Farm-gate Prices – September milk

| Processor | c/L protein value | c/L fat value | Volume charge | A+B-C | Bonus | VAT | Standard Price |

| DAIRYGOLD | 20.09 | 13.39 | 4.00 | 29.47 | 0.65 | 1.63 | 31.75 |

| KERRY | 19.35 | 14.07 | 4.00 | 29.42 | 1.59 | 31.00 | |

| LAKELAND | 21.75 | 12.09 | 3.50 | 30.34 | 0.00 | 1.64 | 32.00 |

| GLANBIA | 20.33 | 12.31 | 4.00 | 28.64 | 0.82 | 1.59 | 31.00 |

| LISAVAIRD | 19.93 | 14.50 | 3.70 | 30.73 | 0.50 | 1.69 | 32.91 |

| AURIVO | 20.43 | 13.05 | 4.25 | 29.23 | 0.65 | 1.61 | 31.50 |

| BARRYROE | 20.10 | 14.62 | 4.00 | 30.72 | 0.50 | 1.69 | 32.91 |

| DRINAGH | 19.93 | 14.50 | 3.55 | 30.88 | 0.50 | 1.69 | 33.08 |

| ARRABAWN | 21.33 | 11.48 | 3.35 | 29.46 | 0.20 | 1.60 | 31.26 |

Farmgate prices for September milk range from x to y. EU average price for August was 32.7c/L (4.2% fat/3.4% protein, ZuiveNL) Fonterra forecast price for this season is 24.5c/L-28.45c/L.

Ornua PPI

| Jul | Aug | Sep | |

| Ornua PPI | 101.7 | 101.8 | 102.8 |

| Ornua PPI (c/L) | 29.3 | 29.4 | 29.7 |

| Ornua Value Payment | €3.2m | €3.4m | €5.9m |

| Adjusted PPI (c/L) | 30.29 | 30.8 | 32.1 |

The IFA adjusted PPI saw a 1c/L increase for September. Interestingly for the first time ever farmers can now see the value of the Ornua value payment which early indications suggest can vary some bit month to month.

Irish Dairy Exports

| 2020 – Aug YTD | 2019 | |||||

| Country | Category | € (thousand) | tonne | €/tonne | Volume% difference | Value % difference |

| Great Britain | Total | 511704 | 183435 | 2790 | -6.3 | -15.4 |

| Butter | 83550 | 25211 | 3314 | -24.2 | -42.1 | |

| Cheese | 201066 | 64463 | 3119 | -10.0 | -5.9 | |

| Germany | Total | 274044 | 70951 | 3862 | -1.5 | 7.7 |

| Butter | 89843 | 24814 | 3621 | 2.5 | -10.4 | |

| Cheese | 81377 | 14860 | 5476 | 16.6 | 100.2 | |

| Netherlands | Total | 461452 | 188217 | 2452 | 12.7 | -8.5 |

| Butter | 186253 | 83356 | 2234 | 33.9 | -21.2 | |

| Malt extract | 74833 | 23577 | 3174 | 37.7 | 31.2 | |

| USA | Total | 244726 | 38605 | 6339 | -2.6 | -0.5 |

| Butter | 146561 | 23277 | 6296 | 4.0 | -3.6 | |

| Casein | 56811 | 8169 | 6954 | -10.9 | 15.0 | |

| China | Total | 334720 | 70730 | 4732 | -2.7 | 10.6 |

| Food Prep | 255841 | 31105 | 8225 | -90.4 | 14.3 | |

| Whey | 26046 | 16294 | 1599 | -4.9 | -23.7 | |

| ALL COUNTRIES | Total | 3403393 | 1061909 | 3205 | 0.4 | 1.8 |

| Butter | 696815 | 210629 | 3308 | 12.3 | -16.5 | |

| Cheese | 546435 | 154382 | 3539 | -9.6 | 0.7 | |

| Food Prep | 644926 | 94151 | 6850 | -8.6 | 2.6 | |

Irish dairy exports are very similar to 2019-YTD. Exports to GB are back considerably, while exports to other EU countries are competitive. Butter prices have seen a fall in prices across the board (-25%). The food prep category includes powders for infant formula. These are considerably more valuable than the commodities we’re used to dealing with, and dominate our Chinese exports. The value of this market now supersedes our cheese market.

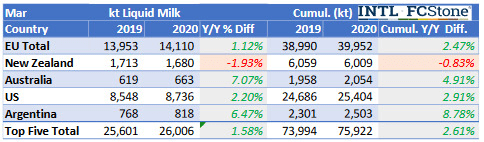

Global Supply – Jan to Aug 2020

| Global | +1.6% |

| USA | +1.4% |

| EU – 27 | +1.5% |

| NZ | – |

| NE | +1.3% |

| PL | +2.2% |

| UK | -1.1% |

| IE | +3.3 |

Global supplies are positive going into the backend which threatens to dampen price, but it is anticipated that the holiday season could underpin it somewhat. Early indication suggest that the NZ season has got off to a positive start.

