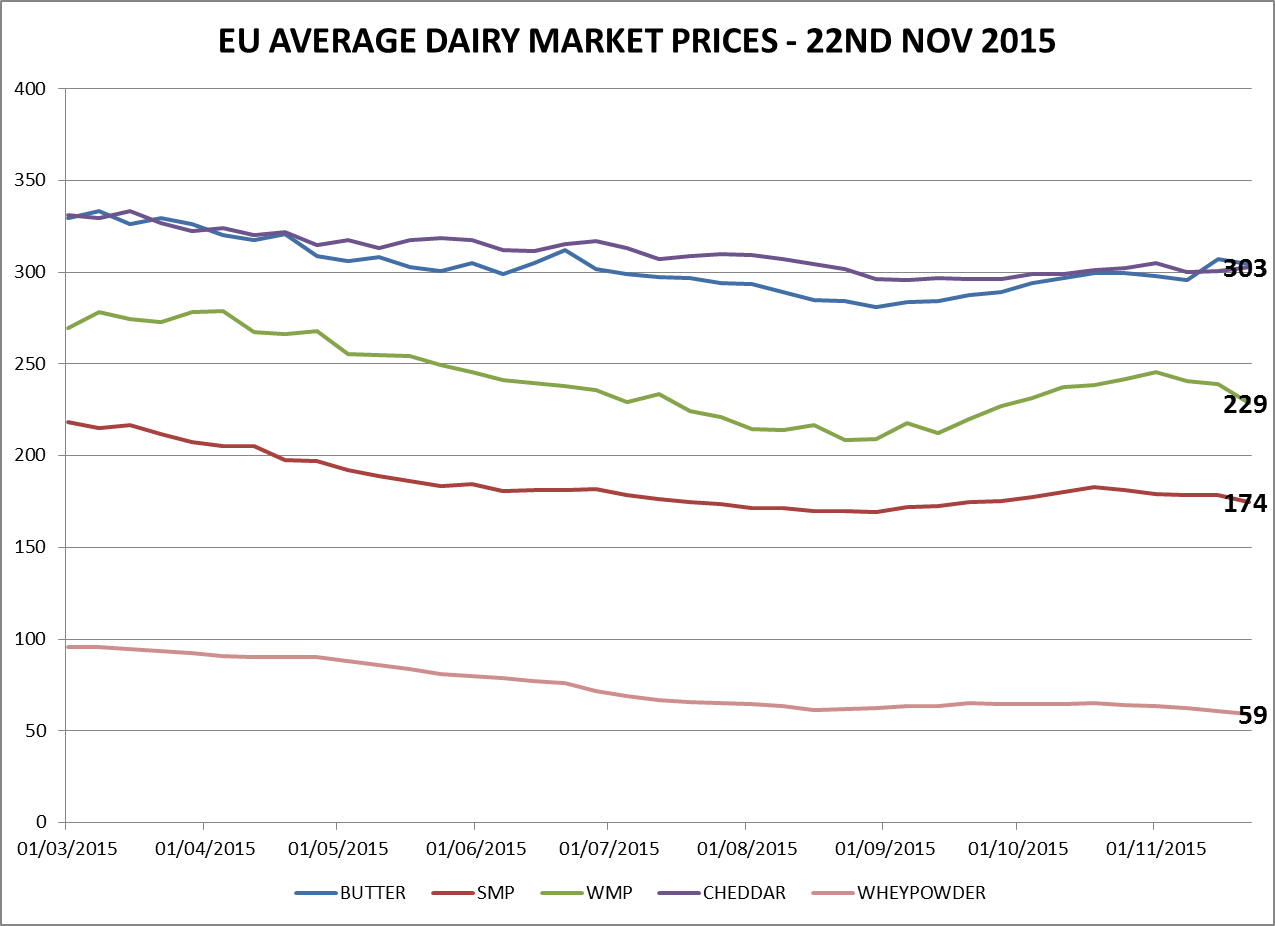

EU dairy prices – mixed, but mostly easing

EU dairy commodity prices had been picking up slightly in October and there has been some easing in November, as is evident in the graph below. Recent milk powders prices have eased in light of continued strong production (see graph at top of blog), while butter prices have been more mixed (different trends in different countries).[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_column_text] Based on EU MMO data[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]EU returns slightly easier, but still around current milk prices

