Latest Dairy Market Update – Output Growth Outpaces Demand

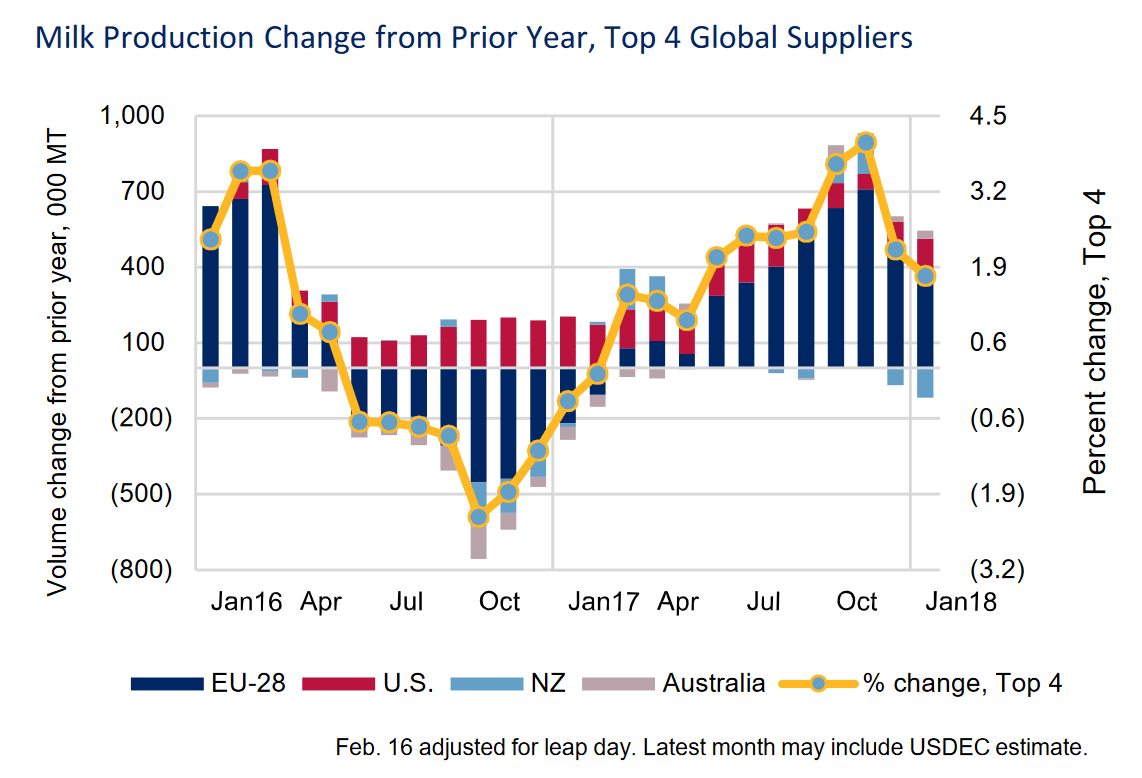

Milk output has responded to the milk price recovery of 2017, and volumes are up in most regions, except New Zealand where weather factors have actually reduced growth. Growth has been relatively more moderate in the EU in December and January however, which, together with lower production in New Zealand, explains the overall slower growth noted in the most recent two months for which data is available (USDEC graph below).

