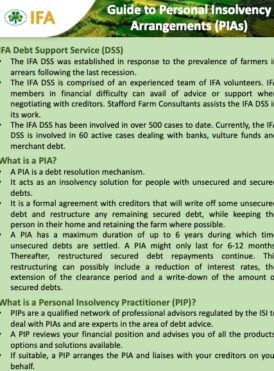

Guide to Personal Insolvency Arrangements

You can use the following guide to better understand what a Personal Insolvency Arrangement(PIA) is, whether you are eligible, what are the benefits of a PIA and how you can apply.

A version of the guide can also be downloaded from here.

IFA Debt Support Service (DSS)

- The IFA DSS was established in response to the prevalence of farmers in arrears following the last recession.

- The IFA DSS is comprised of an experienced team of IFA volunteers. IFA members in financial difficulty can avail of advice or support when negotiating with creditors. Stafford Farm Consultants assists the IFA DSS in its work.

- The IFA DSS has been involved in over 500 cases to date. Currently, the IFA DSS is involved in 60 active cases dealing with banks, vulture funds and merchant debt.

What is a Personal Insolvency Arrangement (PIA)?

- A PIA is a debt resolution mechanism.

- It acts as an insolvency solution for people with unsecured and secured debts.

- It is a formal agreement with creditors that will write off some unsecured debt and restructure any remaining secured debt, while keeping the person in their home and retaining the farm where possible.

- A PIA has a maximum duration of up to 6 years during which time unsecured debts are settled. A PIA might only last for 6-12 months. Thereafter, restructured secured debt repayments continue. This restructuring can possibly include a reduction of interest rates, the extension of the clearance period and a write-down of the amount of secured debts.

What is a Personal Insolvency Practitioner (PIP)?

- PIPs are a qualified network of professional advisors regulated by the ISI to deal with PIAs and are experts in the area of debt advice.

- A PIP reviews your financial position and advises you of all the products, options and solutions available.

- If suitable, a PIP arranges the PIA and liaises with your creditors on your behalf.

- PIPs are regulated by the Insolvency Service of Ireland.

- The Insolvency Service of Ireland is an independent government body established to tackle personal debt problems by restoring insolvent debtors to solvency in a fair, transparent and equitable way.

Am I eligible for a PIA?

- You must be insolvent i.e. unable to make existing loan payments when they fall due.

- You must have secured and unsecured debts.

- As of November 2020, the Oireachtas is considering one of two Bills which will reform the area of personal insolvency and amend the current eligibility requirements for a PIA.

How can I apply for a PIA?

- Firstly, you must attend a virtual or in-person consultation with a PIP of your choice. The PIP will review your financial position and advise you of all the products, options and solutions available.

- If you decide to proceed, the PIP will prepare and submit a Prescribed Financial Statement which is a comprehensive overview and disclosure of your financial position.

- Next, the PIP will apply on your behalf in Court for a Protective Certificate. This is a certificate issued by the Court which offers you and your assets protection from legal proceedings by creditors for 70 days while a PIP is applying for a PIA on your behalf.

- For a PIA to be accepted, it must approved by a qualified majority of your creditors, processed by the ISI, approved by the Court and details of it registered in a public register maintained by the ISI. On appeal, the courts have the power to review and approve a PIA which has been rejected at a meeting of creditors.

How will I benefit from a PIA?

- Protection from your creditors – The PIP communicates with your creditors on your behalf.

- Affordable repayments – Monthly payments over a fixed period of time. You will repay a percentage of your overall debts.

- No surprise changes – a PIA is a binding legal document.

- Reasonable standard of living guaranteed – Food, clothing, education, healthcare and a modest allowance for savings.

- Peace of mind – settling and restructuring your debts.

- Credit rating – On completion you will be solvent.

IFA Debt Support Service Protocol on PIAs

- It is the sole prerogative of an IFA member to choose whether they pursue a PIA and, if so, which Personal Insolvency Practitioner (PIP) they choose.

- Where appropriate, IFA Debt Support Service will suggest to an IFA member his/her possible suitability for a PIA and to consider his/her position.

- If requested by an IFA member, IFA Debt Support Service can suggest several PIPs with agricultural experience or refer the IFA member to the list of PIPs issued by the Insolvency Service of Ireland.

- Any recommendation made by the IFA Debt Support Service in relation to a PIP or PIPs will be done privately and confidentially.