Ongoing Investment in Agriculture Needed to Maintain Growth – IFA

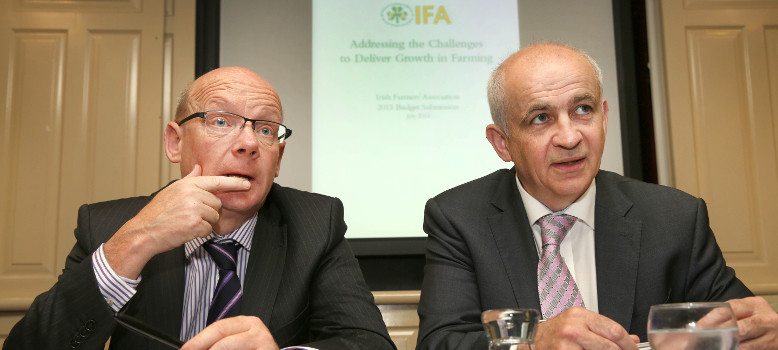

Launching the IFA’s pre-Budget submission in Dublin today (Tues), IFA President Eddie Downey said the next budget has to deliver for farm families in three areas: Funding to support the new Rural Development Plan, a reduction in the tax burden on working families and new tax measures to support farm restructuring and income volatility.

Mr Downey said despite the difficulties this year, especially on livestock and tillage farms, the sector continues to deliver positive growth in food exports and jobs, which is a real and sustainable return on the Government’s investment in agriculture.

Eddie Downey said funding for farm schemes underpins farm incomes and output, especially in vulnerable sectors and regions. “Under the new Rural Development Programme (RDP) for the period 2014-2020, there is an overall allocation of €2.1bn of EU funding and €1.9bn of national funding. Over €500m of funding for RDP farm schemes must be provided in this October’s budget to pay out on a range of farm schemes next year.”

Expenditure priorities for farming in Budget 2015 are:

- Commencement of contracts for the new agri-environmental GLAS scheme in early 2015, with 30,000 farmers allowed into the scheme in its first year and payments made in 2015;

- Allocation of €30m for the TAMS scheme in 2015 to fund on-farm investment programmes across all sectors;

- Funding of €52m for the Beef Data & Genomic Scheme to support the vulnerable suckler sector;

- Increased capital funding allocations for the horticulture, forestry and aquaculture sectors to achieve output targets and employment growth.

On the taxation side, IFA Farm Business Chairman, Tom Doyle said, “The agri-taxation review provides an opportunity to ensure that the taxation system delivers a coherent support for the achievement of the key policy goals for agriculture outlined in Food Harvest 2020. These include promoting on-farm investment, encouraging new entrants to farming, increasing land mobility, and improving the overall structure, efficiency and productive capacity of agriculture”.

Taxation priorities for farming in Budget 2015 are:

- Introduction of a Tax Deposit Scheme to better manage income volatility as a result of weather extremes and product price fluctuations;

- Introduction of a Phased Transfer Partnership model, providing tax relief to farmholders during the defined period of transfer to the next generation of young farmers;

- Retention of 90% Agricultural Relief to support the transfer of viable family farms;

- Retention of Pay & File deadline for self-assessed income tax returns and simplification of income tax returns for farmers with low turnover;

- Simplification of taxation system to reduce cost of compliance on small farm businesses.

Mr Downey concluded, “IFA will be presenting its budget proposals to the Oireachtas Committees on Finance and Agriculture later this week. We will be emphasising that, while farming is facing significant challenges at the moment, the right Government supports in this year’s Budget will underpin growth, which is making a major contribution to economic recovery, especially across rural Ireland”.