Dairy Market Blog – 1st April 2020

Coronavirus affects markets in positive or negative ways – depending on whether you sell retail consumer product or not

Before the COVID-19 pandemic, dairy markets were headed for a positive 2020: modest milk supply growth, solid demand.

Things have changed, but not all for the bad. We have seen a dual market impact to the outbreak of COVID-19: on the one hand, panic buying and a return to cooking at home have boosted retail sales in a significant way. Though it must be said that even the initial stock piling has eased, and may militate against further purchases as the home stocks are consumed first.

On the other hand, the closure of restaurants and cafes has meant food service sales have crashed. I remember a statement by Starbucks some years ago that they had just reached the point where they sold more milk than coffee, globally. Losing the coffee shop sector alone is a major blow to the sector.

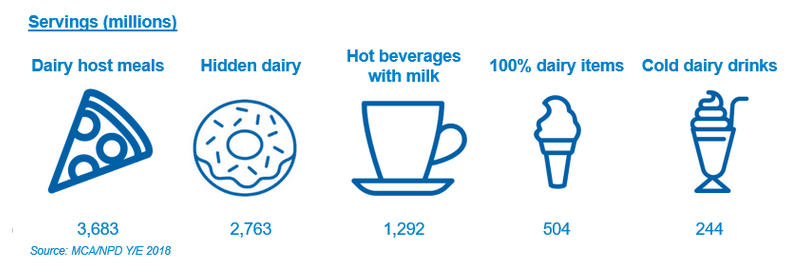

The graphic below illustrates well the importance of the food services market to the dairy sector.

A study by AHDB Dairy UK in 2018, came to the conclusion that 51% of all meals eaten out in the UK included dairy, in either of the formats below, from dairy host meals (e.g. pizza or other take away), dairy as a (hidden) ingredients, hot beverages with milk, pure dairy as in ice cream or cold dairy drinks.

Source: AHDB Dairy UK

For dairy sectors which are mostly engaged on the domestic market, extra retail sales as people now eat and cook at home may have partly offset the food services downturn – indeed, there is some evidence that Irish milk processors involved in liquid milk are coming under pressure to ramp up volumes for retailers, which is a positive.

However, for most of the Irish dairy sector, which is export and business-to-business oriented, retail sales are not saving the day.

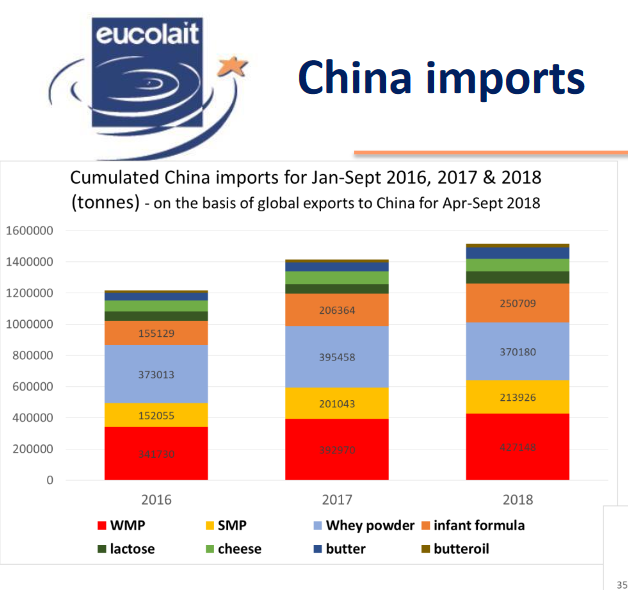

For exporters, there was also a significant physical disruption in trade caused by containers  becoming stuck at ports, in China especially, either full or empty, but blocked in situ when lockdowns were preventing any work being carried out. This has shown on Chinese powder imports especially (see below). The situation was such that containers for global trade of ANY product were impossible to secure, with up to 6 weeks waiting times, and at significantly higher freight costs.

becoming stuck at ports, in China especially, either full or empty, but blocked in situ when lockdowns were preventing any work being carried out. This has shown on Chinese powder imports especially (see below). The situation was such that containers for global trade of ANY product were impossible to secure, with up to 6 weeks waiting times, and at significantly higher freight costs.

There are now signs that containers are moving again, but there are also concerns over product still in transit or storage having to be dealt with (consumed, or disposed of where the shelf life has to little to go) before any trade in fresh product can resume.

In addition, we have seen a lot of disruption even closer to home with border closures in Europe, though this has been somewhat mitigated by all European government and the EU instances agreeing to treat the food chain from farm to fork as an essential sector.

Stock have been building up, and food wastage has increased with a very sudden closure of the food services market either as a result of social distancing, or simply by mandated decision.

One other element to the disruption are shortages of inputs of which China would have been the source: certain food or feed ingredients, crop protection products, etc. This has lifted the cost and reduced the availability of some of those products, to the detriment of the farming/food producing community globally, including in Europe.

The upshot of these major disruptions and the uncertainty created by the sheer overwhelming nature of the pandemic have led to dramatic falls in the world’s stock markets, in economic growth forecasts – some frankly catastrophic, possibly too much so! – and to negative price trends for the majority of commodities, from oil to food.

What’s happening to milk output?

