CAP Reports

CAP Council Report June 2021

Update on CAP Trilogue negotiations

- CAP negotiations suspended on Friday 28th May without an agreement.

- Parliament considered the Council mandate on Thursday 27th.

- Parliament rejected this proposal.

- Portuguese Presidency tried to get new position from Council (late Thursday 27th) but Member States were not willing to go further so there was no revised mandate.

- Technical CAP negotiations continuing 4th June on Horizontal Regulations.

- Informal Ministers of Agriculture Council Meeting in Lisbon 14-15th June will now proceed as scheduled

- Possible dates for next Trilogue (to be determined)

- 10th June (Brussels)

- Week commencing 21st June (Brussels)

- A Super Trilogue is scheduled for 28th – 29th June in Luxembourg.

- Agriculture Council Meeting scheduled for 28th – 29th June in Luxembourg.

- If an agreement is reached, it will be voted on at the European Parliament Plenary on 13th September.

- Eco-scheme

- Original Proposal of 25% (22% for 3 years moving to 25% in 2026).

- Council offer: 25% (with base or floor of spending at 18%).

- Second offer: 25% for the whole period with 30% Agri Environment measures in Pillar II.

- Third proposal: 25% with 35% (37% Parliament) Agriculture-Environment-Climate Measures (AECMs) in Pillar II.

- Parliament want floor at 22% (2023) and 23% for 2024.

- Flexibility in eco-scheme (ES)

- Ring-fencing for ES 25% per annum for whole period (Council & Parliament)

- Detail on flexibilities and the 2-year Learning Period (Parliament want better defined Year 1 + 2 obligations).

- If 18% to 25% of annual target ES figure during year 1 & Year 2 is unspent, Member States can distribute unused funds via decoupled direct payment, under no obligation.

- If Member State spend on ES is lower than the 18% floor the Member State can:

- (i) distribute the unused funds to decoupled payments but they must compensate with a higher ES % in subsequent years; or,

- (ii) lose the unused funds below the 18% floor with no requirement to compensate in subsequent years

- Point or Rating System: Voluntary (Council) and Mandatory (Parliament)

- Internal Convergence

- Original Council proposal: 75%

- Parliament Position: 100%

- Current Council position: 85%

- Safeguard Clause: No payment entitlement can lose more than 30% of its value, through internal convergence (Article 20.7).

- Redistributive Payment – Complementary Redistributive Income Support for Sustainability (CRISS)

- Targeting of support is addressed through the Redistribution Package – capping, degressivity and CRISS.

- Mandatory redistribution (Commission & Parliament, to which Council could agree) with flexibility for Member States

- Council proposal to reach 10%, taking into account Member State farm structure to derogate from this level and go below 10%.

- Member State may not have to implement this measure if redistribution is achieved through other means such as capping, degressivity or internal convergence.

- Parliament is against the inclusion of internal convergence.

- National co-financing

- Co-financing as per MFF Conclusions, endorsed by Heads of State.

- 43% (maximum EAFRD – European Agricultural Fund for Rural Development rate).

- Minimum EAFRD contribution is 20%.

- Rate of 80% for environmental, climate and other management commitments, EIP, Leader and non-productive investments.

- Social Conditionality

- New article on social conditionality could be introduced as per EP proposal.

- System should rely on existing controls and checks.

- Control and penalties should be disconnected from CAP conditionality in the Horizontal Regulation.

- Two Directives to be complied with (Council).

- Four directives to be complied with (Parliament).

- Including Freedom of Movement of Workers and Framework for Equal Treatment.

- Begin implementation from 2025 (Council) and from 2023 (Parliament).

*** [..]* Square brackets denotes that the % is under negotiation ***

- Active Farmer

- Mandatory definition.

- Flexibility for Member States.

- Inclusion of a voluntary negative list.

- No comparison with other economic sectors.

- Young Farmer

- [3%]* allocation under both pillars/ with only measures referred to in Article 69(Installation for young farmers and rural business start up) for Pillar II.

- No backsliding.

- Not less than 35 years old, not more than 40 years old.

- New Farmer

- Agreed on a definition (other than young farmer, head of holding for the first time, benefits from training and skills).

- Small Farmer

- Voluntary application of the definition.

