Farm-gate Prices – October milk

| Processor | c/L protein value | c/L fat value | Volume charge | A+B-C | Bonus | VAT | Standard price |

| DAIRYGOLD | 20.09 | 13.39 | 4.00 | 29.48 | 0.65 | 1.62 | 31.76 |

| KERRY | 19.44 | 14.14 | 4.00 | 29.58 | 0.5 | 1.62 | 31.7 |

| LAKELANDS | 21.95 | 12.19 | 3.50 | 30.64 | 0 | 1.65 | 32.29 |

| GLANBIA | 20.32 | 12.31 | 4.00 | 28.63 | 0.78 | 1.59 | 31 |

| AURIVO | 20.43 | 13.05 | 4.25 | 29.23 | 0.65 | 1.61 | 31.5 |

| ARRABAWN | 21.42 | 11.57 | 4.00 | 29.64 | 0.2 | 1.61 | 31.5 |

| BARRYROE | 20.10 | 14.62 | 4.00 | 30.72 | 0.5 | 1.68 | 32.91 |

| DRINAGH | 19.93 | 14.50 | 3.55 | 30.88 | 0.5 | 1.69 | 33.07 |

Farmgate prices for October milk range from 31 to 33c/L. EU average price for October was 33.26c/L, the Fonterra price was 29.14c/L and the price for the US was 45.06c/L (4.2% fat/3.4% protein, ZuiveNL).

Ornua PPI

| Aug | Sep | Oct | Nov | |

| Ornua PPI | 101.8 | 102.8 | 104.1 | 104.3 |

| Ornua PPI (c/L) | 29.4 | 29.7 | 30.2 | 30.3 |

| OrnuaValue Payment | €3.4m | €5.9m | €5.8m | €5.6m |

| Adjusted PPI (c/L) | 30.8 | 32.1 | 32.7 | 33.2 |

In 2019, Ornua purchased 340,000 MT of dairy products, to the value of over €1 billion (Total dairy exports = €4.4bn). Given its size in the market, we expect that farmgate prices should reflect the upward price trend seen in the PPI.

Irish Dairy Exports – September YTD

| Country | Category | € (000) | tonne | €/tonne | Volume% difference | Value % difference |

| Great Britain | Total | 599362 | 214352 | 2796 | -7.1 | -15.7 |

| Butter | 12855 | 3613 | 3558 | -33.8 | -35.1 | |

| Cheese | 39007 | 12497 | 3121 | -29.6 | -25.6 | |

| Germany | Total | 305733 | 81508 | 3751 | 1.1 | 7.8 |

| Butter | 13530 | 3889 | 3479 | 64.5 | 44.9 | |

| Cheese | 8409 | 2730 | 3080 | 23.0 | 26.0 | |

| Netherlands | Total | 523560 | 215982 | 2424 | 10.4 | -6.3 |

| Butter | 24650 | 10080 | 2445 | -0.9 | 91.1 | |

| Milk Powder | 7086 | 3528 | 2009 | -58.4 | -56.3 | |

| USA | Total | 276239 | 43841 | 6301 | -1.2 | -0.2 |

| Butter | 19057 | 3176 | 6000 | 17.1 | -0.1 | |

| Casein | 6869 | 1014 | 6774 | -6.5 | 17.0 | |

| China | Total | 378707 | 80512 | 4704 | -0.2 | 13.0 |

| Food Prep – infant formula | 31999 | 4096 | 7812 | 34.0 | 44.0 | |

| Milk Powder | 5455 | 2368 | 2304 | 2.2 | 8.3 | |

| ALL COUNTRIES | Total | 3827770 | 1202370 | 3184 | -0.8 | 0.8 |

| Butter | 90188 | 26467 | 3408 | -8.6 | -3.0 | |

| Cheese | 82118 | 25355 | 3239 | -19.2 | -16.8 | |

| Food Prep – infant Formula | 65190 | 10256 | 6356 | -1.7 | 2.1 |

Irish dairy exports are almost identical to 2019-YTD. The top two products traded for the month of September in each destination are listed in the table above. Butter exports to the USA are ahead of this time last year, what is worth noting is that this growth has persisted despite the presence of trade levies and the product commands a premium. It is crucial that the sector focus on products that command a premium rather than depend on trading commodities.