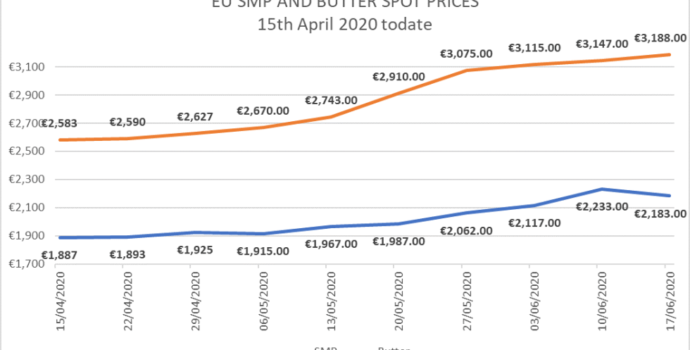

Spot Commodities and Futures

| Butter | SMP | Cheese | Whey | |

| GDT – 20th Oct | €3678 (3.3%) | €2408 (-0.2%) | €3803 (3%) | |

| EU MMO – 25thOct | €3450 (-0.6%) | €2170 (0.5%) | €3040 (0.4%) | €2720 (-0.2%) |

| EEX Futures | €3300-3500 | €2200-2350 |

Other

- Vat rate on milk sold to rise to 5.6% in Jan 2021.

- Carbery announced a 3 year fixed milk price scheme of 33c/L

Budget Outcomes

- €5m allocated for a calf weighing measure for farmers that rear dairy calves.

- Consanguinity relief has been extended to the 31st December 2023 – effective stamp duty rate of 1% Consolidation relief has been extended until December 2022 – effective Stamp Duty rate of 1%.

- Vat flat rate addition rose to 5.6%.

- Earned Income credit (self-employed) increased by €150 to €1650 – in line with PAYE earners.

DAFM Inspections during Level 5

- Inspections can go ahead during Level 5.

- 48 hour notice for all inspections.

- Where the farmer has COVID 19 – a representative can be present for the inspection or the inspection can be postponed for 3 weeks.

- Where the farmer is self-isolating – a representative can be present for the inspection or the inspection can be postponed for 3 weeks. Payment processing may be delayed if inspection is deferred.

- Where the farmer is concerned about exposure to COVID-19 – a representative can be present for the inspection instead. In exceptional circumstances the inspection can be deferred by three weeks but no longer. Delaying the inspection may result in delayed processing of payments.

Dairy Denominations

- In mid-October, MEPs voted in plenary to accept an amendment to further protect the use of words to describe dairy.

- Words such as cheese, milk, yoghurt and ice-cream are already protected and can only be used for products exclusively containing dairy.

- This amendment enhances this protection by also preventing descriptions such as “butter substitute” and “yoghurt-style” to be used on plant alternatives.

- This amendment will now go to trialogue to be passed into European Common law.

TB testing – Level 5

- In light of the enhanced COVID-19 restrictions, calves can now be moved off farm without a TB test up to 120 days of age.

- A grace period of 28 days will apply from the due date of the annual round test before the herd will be restricted. This will enable farmers with concerns about COVID-19 to delay their round test and continue trading.

BREXIT – Dairy

- IFA representatives met with Minister Simon Coveney in early October to discuss ongoing Brexit negotiations.

- Country of Origin rules could pose as a challenge for milk collected in the North but processed in the South.

- Though it will meet all EU standards as per the Northern Ireland Protocol, it is not recognised as ROI product.

- While this arrangement will suffice for export to other EU MS, such product will not be eligible for export to third countries without amending existing trade agreements (of which there are 60).

- Amending such agreements will be laborious and may come with additional asks from third countries.

- The Minister gave assurances that he is highlighting the issue and working with affected companies to make alternative arrangements.

Climate Change – Progress

- IFA issued a press release in Oct documenting farmers achievements in transitioning to the use of LESS and protected urea which was picked up by the Irish Times.

- With TAMS support, farmers have already invested an estimated €79.6m in LESS equipment such as trailing shoes and dribble bars.

- Sales of protected urea have increased significantly this year. From January to June, just under 40,000 tonnes were sold, compared to 21,000 in 2019.

Dates for the Diary

- TAMs application deadline extended to the 13th November.

- Nitrates – slurry export forms due in 31st December 2020.

- Nitrates – dairy cows stocking rate to increase from 85 to 89kgN/year. Please check with your advisor if this impacts your overall farm stocking rate for nitrates.