Covid-19 (the illness caused by the new Coronavirus) now permeates every aspect of our social, professional, cultural, sporting lives… Is it any wonder, then, that it is also a major preoccupation for the dairy (and all other food) sectors?

In this blog, we try to examine objectively, without hysteria, and bearing in mind that the situation evolves by the hour, what Covid-19 might mean for Irish dairy farmers in 2020.

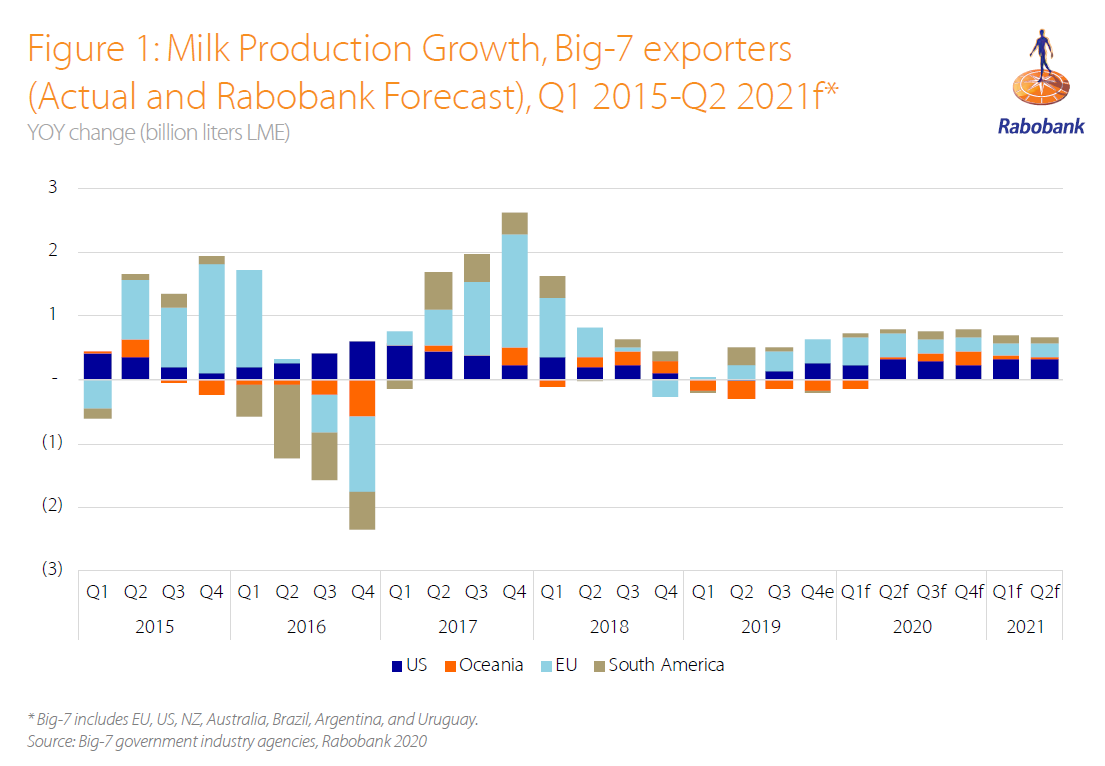

Modest increase in early 2020 milk supply growth to continue moderate, says Rabobank

Global milk output had grown very moderately through 2019, which, outpaced by reasonable demand growth in both emerging and developed countries, contributed to a very positive market outlook for 2020.

The EU produced only 0.4% more milk in 2019 than in 2018, and the US only 0.3% more. New Zealand was in the same ballpark, at +0.3% (calendar year) while Australia was down 4.3%.

Early 2020 saw a very modest recovery of production in Europe, with January output estimated up 1%, up 0.9% in the US, down 0.7% in New Zealand (although up 1.1% on a milk solids basis), and for the first time in 20 years (!) up 0.5% in Australia – this despite the fires and drought.

Trends for both New Zealand and Australia are for lower production over coming months, largely linked to weather/soil moisture issues. Australian production relies substantially on irrigation, and recent droughts have increased the cost of water. For New Zealand, Rabobank in its just published Q1 2020 Dairy Report states it has revised its 2019/20 output expectation to a fall of 1% compared to the previous full season.