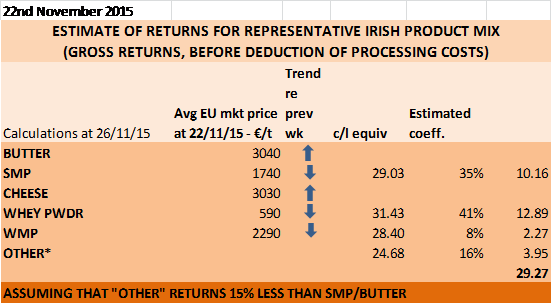

Based on EU MMO data[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]EU returns slightly easier, but still around current milk prices

With the exception of butter and cheese, prices have eased a little in the last week. At just over 29c/l gross, current EU returns for the main basic commodities are not far off the prices currently paid by co-ops in Ireland.[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_column_text] Based on EU MMO data[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]The Ornua PPI for October, only 0.5 points down on September at 90.1 points, equivalent to just under 26c/l incl VAT at 3.3%f 3.6%p, continued to justify holding current prices, and this is what most co-ops have done. The exception was Carbery (West Cork co-ops), but this was after holding their price for the four prior months.

Based on EU MMO data[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]The Ornua PPI for October, only 0.5 points down on September at 90.1 points, equivalent to just under 26c/l incl VAT at 3.3%f 3.6%p, continued to justify holding current prices, and this is what most co-ops have done. The exception was Carbery (West Cork co-ops), but this was after holding their price for the four prior months.

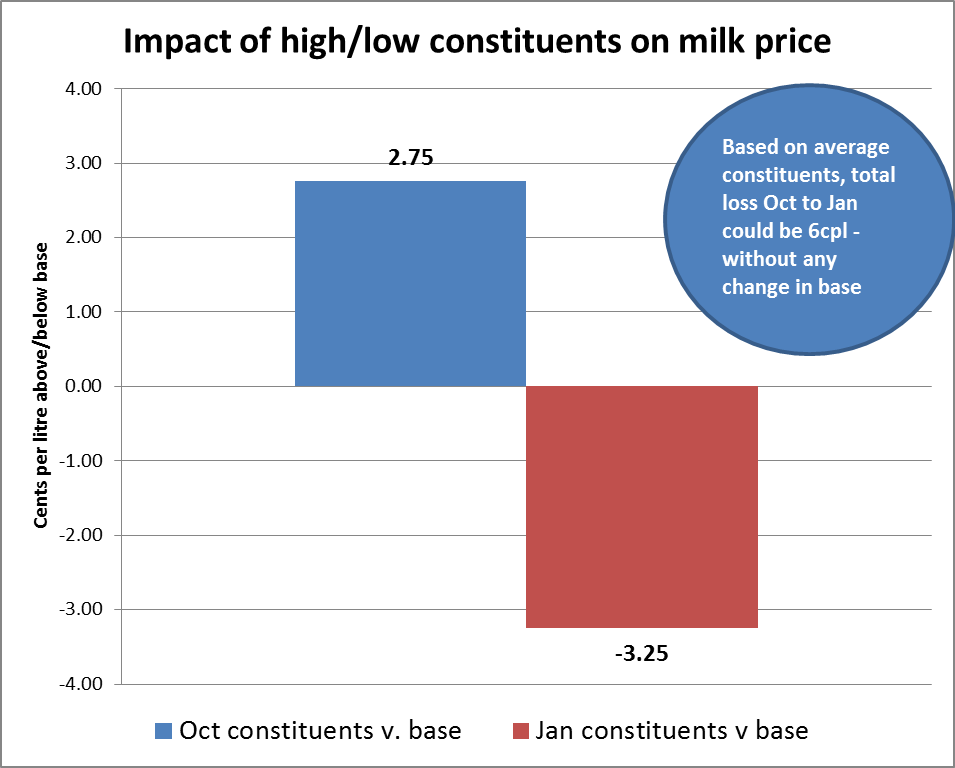

The real concern for all dairy farmers is next spring, because thus far, milk cheques have camouflaged poor milk prices with high constituents and strong volumes.

In a very simple analysis, we have shown that, even if current prices do not change between now and January, the price received for every litre by farmers, at a current level of 25c/l incl VAT for 3.3% protein and 3.6% butterfat, could be 6c/l down on its current level, because of constituents alone.

To calculate this, we have used the average constituents for the last 5 years for October and January as recorded by CSO. October constituents are on average 17.4% above base, while January sees them fall by 9%.

This should be food for thought for co-op boards in early December, when they set about deciding on the November milk price.[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_column_text] Based on CSO data[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]CL/IFA/27th November, 2015

Based on CSO data[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]CL/IFA/27th November, 2015 [/vc_column_text][/vc_column][/vc_row]

[/vc_column_text][/vc_column][/vc_row]