- Ceiling: €1,250

- Active Farmer Definition Proposal

- “In view of further improving the performance of the CAP, income support should be targeted to active farmers. To ensure a common approach at Union level, a framework definition for ‘active farmer’ displaying the essential elements should be set out. On the basis of this framework, Member States should define in their CAP Strategic Plans which farmers are considered active farmers based on objective conditions. To reduce the administrative burden Member States may establish a negative list of non-agricultural activities compared to which the agricultural activities are typically marginal. The negative list should not be the only way in which the definition is determined but should be used as a complementary tool to help identifying such non-agricultural activities, without prejudice for the persons concerned to prove that they fulfil the criteria of the definition of active farmer. To ensure a better income, strengthen the socio-economic fabric of rural areas or pursue related objectives, the definition of active farmer should not result in excluding from support part-time farmers, who in addition to farming are also engaged in non-agricultural activities.”

- “‘active farmers’ [shall] be defined in such a way as to ensure that no support is granted only to natural or legal persons, or to groups of natural or legal persons, engaged in at least a minimum level of agricultural to those whose agricultural activity forms only an insignificant part of their overall economic activities or whose principal business activity compared to their overall economic activities is not agricultural land providing public goods in accordance with contributing to the objectives of the CAP Strategic Plan, while not precluding from support pluri-active part time farmers.

- When formulating the definition, Member States shall apply, on the basis of objective and non-discriminatory criteria, one or more elements conditions such as income tests, labour inputs on the farm, company object and/or inclusion of their agricultural activities in national registers. minimum agricultural activity criteria, Member States may apply additional conditions such as appropriate experience, training and/or skills.

- Member States may decide to exclude from direct payments natural or legal persons, or groups of natural or legal persons, who operate principal non-agricultural businesses or activities such as, for example, airports, railway services, waterworks, real estate services, permanent sport and recreational grounds. In such a case Member States shall provide for the possibility of the persons concerned to prove that they fulfil the conditions of being active farmer as established in the previous paragraph.

- Member States may set, on the basis of their national or regional characteristics, an amount of direct payments, which shall not exceed EUR 5 000 under which farmers, engaged in at least a minimum level of agricultural activity and providing public goods, shall in any event be considered as ‘active farmers’.”

- GAEC 2 – Protection of Wetlands & Peatlands

- Possible to apply this starting in 2024 or 2025 conditional on justification of reasons e.g., Mapping.

- Land covered under this GAEC does not lose its agricultural status.

- (Member States, when establishing the standard for GAEC 2, shall ensure that on the land concerned, an agricultural activity suitable for qualifying the land as agricultural area may be maintained).

- “effective”/“minimum”/ “appropriate” protection of wetland and peatland – no agreement yet on description.

- GAEC 4 – Buffer strips

- Minimum 3m width with no Pesticides or Fertilisers.

- Flexibility for MS with many dewatering and irrigation ditches to adapt it to local conditions.

- GAEC 7 – Minimum Soil Cover

- Where justified, MS may adapt the minimum standard to take into account the short vegetation period resulting from the length and severity of the winter period (Council position). Parliament are against reopening this GAEC and prefer to maintain proposal, “minimum soil cover to avoid bare soil in periods that are most sensitive.

- GAEC 8 – Crop Rotation

- Rotation to include a change of crop at least once a year at parcel level.

- (exemptions: multiannual crops, grasses, other herbaceous forage and land lying fallow).

- Crop Rotation to be possible every other year (Council – Yes & Parliament – No).

- Possible to have crop diversification (Council – Yes & Parliament – No).

- Exemption where more than 75% of eligible area is permanent grassland.

- Exemptions small holdings [5ha/10ha].

- Organic farming de facto compliant.

- MS may/shall introduce maximum limit of area covered with a single crop to prevent large monocultures(Parliament proposal)

- GAEC 9 – Maintenance of high value landscape features

- [4%] minimum share devoted to non-productive (Parliament = 5%)

- ([3]% if Member States additionally implement eco-schemes for,

- at least, 2% of arable land lying fallow; or,

- non-productive areas/features.

- [5%] minimum share of arable land if it includes catch crops and nitrogen fixing crops ([3%] non-productive).

- Exemption for small holdings ([5ha/10ha]) Parliament/Council.

- Capping & Degressivity

- Commission proposed mandatory capping with degressivity at €60k supported by Parliament.

- Council & MFF propose voluntary capping at €100k and voluntary degressivity.

- [50 – 100%] (Parliament – Council) on the deduction of labour costs.