The lower production in Oceania is undoubtedly offsetting to some extent the demand problems related to Covid-19 in China.

Rabo predicts that US milk production will return in 2020 back to its longer term growth trend of around 1.5%.

For the EU, a smaller herd with higher yields, and bearing in mind individual countries’ dynamics, Rabo has revised its prediction slightly up, and plumps for a 0.8% production increase for 2020.

All told the Rabo prediction is that while production will continue to grow globally, this growth will most likely remain well below 1% for 2020 and into 2021 – and for the second quarter of 2020 at least, it is based on low comparables in the previous year.

Relative moderation of supply will not offset a fall in demand, but it should help diminish its impact on farmers.

Source: Rabobank. Coronavirus upsets global trade and global economy

Last December, Covid-19 appeared in China, which is our second most important export market for dairy after the UK, then globally, to finally be officially called a pandemic by the World Health Organisation on 11th March.

The impact of the efforts to contain the spread of the infection in China have affected demand (cities in lockdown, people no longer eating out, limited ability to go out for food shopping) but also supply chains (containers, full or empty, stuck at ports with staff unable to turn up for work to handle them and their contents, consequent global shortages of containers for trade, erosion of shelf life for product stuck in the chain, and likely delays to clear same when things return to normal – let’s nor forget that they will!…).

There is some evidence that, with China getting to somewhat better grips with the virus, the supply chain is starting to move again a little. This is confirmed by Rabobank in its report, which states “Rabobank anticipates China’s consumer buying pattern to normalise by the second half of 2020, with evidence of improvement in some supply chains already visible”. This view is confirmed by pigmeat operators in Ireland.

However, there are many factors at play which are causing concerns for the economy as a whole and dairy commodity markets in particular.

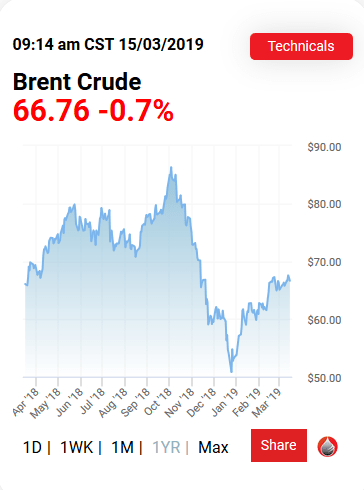

The slowdown in the Chinese economy associated with the extreme disruptions caused by the disease prevention measures had strongly reduced demand for oil. Simultaneously, a supply and price war between Saudi Arabia and Russia has collapsed the price of crude oil to a current level of US$31.50/barrel (12th March 2020), around half of the price for most of 2019.

This is good for us at the petrol pump, but it affects the export income of many of the dairy importing countries which our important customers for us.

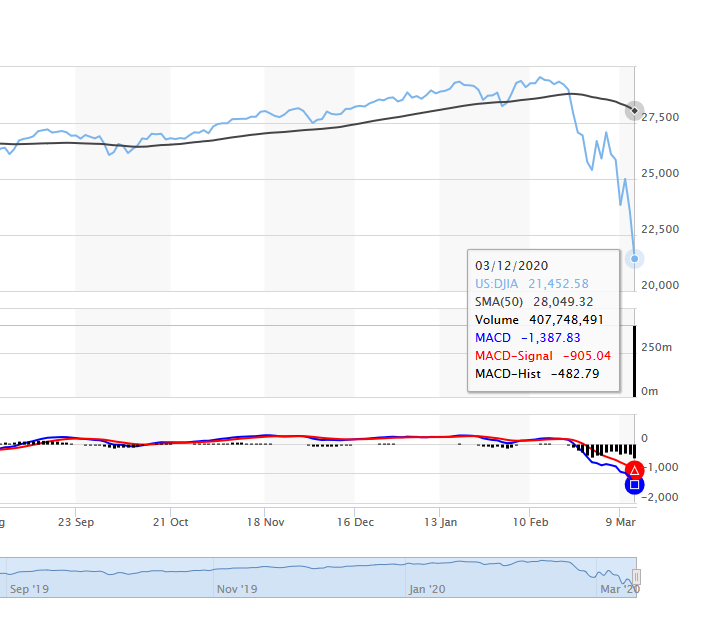

Source: WTI Crude Oil Prices – www.macrotrends.net. This, and the announcements by the UK and the US of drastic measures in an effort to contain the virus have caused great jitters on stock markets, which fell on Monday 9th March, recovered somewhat on Tuesday 10th, only to fall even more dramatically on 11th March in reaction to Donald Trump’s announcement of restrictions on flights from Europe. Overnight on 12th March, the US Down Jones lost over 8%.