Source: USDEC

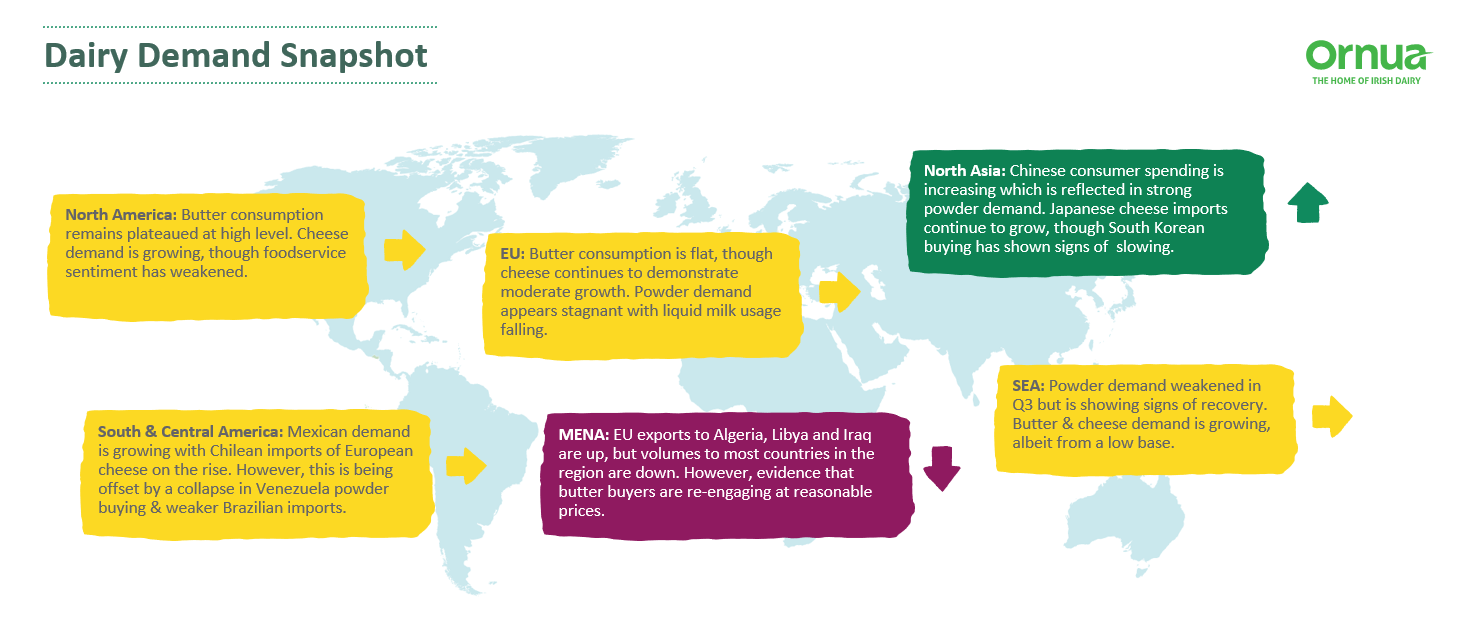

Demand, meanwhile, has remained quite strong in China, but more subdued in the rest of SE Asia, and under pressure in MENA and sub-Saharan Africa. That said, the global trends for dairy demand remain strong for the longer haul despite the temporary supply/demand imbalance. Also, higher oil prices and lower dairy commodity prices should improve the affordability of dairy across the regions where demand had been made sluggish by the high 2017 prices. Global demand for butter remains quite strong, which is being reflected in prices firming again after major falls between September 2017 and mid January 2018. Demand for powder, on the other hand, is a great deal weaker.

With supply trends in the most recent period of around 2%, and demand rising by only 1.5%, the imbalance at the moment is creating some pressure on dairy commodity prices and therefore milk prices.

Source: Ornua

Will the impact of the cold snap persist into peak?

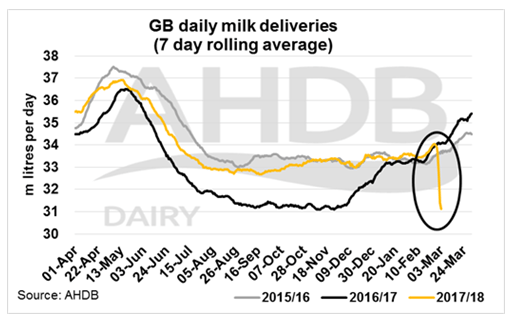

Snow and ice affected much of North Western Europe, with spectacular impacts on UK milk deliveries (see graph below). AHDB estimate that 19m litres of milk were lost in the period from 28th February to 3rd March (The Best from the East) On 2nd and 3rd March, supplies were down by as much as 21 to 29% – but this was shortlived, and represents only a fraction of the normal supplies for the month. However, the full impact of later turnout and poorer grass growth will only show later, and may be more significant.[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