- Coupled Support

- [13+2%] Council and [10+2%] EP

- The following list of products is agreed: “cereals, oilseeds excluding confectionary sunflower seeds as laid down in Article 10a(5), protein crops, legumes, mix between legumes and grasses, flax, hemp, rice, nuts, milk and milk products, seeds, sheepmeat and goatmeat, beef and veal, olive oil and table olives, silkworms, dried fodder, hops, sugar beet, cane and chicory roots, fruit and vegetables, short rotation coppice.” Decision has yet to be made on potatoes or starch potatoes. Council could agree to have protein crops without justifications in exchange for the inclusion of potatoes. [Support for bulls for bullfighting] Parliament does not support this.

- Transfers Between Pillars

- Council rates

- Up to 25% Pillar II to Pillar I, which can be increased:

- by 15% for environmental and climate-related objectives and

- by 2 % for supporting young farmers.

- Up to 25% Pillar I to Pillar II, which can be increased to 30% for Member States with direct payments per hectare below 90% of the EU average/reaching full convergence.

- AECM Ring-fencing

- ANC and animal welfare payments can contribute towards AECM ring-fencing [40%/60%], provided the ring-fencing for AECM is [33-40%].

- Sectoral Interventions

- 15% of the envelope to be dedicated towards environment and climate actions.

- Green Deal Alignment (Parliament proposal)

- MS shall align their CAP Strategic Plans by 30 June 2025.

- Commission to develop a recognised common methodology to track climate expenditure.

- Evaluation by the Commission by 31.12.2023 on alignment to Farm to Fork and Biodiversity Strategies.

- Report to Parliament by 30.06/30.12 2025 on operation of the new delivery model and EU contribution to Green Deal and recommendations to Member States to achieve these.

- Green Investment(Parliament proposal)

- At least 30% of the support for investments to investments for environment and climate

CAP Reform & Farm Schemes – Key IFA Objectives

- With the CAP negotiations at a crucial juncture, IFA has outlined six key objectives on CAP Reform and support schemes.

- Objective 1

- IFA Proposal: Minimise the impact of eco-schemes on each farmer’s basic payment.

- The EU Commission has proposed that a minimum of 20% Pillar 1 payments go to eco-schemes while the European Parliament has proposed 30%. The EU is also proposing that eco-schemes be paid as a flat-rate payment per hectare and there is a risk that ecoschemes measures will be based on ‘cost incurred/income foregone’ basis which effectively eliminate the value of the eco-scheme payments to the farmer.

- IFA is extremely concerned about the impact of these proposed eco-schemes on farm incomes. Accordingly, the Minister for Agriculture must ensure that the minimum possible deduction is made from Pillar 1 for these schemes.

- The Minister must also strongly support the EU Council proposal to allow Member States who have a high level of environmental schemes as part of Pillar 2, to reduce the percentage allocated to eco-schemes under Pillar 1.

- Irish farmers already have very strong credentials on agri-environmental measures. 33% of Ireland’s land is farmed under AgriEnvironmental Climate Measures compared with an average of 13.4% across the EU-27 member states. More acknowledgement should be given of the level of actions undertaken by Irish farmers to date.

- Active farmers whose businesses are more impacted by eco-schemes participation should be rewarded with higher eco-schemes payments. This approach will maximise the number of farmers who participate in eco-schemes. At an absolute minimum, each active farmer must have the opportunity to get back what is being deducted from them for eco-schemes.

- Objective 2

- IFA Proposal: The Minister for Agriculture must robustly defend the EU Council position on 75% internal convergence.

- Convergence was introduced as part of the 2013 CAP Reforms with the objective of flattening per hectare payments across each Member State in the EU. Under the last set of reforms, Ireland undertook partial convergence bringing each farmer’s per hectare payment up to at least 60% of the national average.

- The European Commission and the EU Council of Agriculture Ministers have proposed 75% internal convergence to be achieved by the end of the next programme, while the European Parliament has sought 100% convergence. More recently, the Portuguese Presidency proposed 85% convergence in an effort to reach an agreement.

- In the context of the potential additional flattening effect of eco-schemes, it is vital that the Minister for Agriculture ensures that the European Council position of maximum 75% convergence is robustly defended.

- Objective 3

- IFA Proposal: The Government must confirm its commitment to maximise national co-financing of CAP Pillar 2 schemes.

