Dairy Market Outlook and Analysis – January 2018

Global milk production rising, but so is demand – read more in the latest IFA Dairy Market Blog.

While supplies are booming, demand remains strong

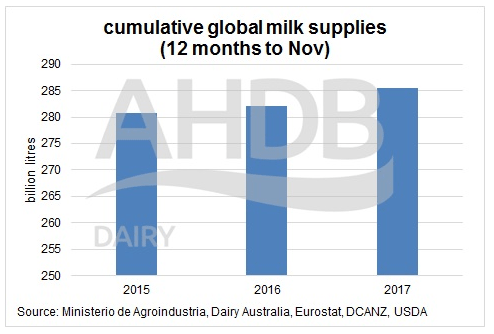

In a report this week, the British AHDB pointed out that, while November milk deliveries from the five main producing regions were up almost 4% by comparison with last year, an annual comparison shows a more modest increase of 3.5 billion litres or 1.2%.

With the UN FAO estimating that demand is continuing to grow by between 1.7% and 2.1%, AHDB stress that the annual increase in milk production should not create a major imbalance in global markets in 2018.

Source: AHDB Dairy (UK)

Milk supplies are rising, especially EU output – however, the comparisons are somewhat distorted by the reduced deliveries in the last quarter of 2016.

The Netherlands – whose herd reduction limited 2017 production somewhat – was the only dynamic EU dairy country to register a decrease. Milk collection were down 0.26% in December, and the annual production was back 0.2%.

December supplies in Germany are estimated by FCStone International to be up 5.2% (after a 6.4% increase for November), while French output is believed to be up 2.6% up for December (5.4% up for November).

December 17 UK production is estimated at 3.5% up on December 2016.

Winter Olympic games boost already fast rising Korean dairy demand

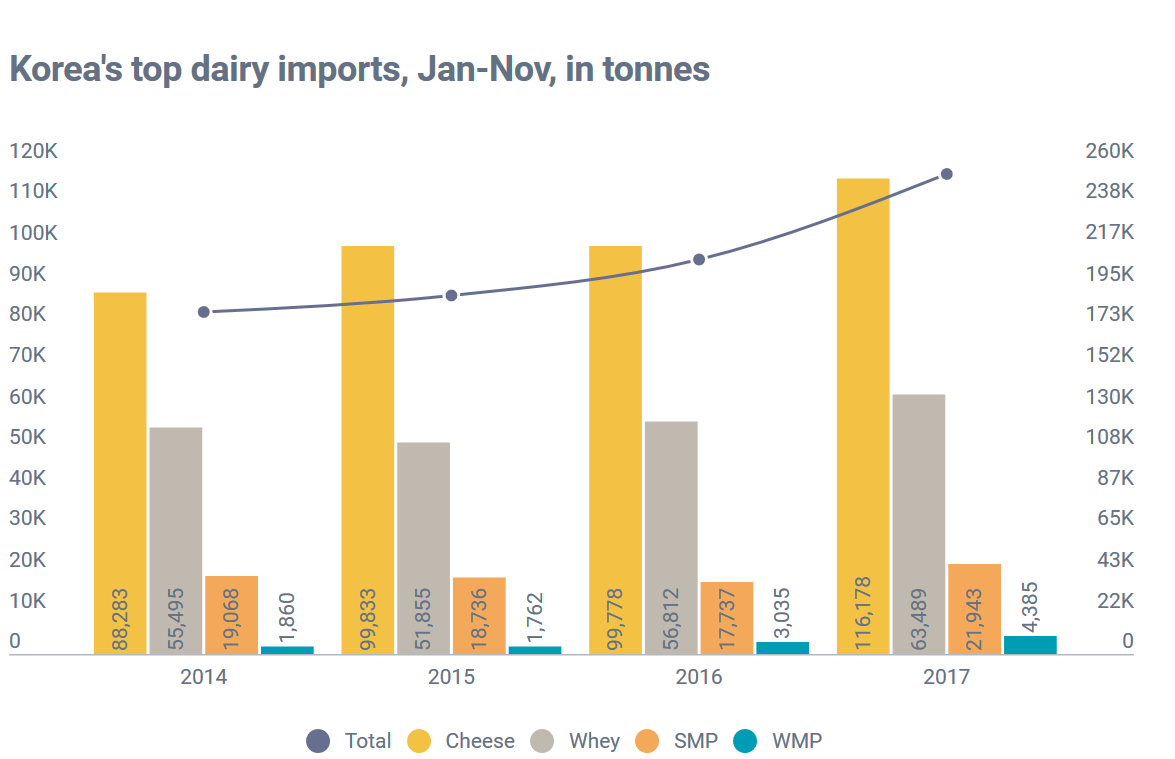

Korea’s Winter Olympic Games from 9th to 25th February will boost demand for dairy products with an influx of visitors. Already in 2017, dairy imports for the January to November 2017 period have increased by over 20% to just over 254,000t.