Source: AHDB Dairy

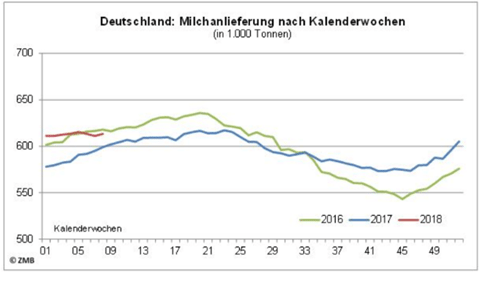

In other countries, like France and Germany, for which supply data is available for almost real time, there is no sign of a major downturn in supplies to coincide with the cold snap. However, this is in the case of Germany by comparison with 2017 supplies, which were well back on 2016. Compared to 2016, week 8 of 2018 is a little down.

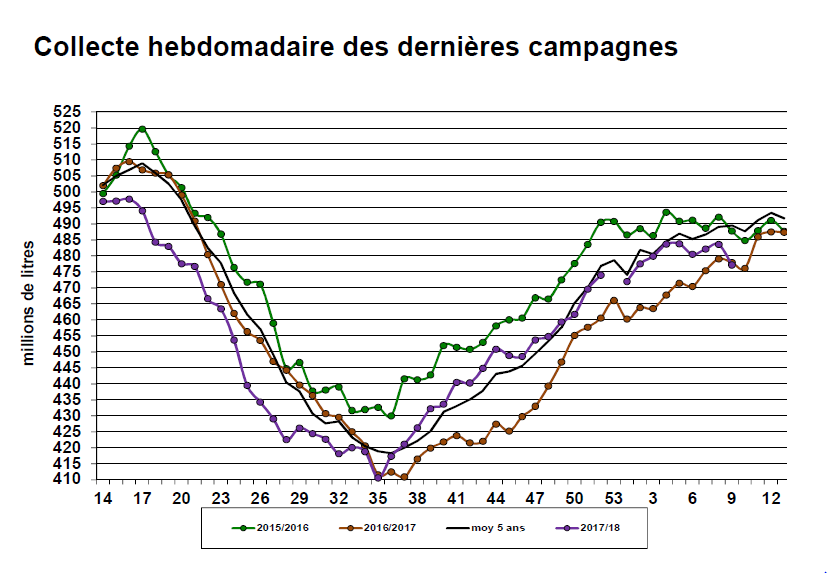

French milk deliveries were down 2.5% for the week between the end of February and the beginning of March when compared with the 5 year average, and down on the previous week by 1.3% and by 0.2% compared to the same week in 2017 – this should be seen in the context of the effect of the production reduction scheme in late 2016 and early 2017, so these decreases are meaningful.

However most important of all will be what impact, if any, the bad weather will have had on the 2018 production season (fodder/grass growth, cow condition, breeding impact if any, etc.).

Source: France Agrimer

]Dairy prices – divergence between butter and powders continues, but at lower levels

