€7000 Comes off Farmer’s May Milk Margin Even Without May Price Cuts, IFA Case Study Finds

IFA National Dairy Committee Chairman Sean O’Leary said an IFA case study has shown that a producer who started out with 400,000l output in 2013 and increased his production in line with national output growth to date would, even assuming no further milk price cut, lose €7,181 from his May milk margin compared with May two years ago.

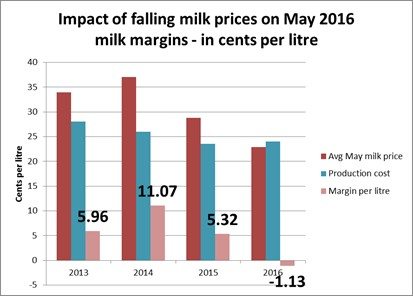

This means the producer would be in the red by €744 in May 2016 because his milk price falls 1.13c/l below his production costs for this month. Superlevy deductions will compound the problem, and Mr O’Leary called on Minister Creed to take immediate action to stop those deductions.

“Our calculations are for a farmer who grew relatively organically, on par with national growth of 4.5% in 2014, 13.09% in 2015, and we have assumed growth of 7% for 2016. Any farmer who made a significant investment will be faced with much higher costs, and their losses will be proportionally higher. Also, the remuneration of the farmers’ own labour is not included as a cost by Teagasc in the National Farm Survey,” Mr O’Leary said.

“I understand that markets are challenging, with only limited signs of improvements – and those unlikely to take hold for some time – but farmers simply cannot take any further pain. Every cut now sinks them further into the red, damaging their families’ livelihoods and the potential of the entire dairy sector. The industry needs a better strategy than one which relies on all the risk being imposed on the farmer, and I will continue to press for this around the Ornua Board table and with co-ops” he said.

“To compound the problem, Superlevy deductions for farmers who signed up to the three-year repayment scheme have started to be taken from the April milk cheque, and will continue into May and other peak months. Minister Creed must suspend those immediately,” he said

“He must then introduce, as intended by the EU Agriculture Council’s March decision on state aid, short-term loans designed to relieve cash flow pressures from Superlevy, merchant credit, and other debt,” Sean O’Leary concluded

Case study

- Farmer produces 400,000l in 2013

- Grows output on par with national growth through to 2016 (+7% assumed for 16)

- April output value based on national output for that month

- Milk price for May 13 to 15 = simple average FJ League for those months (estimated for May 16 on the basis of no further cuts from April )

- Production costs as per Teagasc for 2013 to 15 – increased to 24c/l (from 23.3c/l) for 2016 forecast published Dec 15 to reflect harsh 2016 spring

- All prices net of VAT

- May data assumes no further milk price cut from April