Domestic Market

After a very difficult harvest, the majority is now finished, however there are pockets of spring crops still to be finished along with most of the beans. Yields have remained very variable. Some of the Spring barley crops were promising good late yield potential, however the continuation of the broken weather scuppered this hope for a lot of farmers.

It is likely that the total Irish main cereal harvest will come in somewhere between 1.9 and 1.95m tonnes. While total barley and oats tonnage are down on last year, the real hit is on wheat, which will be down over 200,000 tonnes on 2019.

Grain prices have risen again by €3 to €5/t, with green harvest prices for barley and wheat in the range of €148- €151/t and €170 – €172/t respectively. Prices have again moved on the basis of reduced local supply and increased international crop prices.

Over in the UK, the further weakness of sterling has made UK barley more competitive on international markets. However, due to the major reduction in wheat production, the UK will not have the same barley surplus for export as last season. To date, there appears to be no panic selling for export, on fears of a potential no trade deal. UK Barley is currently trading at nearly a 25% discount to wheat, compared to a five- and 20-year average of 7.5%.

This week was the final date for the malting barley price model on the FOB Creil. The final settlement price for any malting barley supplied which was not forward sold will be €173.73/t.

Irish Native / Import Dried Feed Prices 17/09/2020

| Spot €/t | Nov 2020 €/t | |

| Wheat | 200-202 | 202-205 |

| Feed Barley | 177 | 179-182 |

| FFOB Creil Malting Barley | 177 | |

| Oats | 160 | 160 |

| OSR | 375 | |

| Maize (Import) | 190 | 183 |

| Soymeal (Import) | 355 | 355 |

International Markets

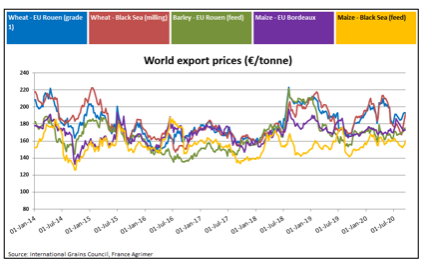

Following last week’s USDA estimates which revised world wheat production upwards, wheat futures initially weakened. However, they have jumped over 3% in two days following the trend in maize and soybeans. The global wheat harvest is forecast to show a 24 million surplus, however the trend in the world markets is bullish, based on anticipation of increased demand. Recent tenders for wheat filled by Baltic supplies, have shown an increase of $8 – $10/t on two weeks ago.

Chicago corn (maize) futures have continued to climb as the USDA estimates again revised production lower and Chinese purchases continue. In addition to US production, French and Ukrainian output have been revised lower. Recent storms in China have caused crop losses of up to 10m tonnes. Despite forecasts of record production, the increased world demand for maize is leaving a surplus of only 5m tonnes. Any future hits on the supply side will leave world stocks in deficit.

US soybean futures market has risen by 15% in the past month and is now at a two year high. The USDA reduced soybean production by 2.5% in its recent forecast, while Chinese purchases continue at record levels. Rapeseed futures have also strengthened in combination with all commodities in the oil and protein complex. In addition, the revised lower figures for rapeseed output in Canada and the Ukraine have helped firm prices.