The most significant increases were in cheese (up 17%), whey powder (up 12%) and SMP (up 24%). The top three sources of those imports were the US (over 71,000t of products, a 32% increase year on year), the Netherlands (31,500t up 26%) and New Zealand with just under 27,800t.

Fresh cheese imports increased 16% to 77,800 tonnes, while hard and semi-hard cheeses, which are gaining in popularity, went up by 22%, led by cheddar (an interesting fact, in light of the potential implications of Brexit for our own cheddar marketing).

Commentators from Agra Informa add: “The Olympics may spur a fitness kick among health-conscious Koreans, and if so whey powders aimed at this market is a trend to watch.” The graph below shows that they imported 63,500t of the stuff already last year!

Source: IEG Vue – Dairy Markets

Strong growth in exports to continue, predicts EU Commission

The EU Commission estimates that 776,000t of SMP were exported out of the EU in 2017, up 35% on 2016 – so an awful lot of powder went out to commercial markets, not into intervention, in 2017! For 2018, they expect a further 6% increase in SMP exports.

2017 exports of butter were slightly down – we remember shortages caused prices to sky-rocket – and the EU Commission expects them to be a little lower again in 2018.

What they expect to see, is more cheese and WMP. On whole milk powder, they expect a slight increase from 674,000t to 677,000t, while cheese exports, already up 6% in 2017 to 848,000t could lift to 907,000t, another 7%.

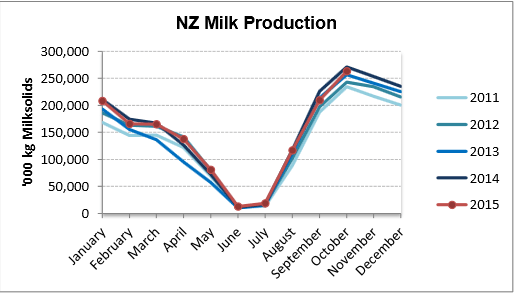

Two positive January GDT auctions reflect lower NZ output forecasts

New Zealand milk production for December 2017 was down 4.6% in milk solids, and 2.6% in volume. Fonterra’s December collection were down 6%. For the calendar year January to December 2017, national milk solids output was 1.76% up. Reviewed forecasts of milk production by Fonterra for the 2017/18 season (July 17 to June 18) suggests it may fall by 3% relative to previous season. Weather factors, especially moisture deficits in the North and South Island at and immediately after peak, explain the drop in output

Source: DCANZ

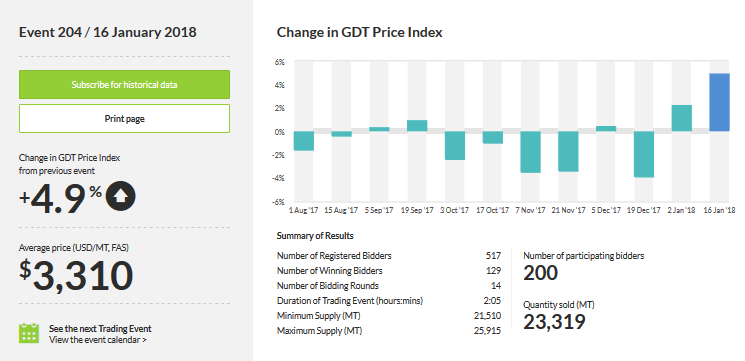

The impact of the reduced output and the expectations of lower production for the whole season has been felt in the first two GDT auctions of 2018, which showed a weighted average price increase of respectively 2.2% and 4.9%.

This still leaves SMP prices at US$600/t less than it was last year, though butter has made a good recovery in the last two auctions. Together, they would return a gross milk return equivalent of 31c/l before processing costs are deducted.

Source: GDT

Spot quotes stabilising

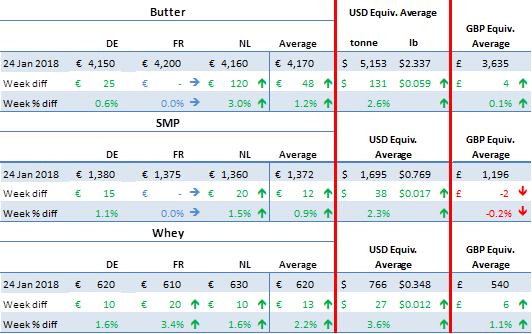

It has been some time since we have last seen the FCStone International spot quote table coloured entirely in green (positive price trend) or blue (neutral price trend).

For the week of 24th January, spot butter prices in Germany, France and the Netherlands rose by around €48/t on average, with SMP up a modest €12, and whey powder also slightly up (see table below).

This follows two positive GDT auctions (see below), and the apparent stabilisation of EU average dairy product prices on the positive side (also below), and the sale of 1800t of SMP out of intervention for nearly €200 less than the average spot at the more negative end.

Could it be that market prices are stabilising somewhat, despite the intervention stock overhang?

