Progress on Reducing VAT Rate for Non-Oral Vaccines

IFA Animal Health Chairman TJ Maher has welcomed progress by the Department of Agriculture towards reducing the VAT rate on non-oral vaccines to 0%.

He said the objective to provide this from 2024 is the first time a target date has been set and it’s important this objective is delivered on.

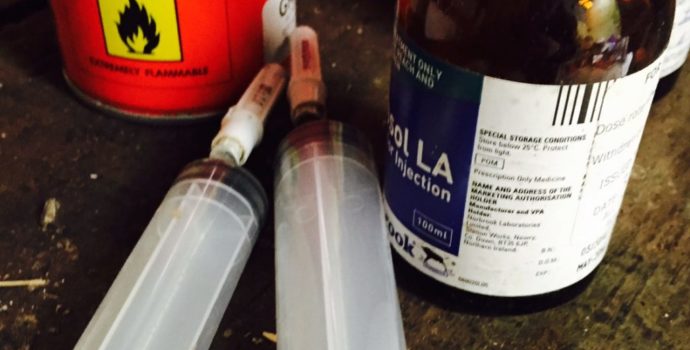

The current VAT rate is 23%. With farmers spending in excess of €40m annually on vaccines alone, this could result in savings of over €10m for farmers.

IFA has actively campaigned for the removal of VAT on vaccines for a number of years in order to reduce the cost for farmers, and to provide some of the tools necessary to reduce dependence on antibiotics on farms.

TJ Maher said the entire agri-food sector and the general economy benefit from the efforts and investments made by farmers to continue improving the health status of the national herd.

“The Government must support the commitment of farmers by providing direct and indirect resources to help farmers continue to invest in the health status of the national herd while also protecting farmers from unnecessary bureaucracy and controls.”

TJ Maher said progress on the VAT rate on vaccines is an important first step which must advance to implementation and be built on to support farmers as they continue to raise the health status of the national herd and reduce the need for antibiotics on farms.