- In 2020, the national exchequer contributed over €280m in funding to co-finance Pillar 2 CAP schemes. These included Areas of Natural Constraints (ANC), Green Low-Carbon Agri-Environment Scheme (GLAS), Beef Data and Genomics Programme (BDGP), Targeted Agricultural Modernisation Scheme (TAMS), Sheep Welfare scheme and Organic Farming scheme. These schemes are a vital support for our vulnerable sectors. Current proposals all point to an increased level of national co-financing under the next CAP programme.

- IFA is targeting a combined suckler cow payment of €300/cow, ewe payment of €30/ewe and a new tillage sector scheme as part of next CAP programme.

- The Government’s commitment to maximise Pillar 2 co-financing under the next CAP must be delivered on. Funds from Carbon Tax receipts, already committed for the agri-environmental scheme under the Programme for Government cannot be raided to meet any co-financing commitments. In addition, schemes currently funded by the national exchequer must continue to remain separate from co-financed schemes. For example, The Beef Sector Efficiency Pilot (BEEP) scheme is currently funded by the national exchequer and must remain separate from the co-financed Beef Data and Genomics Programme (BDGP).

- Objective 4

- IFA Proposal: The Minister for Agriculture and the EU must ensure sensible design and pragmatic implementation of Good Agricultural Environmental Conditions (GAECs)/cross-compliance.

- Proposals for the next CAP programme include revised definitions of GAECs. GAECs, commonly known as cross-compliance, are standards that all farmers must adhere to in order to receive CAP funding. The revised GAECs cover a number of different areas related to farming practices, including the protection of peatlands/wetlands, imposition of buffer strips, and minimum amount of land designated to non-productive areas.

- The Department of Agriculture must adopt a flexible and facilitative approach when implementing GAECs at a national level. This approach must minimise the impact of GAECs on farmers and their farm businesses.

- Of particular concern is GAEC 2, which relates to the protection of peatlands and wetlands. Peatlands and wetlands currently make up a substantial amount of Ireland’s land area with peatlands alone accounting for c. 21%. Much of this land is under agricultural use with an estimated 300,000 acres of permanent grassland on drained, carbon-rich soils.

- Regulations on the appropriate wetland and peatland protection will potentially prove a major issue in Ireland where a large share of this land is under agricultural use. The economic importance of agricultural activity for rural areas with high levels of wetland and peatland cannot be ignored. Any changes in GAECs must not undermine the economic agricultural activity taking place on these soils.

- The high level of peatland and wetland soils in Ireland underlines the need for flexibility to be given to Member States within the next CAP programme, to address this issue in a sensible and appropriate fashion.

- Objective 5

- IFA Proposal: Appropriate Genuine Farmer definition with phasing out of long-term leasing of entitlements.

- The next CAP programme will include a requirement for all member states to have a genuine farmer definition. This definition must ensure CAP payments are made to farmers who are actively farming.

- IFA proposes a minimum economic output metric to be used in defining a genuine farmer. This metric will be based on sales or output per hectare with a differentiated rate depending on Areas of Natural Constraint (ANC) designation.

- In order to help encourage more young farmers into the industry it is proposed to use any money generated from redefining the genuine farmer for generational renewal initiatives.

- IFA also proposes a reform of regulations governing the leasing of entitlements which would include the phasing out of longterm entitlement leasing. It is proposed the revised regulations will take account of exceptional cases such as family ill-health or bereavement where leasing of entitlements will still be permitted.

Table 1: Annual allocations of Annual Carbon Tax Yield (€m) required to meet €1.5bn agri-environmental scheme commitment

| Year | Estimated Carbon Tax Yield (€m) | Agri-Environment Scheme Budget (€m) |

| 2021 | 571 | 66.68 |

| 2022 | 730 | 85.25 |

| 2023 | 889 | 103.82 |

| 2024 | 1,048 | 122.39 |

| 2025 | 1,207 | 140.96 |

| 2026 | 1,366 | 159.53 |

| 2027 | 1,525 | 178.10 |

| 2028 | 1,684 | 196.67 |

| 2029 | 1,843 | 215.24 |

| 2030 | 1,981 | 231.35 |

| Total | 12,844 | 1,500 |

Source: IFA Estimates

- Minister for Agriculture and Ireland’s EU Commissioner must Defend Irish Farmers from Attack on CAP Reform

- The original purpose of the CAP was to support farmers to produce food. However, the policy has become a diminishing part of the EU budget, while trying to achieve more objectives.