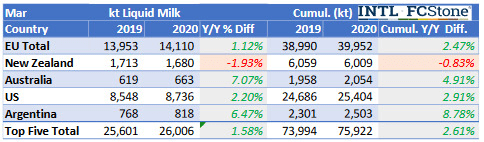

Global Supply – Jan to Sept 2020

| Global | +1.6% |

| USA | +1.5% |

| EU – 27 | +1.4% |

| NZ | +0.4% |

| NE | +1.2% |

| PL | +2.2% |

| UK | -0.9% |

| IE | +3.0% |

Global supplies are positive going into the backend. NZ are on track for a record year for milk supply as they approach peak. Futures market prices for commodities remain flat toward H1 2021. Butter is most exposed to the closure of food services and is where we see the most volatility.

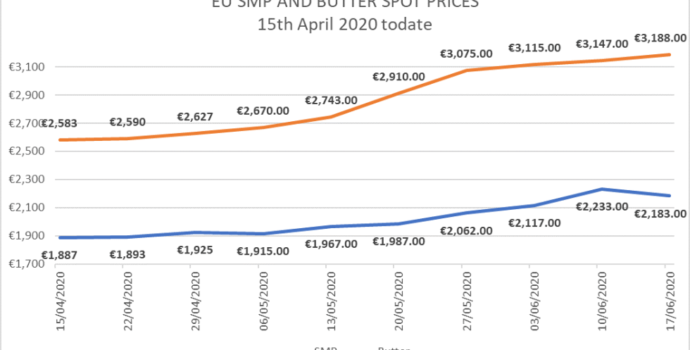

Spot Commodities and Futures

| Butter | SMP | Cheese | Whey | |

| GDT – 1st Dec | €3309 (3.8%) | €2398 (3.6%) | €3100 (2.4%) | |

| EU MMO – 15thNov | €3490 (0.6%) | €2150 (-0.8%) | €3090 (0.5%) | |

| DL/NE/FR – 18thNov | €3348 (-0.25%) | €2157 (-0.8%) | €713 (2.39%) |

Other Notes

Aurivo announced a 3 year fixed milk price scheme of 32.5c/L.

Lakeland announced a 3 year fixed milk price scheme of 33c/L including VAT.

Nitrates Rule Change

New measures introduced in the new SI 529/2020. All farms stocked over 170kg (INCLUDING THOSE THAT EXPORT SLURRY) must:

- feed concentrate of less than 15% crude protein from 1st April to 15th September.

- Adopt a liming programme

- Use LESS for slurry spread after the 15th April 2021oNot use watercourses as a source of drinking water and Fence watercourses (solid blue line on OSi map) 1.5m from top of the bank – permissible to cross cattle across watercourses to get to land parcels.

- Water troughs must be 20m away from a watercourse as identified by a solid blue line on OSi Map.

Regardless of stocking rate all roadways must be sloped AWAY from drains and watercourses identified as solid and speckled blue lines on the OSi map.

The excretion rate for dairy cows has increased from 85kgN/year to 89kgN/year. This will increase your Stocking rate next year. This change applies to all herds.

The public consultation on Ireland’s Nitrates Action Programme is currently open and will close on the 15th January.

Yemen Appeal

IFA would like to pay tribute to Mike Magan for his successful campaign to raise vital funds to combat the famine in Yemen. So far in excess of €200,000 has been raised. Thanks to all the generous farmers out there who kindly donated to the appeal.

MILK Cookbook

Supported by the NDC the MILK cookbook written by John and Sally Mc Kenna was launched in October.

The book currently ranks at No. 8 of the cookbook sales chart.

Why not give this book as a present this Christmas and promote dairy amongst your friends and family!

Breeding Update

The proportion of dairy births with a beef sire continues to grow and now stands at 30% (23% in 2015).

Of beef calves born from dairy cows; 19% had an AI sire, 36% were bred by a stock bull and 45% had no sire recorded.

Of dairy calves born from dairy cows; 61% had an AI sire, 12% were bred by a stock bull and 27% had no sire recorded.

89% of dairy straws used this year were Ho, 6% were Fr and 4% were Je.

€5m dairy beef scheme

- Exchequer funded scheme announced in the Budget

- Current proposal is that the scheme will look to weigh dairy beef calves in their first year of life and is open to both dairy and beef farmers who have a dairy/beef enterprise.

- It is hoped to expand the scheme after 2021

Dates for the Diary

- TAMs application deadline – mid January, date to be confirmed.

- Slurry export forms – 31st December 2020