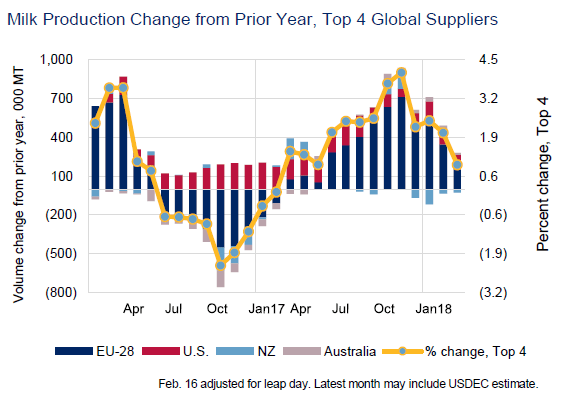

Meanwhile, milk production globally is not expected to grow by much more than 1% against the 5-year average, according to Bord Bia.

2019 deliveries globally were only about 0.1% on 2018.

While there is some greater dynamism in the early months of 2020 in Europe and the US as the spring peak approaches – and how the spring output turns out in those two regions, with lower feed costs reported, will be crucial to global markets – it is somewhat offset by the impact of drought in the NI of New Zealand.

The EU lifted output by 1.7% in January, while the US February supplies are up a whopping 5.6% for February.

Source: USDEC

Dairy imports into China

In its latest report, CLAL shows better than expected results for dairy imports into China, especially from the EU. Overall while total volume was down by 1.9% for the first two months of 2020 (slap bang in the middle of the COVID19 pandemic in China), value is up 3.8%. However, as the table shows, this is a mixed picture. Milk, cream, butter, cheese and whey powder have seen continued significant increases, albeit mostly from relatively low volumes.

Powders, on the other hand, are well back: WMP down nearly 5%, SMP nearly 25% back, and fat filled powder down 34% – though the latter also from low volumes.

Infant formula is down by 1.6%.

Source: CLAL.it

Green shoots in Asia?

The COVID-19 pandemic has been such a catastrophic and global event, it is very difficult to predict anything. However, there are interesting signs coming from China. As it seems the country is slowly starting to come out from under the pandemic, towns which had been mandatorily locked down like Wuhan are being re-opened to quasi normal life. Food imports have been prioritised by government. Many operators report containers moving again, and therefore becoming available for trade.

Restaurants in Japan and Korea are reported to have reopened, which is a good sign, but business is most definitely not back to normal.

Chinese consumers are also starting to run out of imported infant formula. There was a lot of stockpiling in the early days of the outbreak, and stores are now out of stock, while consumers are back demanding product. EU suppliers supply 71% of all China’s IMF imports, with France and the Netherlands supplying the largest volumes, but Ireland not too far behind.

As food imports are been green-lighted by government as Chinese trade and business progressively returns to something approaching normal, this should in time benefit milk powder trade, and Irish infant formula manufacturers, with positive impacts for the Irish dairy sector.

Lower commodity prices and weaker market returns

We have documented in recent months just how global milk supplies had grown only modestly and stayed very much in tune with reasonably good demand. The COVID19 crisis is causing a demand shock, but at a time when supply is moderate – which would not have been the case, say, when the Russian ban hit back in late 2014. This will hopefully allow for a quicker market recovery when the pandemic ebbs and trade returns towards normality in coming months.

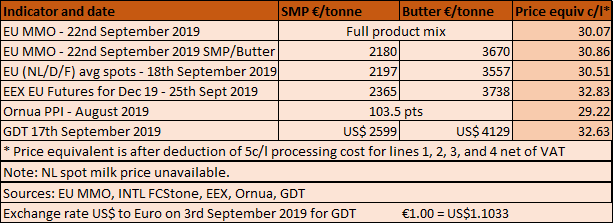

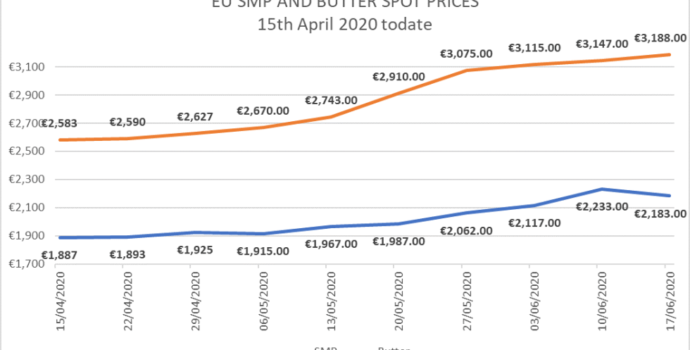

Meanwhile, commodity prices have been affected by the trade disruption and demand shock caused by the collapse of food services.

The table below shows that average EU average returns from product combinations relevant to the Irish product mix have come back by between 2.5 and 3.6c/l equivalent since early January (at which point they were on an upward trend). Spots for SMP and butter have come back further (4.6c/l), and this week’s trend for the Dutch products suggest further price decreases. It is worth noting that an index such as the Ornua PPI, which reflects a combination of forward contracts, branded consumer products and other elements, has offered a good buffer against the short term trends – in fact, the Ornua PPI had been firming to February. It is also worth reminding ourselves that the majority of co-ops have undershot the PPI for 18 months or more in the milk prices they have paid farmers.

However, as we write, the Ornua PPI for March is not yet available, and chances are that it will start to reflect a more difficult price situation, while still providing a buffer relative to the other indicators.