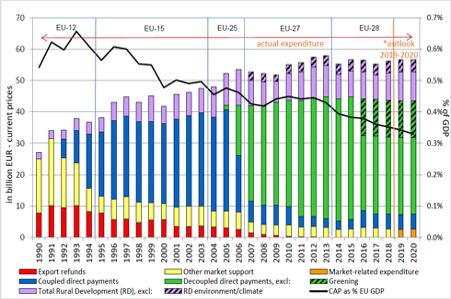

- Figure 1 highlights the reduction in the CAP as a percentage of the overall EU budget. The requirements placed on farmers in order to be eligible for payments have been increasing. This is contributing to the price-cost squeeze on farmers. CAP funding is divided between Pillar 1 which includes the Basic Payment Scheme and Pillar 2 which funds schemes such as ANCs, GLAS, TAMS, BDGP, Sheep Welfare Scheme and Organic Farming Scheme.

Figure 1: Evolution of CAP payments and as a % of EU GD

Source: European Commission

- The policy has evolved from market supports to direct payments per unit of output (coupled), to direct payments per hectare. In the last CAP programme, 30% of Pillar 1 payments were for greening measures and paid as a percentage of each farmer’s per hectare entitlement. The reality is that the link between production and supports is now almost completely broken.

- These proposals will see up to 30% of Pillar 1 payments allocated to ‘eco-schemes’ with farmers now required to carry out additional environmental actions in order to receive a substantial portion of what is their basic payment under the current programme. To further compound matters, there is a substantial risk that farmers with higher per hectare entitlements will face a cut in their Pillar 1 basic payment, even if they fully participate in eco-schemes. This will occur should eco-scheme payments be made on a flat-rate basis per hectare, rather than being paid as a percentage of each farmer’s entitlement per hectare.

- The current CAP programme, which commenced in 2015 was due to finish in 2020 but has been extended to 2022 under transition arrangements. A new CAP programme is currently under negotiation in a ‘Trilogue’ process between the European Commission, the European Council of Agricultural Ministers, and the European Parliament. In tandem with these negotiations, the Department of Agriculture is currently devising a CAP National Strategic Plan for submission to the European Commission. This plan must be submitted by the end of 2021 and must set out, in full detail, how the new CAP programme will be implemented in Ireland.

- CAP Reform must not make more farmers unviable

- The importance of the Common Agricultural Policy (CAP) to Irish farmers cannot be overstated. Without the support CAP provides in the form of direct payments, the vast majority of Irish farmers would be completely unviable. Analysis of the 2019 Teagasc National Farm Survey, outlined in Table 2, shows that on average 77% of farm income comes from direct payments, while direct payments make up between 129% and 160% of dry stock farmers’ total income.

Table 2: Average value of direct payments (DP) & contribution of DP to Average Family Farm Income (FFI) 2019

| DP (€) | DP as a % of FFI | |

| Cattle Rearing | 14,562 | 162 |

| Sheep | 19,495 | 132 |

| Cattle Other | 17,775 | 129 |

| Tillage | 24,775 | 76 |

| Dairy | 20,360 | 31 |

| All | 18,325 | 78 |

Source: Teagasc National Farm Survey 2019

- CAP National Strategic Plan

- For the first time, each member state will prepare a CAP National Strategic Plan for submission to the European Commission.

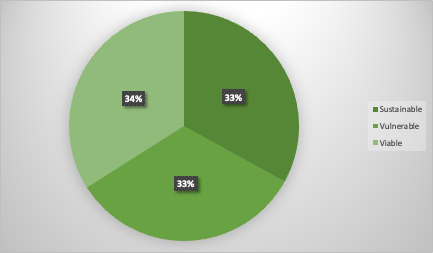

- This plan will play a pivotal role in implementing the next CAP programme in Ireland. According to the 2019 Teagasc National Farm Survey, only 34% of Irish farmers are viable. The Irish Government cannot allow the next CAP programme to create any further unviable farmers. This Plan must take account of the economic impact any new policy initiatives will have and requires that a full economic impact assessment of any policy reform measures be undertaken before implementation.

- Figure 2 illustrates the viability of Irish farming. A farm business is deemed to be viable if the farm income can remunerate family labour at the minimum agricultural wage and provide a 5% return on capital invested in non-land assets (e.g. livestock/farm machinery). A farm household is considered sustainable, even if the farm business is unviable, if the farmer or spouse are in receipt of an off-farm income. A farm household is considered to be economically vulnerable if the farm business is not viable and neither the farmer or spouse work off-farm.

Figure 2: Viability of Irish Farming

Source: Teagasc National Farm Survey 2019