Rabobank and other analysts and commentators fear for the global economy, which already looked like slowing down for 2020, and expect sharp falls in oil prices could lead to a downturn, with global impact for food demand. Also an issue are currency swings, as central banks in the EU, the US and beyond take measures to offset the difficulties caused by the Coronavirus (stimulus packages, interest cuts…).

Source: Dow Jones. Stock markets and commodity markets behave fundamentally the same, and the one thing they hate is uncertainty. Nervousness leads to price decreases, and dairy commodity markets are no exception.

However, Rabobank advises that “global dairy commodity prices have already priced in the uncertainty – but a less-than-favourable expected finish to the New Zealand production season is providing some price support”.

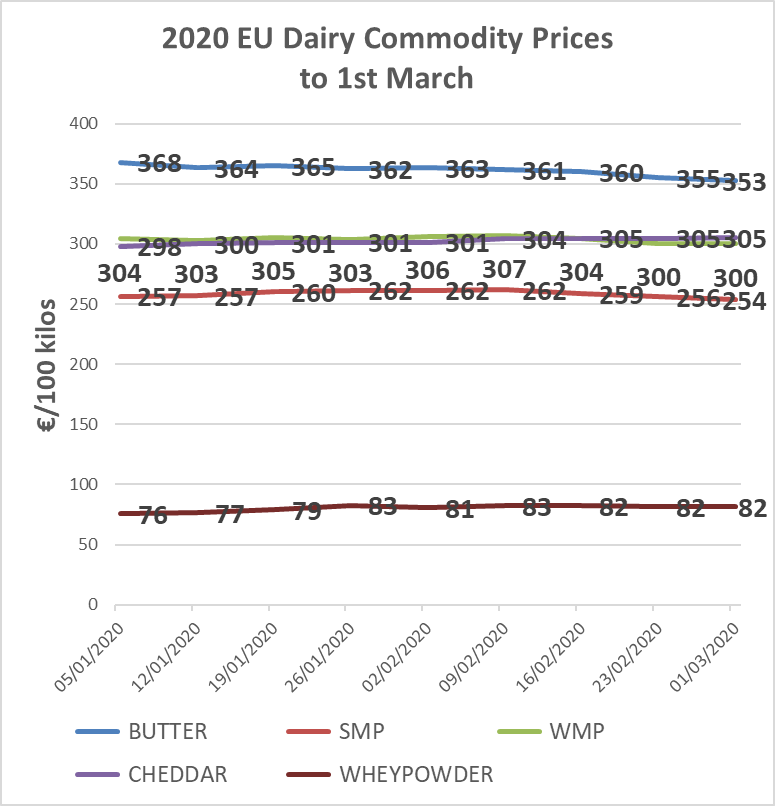

Dairy commodity price impact

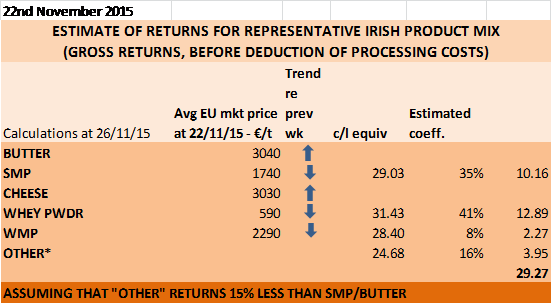

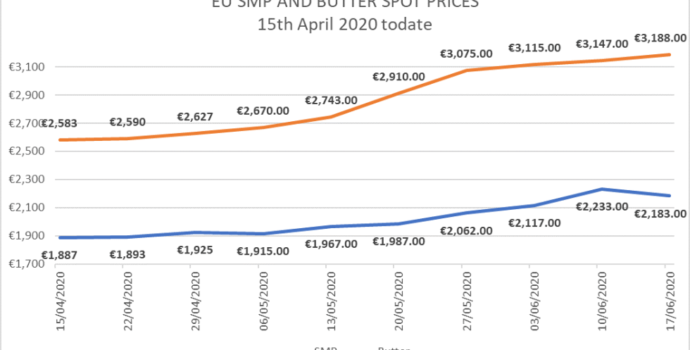

In recent weeks, average EU butter and powder market prices, as monitored and reported by the EU MMO (graph below) have weakened, with butter going down €100/t in the last month, and SMP around the same. For all that, returns remain at around the level of milk price being paid by co-ops on average for 3.3% protein, 3.6% fat milk.

Cheese has held up pretty well, as has whey powder – both are important elements in our national product mix.

Data from EU MMO

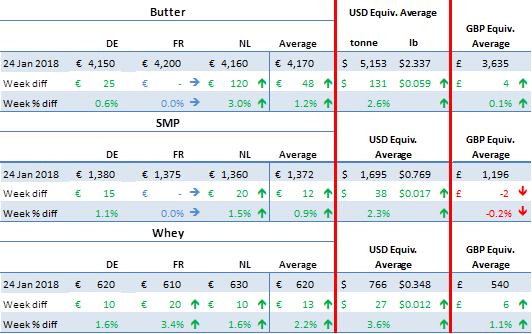

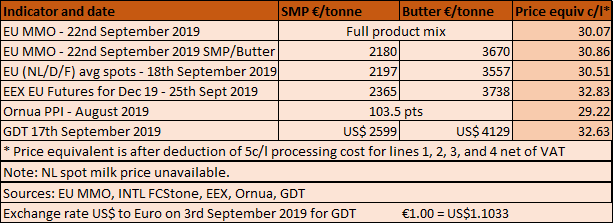

Spot prices (first table below right) represent the price for a product available immediately, as opposed to an average price derived from a combination of contracts signed when market signals were more positive. They tend to anticipate market trends, and show the nervousness which Covid-19, falling oil prices and concerns over the global economy have caused.

Looking at the most recent available spot prices, the trend is not good: butter prices are €180/t lower than a month ago, and SMP prices over €200/t lower. Let us bear in mind that very little product is traded on spots, and most Irish co-ops would have forward contracts at stronger prices at this point. Spots, however, do indicate market trends.