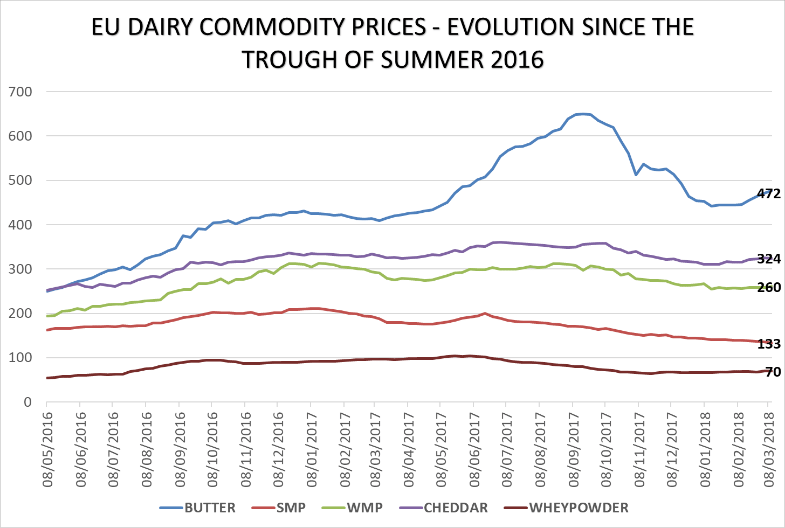

Since May 2016, dairy prices have first recovered – butter most spectacularly, to levels never previously reached – then weakened fairly significantly.

Since early 2018, butter prices have been firmly quite significantly, with Cheddar cheese improving more moderately, and whey powder has lifted up to €700/t. WMP has been stable, but at levels well below €3000/t.

Most worrying of all is the SMP price. SMP is crucial to the Irish product mix, and the price has been weakening non-stop since June 2017 – most recently reaching €1330/t. For reference, the intervention “reference” price, below which intervention buying-in may take place, is €1698/t – €368/t above current average market price.

Based on EU MMO data

Intervention buy-in will technically come in this month, as it is triggered by the price falling below the reference price of €1698/t – which it well and truly has. However, earlier this year, the EU Commission obtained the Agriculture Council’s agreement to remove the legal obligation to buy up to 109,000t at the minimum price of €1698/t. Concretely, this means the EU Commission may choose not to buy any SMP at all – by simply drawing the line at €0. As doing anything different would in effect increase the stock beyond the 377,175t still in intervention warehouses, it is easy to understand why the Commission would abstain. The Commission’s strong message of recent months – especially expressed by Commissioner Phil Hogan – has been that the EU dairy industry need not produce SMP willy-nilly and expect it to be taken in by the EU. It seems the industry has been paying some heed, as there was 2.6% less SMP produced in 2017 compared to 2016.

The EU Commission has by now sold out 6,121 tonnes of SMP out of intervention since December 2016 – out of a total product made available of around 100,000t (product sold into intervention pre-April 2016, so coming on to 2 years old and older). There is around 95,000t left over for tender this month – it has not yet been adjudicated as we write. The previous tender, adjudicated on 20th February, set the price at €1190/t – a very substantial discount even on current weak fresh product prices.

Implications for returns… and prices

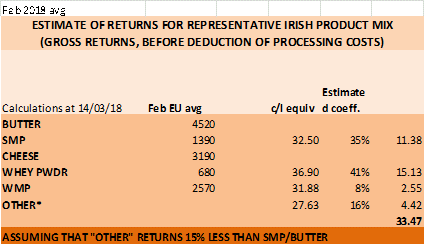

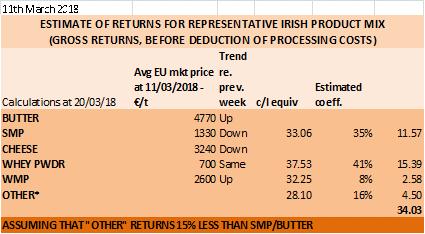

Weaker dairy commodity prices have reduced returns in proportion. The most recent EU MMO quotes show that butter prices are picking up, but still, the typical Irish product mix would return, as at 11th March, a gross 34c/l, before processing costs are deducted, or VAT is added on – that would be a milk price equivalent of 30.5c/l including VAT. This is a small improvement on the returns the average February dairy commodity prices would have yielded – but an improvement which shows that there is life in the strong butter price trend yet, with continued good demand for butterfat in Europe and on export.

The Ornua PPI is a small hedge on this, with a February 105 points equivalent to a milk price of 31.4c/l incl VAT – though this remains below the prices currently being paid (see below).