Source: FCStone International

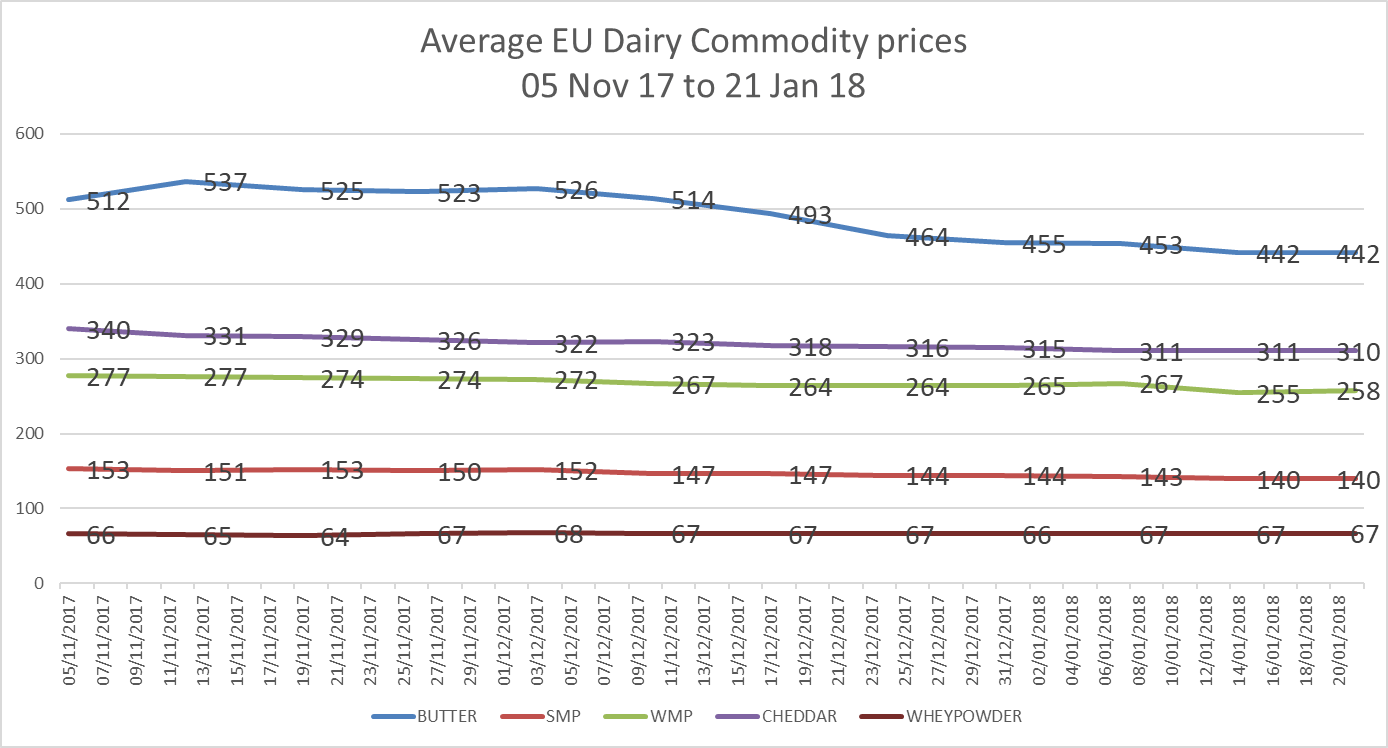

Average EU dairy prices reported for 21st January 2018 also appear to mark a beat after weeks of slow decreases. There are little or no changes in the last two weeks for butter, cheddar, SMP and whey powder prices. Whole milk powder prices have even lifted by a small €30/t.

Based on EU MMO data

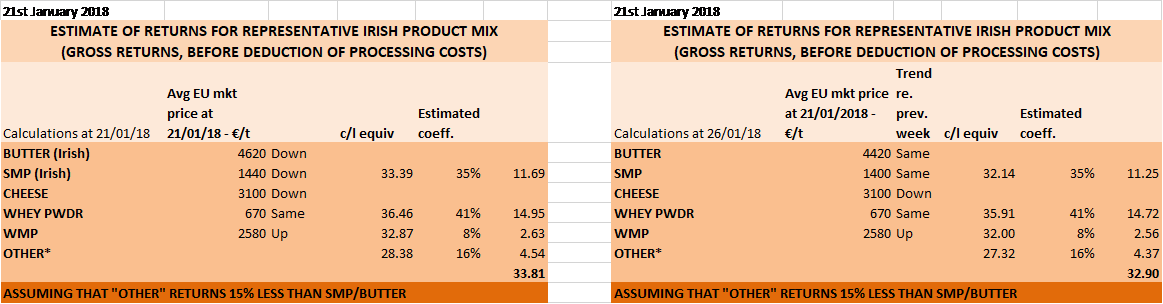

Gross returns have eased by around 7c/l gross since September last, so there is still a legitimate concern about dairy commodity and milk price trends for spring of 2018. A representative product mix for Irish milk would have, if traded entirely on 21st January average product prices, yielded a gross return of 33 to 34c/l approximately before processing costs and VAT. That would be a farm gate milk price of around 30.6c/l incl VAT.

Based on EU MMO data