Data from EU MMO The Ornua PPI for February was also pretty much stable, returning the equivalent of 31.97 c/l + VAT (33.7c/l incl VAT).

In the table below, which considers the returns from the main dairy market indicators, we allow for a nominal 5c/l processing cost which we deduct before recording the price equivalent before VAT in the right column. The exception to this is the Ornua PPI price equivalent, calculated by Ornua themselves with a 6.5c/l processing cost netted from it.

It is difficult to look too far ahead on dairy commodity price trends at the best of times, but these are most definitely not normal times. The impact on the global economy cannot be underestimated, but to quote Rabobank’s Q1 2020 Dairy Report again, “Rabobank anticipates China’s consumer buying pattern to normalise by the second half of 2020, with evidence of improvement in some supply chains already visible”.

The impact on the global economy cannot be underestimated, but to quote Rabobank’s Q1 2020 Dairy Report again, “Rabobank anticipates China’s consumer buying pattern to normalise by the second half of 2020, with evidence of improvement in some supply chains already visible”.

We are certainly living through worrying times, with a lot of societal and global economic instability resulting from what is now officially a pandemic governments the world over struggle to try and gain control of.

It is important to remain as objective and calm as possible, and not talk ourselves into a worse crisis. While there has been some weakness in prices in very recent weeks, the rising returns of prior months were not fully passed back to farmers, as IFA has evidenced in our regular blogs and market analyses.

In the interest of supporting farmers through a difficult spring, and not adding to the stresses caused by workload and increased costs – never mind the concerns for public health caused by Covid-19 – we believe boards must at the very least hold firm on milk prices for the short to medium term.

We will get to the other side of this crisis. Meanwhile, we all need to heed the advice of WHO https://www.who.int/emergencies/diseases/novel-coronavirus-2019/advice-for-public and the HSE https://www2.hse.ie/conditions/coronavirus/coronavirus.html to ensure we and our families remain safe and well.