Based on EU MMO data

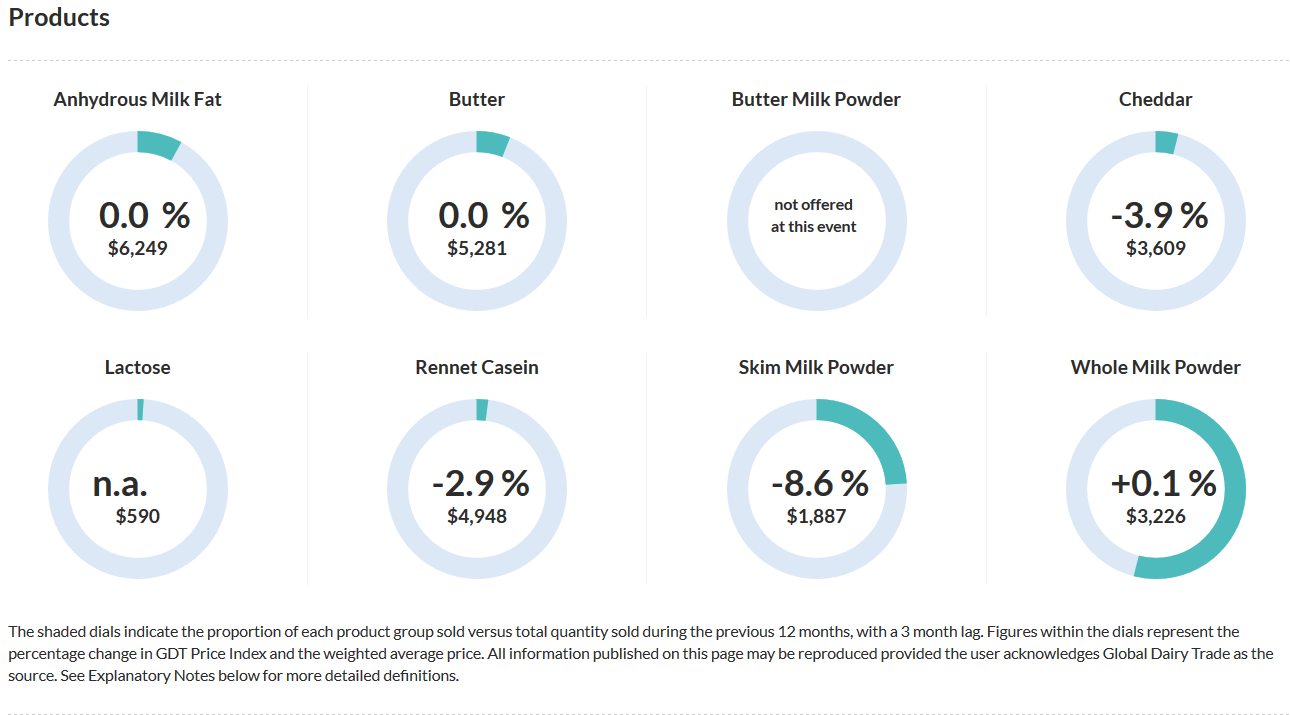

The last GDT auction (20th March) saw a further 1.2% drop, but most meaningfully a fall of 8.6% in the SMP price.

Combined, the average SMP and butter prices reached in the GDT of 20th March are equivalent to a gross return of 32.7c/l before processing costs are deducted.

Source: GDT

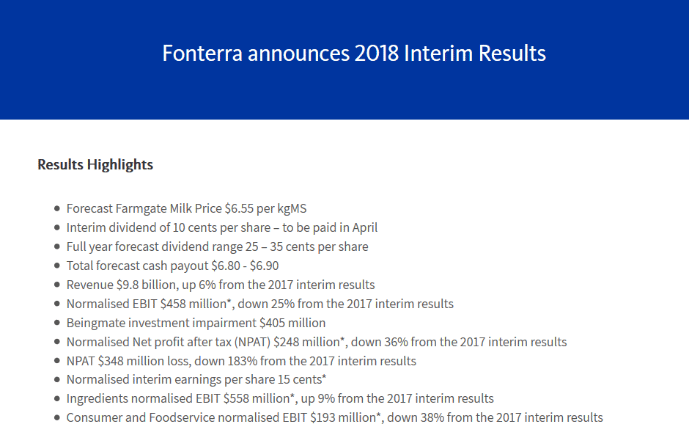

Fonterra Co-op lifts milk pay-out for 17/18 – showing that milk price is not all about today’s market returns!

Fonterra yesterday (21st March) announced their 2017 interim results, showing a 6% increase in turnover, but reduced profits and a probably disappointing performance in other areas (not least their Beingmate Chinese investment in IMF).

Interestingly, they also announced an increase in the forecast farmgate milk price for 2017/18 to NZ$6.55 per kilo of milk solids, with a full year dividend forecast of 25 to 35 cents, which would put the forecast total payout for the current season at NZ$6.80 to 6.90/kg MS, i.e. up to 30.6c/l incl VAT at 3.3% protein and 3.6% butterfat.

Source: Fonterra

Some interesting quotes from Chairman John Wilson’s announcement of the results suggest that there is more to milk price setting than pure current market product price trends:

Chairman John Wilson says the ongoing strong global demand for dairy and stable global supply are continuing to support global prices, particularly for the important Whole Milk Powder category.

“Farmers will welcome a forecast cash payout of $6.80 – $6.90, which would be the third highest in the last decade. This is also good news for New Zealand as it represents around $10 billion flowing into the country’s economy. However, we are very aware of the challenges many of our farmers are facing this season with difficult weather conditions impacting production. While the global supply and demand picture remains positive and we expect prices to stay around current levels, we will be watching for any impact on market sentiment as spring production volumes build in Europe”.

Irish co-ops should take a leaf from Fonterra’s book in looking beyond just markets!

February 2018 has seen the first price cuts since June 2016, and the extent, timing and context has frankly shocked Irish dairy farmers – most of all Glanbia suppliers who saw a 3c/l milk price cut days after they were worst hit by snow storm Emma. The 1c/l bad weather bonus paid to farmers, and the new seasonality bonus under which some qualify for a 4.25c/l bonus on February supplies did not seem to make up for this in the minds of the many farmers who contacted this office!

February milk supplies in 2017 accounted for around 3.8% of total annual supplies. February 2018 supplies will probably prove to have been somewhat moderated by the cold weather, so expected growth would be modest – just as January supplies only rose by 1.5% on January 2017. Our strong seasonality would have led milk producers to expect a more circumspect approach to milk price adjustments, though they were well aware of the market return challenges.

Price cuts for February supplies have now been announced by most milk purchasers in Ireland and are summarised in the table below (sources: press releases and media reports).

| Glanbia | -3c/l to 32c/l incl VAT | + 1c/l “bad weather” bonus Many farmers qualify for new 4.25c/l seasonal Jan/Feb bonus |

| Kerry | -2c/l to 32.25c/l + VAT | |

| Lakeland | -1c/l to 32.79c/l + VAT | Had cut 1c/l “butter bonus” in Jan |

| Aurivo | -1.5c/l to 32.25c/l + VAT | 1.5c/l seasonal bonus in addition to base |

| Dairygold | -2c/l to 32.3c/l + VAT | Includes 0.5c/l quality bonus |

| Carbery | -2c/l to 32.88c/l + VAT | Farmers are paid by West Cork Co-ops, not by Carbery |

| Arrabawn | -1c/l to 34.25c/l + VAT | Unclear whether this includes early calving bonus |

| LacPatrick | -3c/l to 31c/l + VAT | +3c/l unconditional early calving bonus in addition to base |

Before March milk prices are examined by boards early next month, farmers will expect them to take into serious consideration the very long cold winter, late spring and generally challenging conditions farmers have had to endure for calving 2018!