Domestic Market

Still no change in the domestic market with barley slow to move due to the import of maize and slowing feed demand. Barley that is moving has been sold at up to €190/t and wheat is moving easier at an average of €205/t. The situation is now critical due to the likelihood of a significant carryover of barley into the next harvest. Figures from Eurostat indicate that 156.000 tonnes of maize from non-EU sources were imported into Ireland this January alone. Canada, Russia and the Ukraine were the main sources for this maize which indicates that it went into the animal feed sector. This level of importation, when Irish barley is readily available is unacceptable and is posing serious questions for Ireland’s brand image particularly in relation to Origin Green. The latest green prices for green barley and wheat for 2019 harvest are €145/t and €155/t respectively.

Native/Import Dried Prices

| Spot 10/04/19 | April – Jun 2019 | New Crop 2019 | |

| Wheat | €203 – €206/t | + €1/t per month | €183-185 |

| Barley | €184 – €187/t | + €1/t per month | €173-175 |

| FOB Creil Malting Barley | €186/t July 2019 | ||

| Oats | €225 | ||

| OSR | €365 | €370 | |

| Maize (Import) | €180 | €177 | €177 |

| Soya (Import) | €330 | €330 |

International Markets

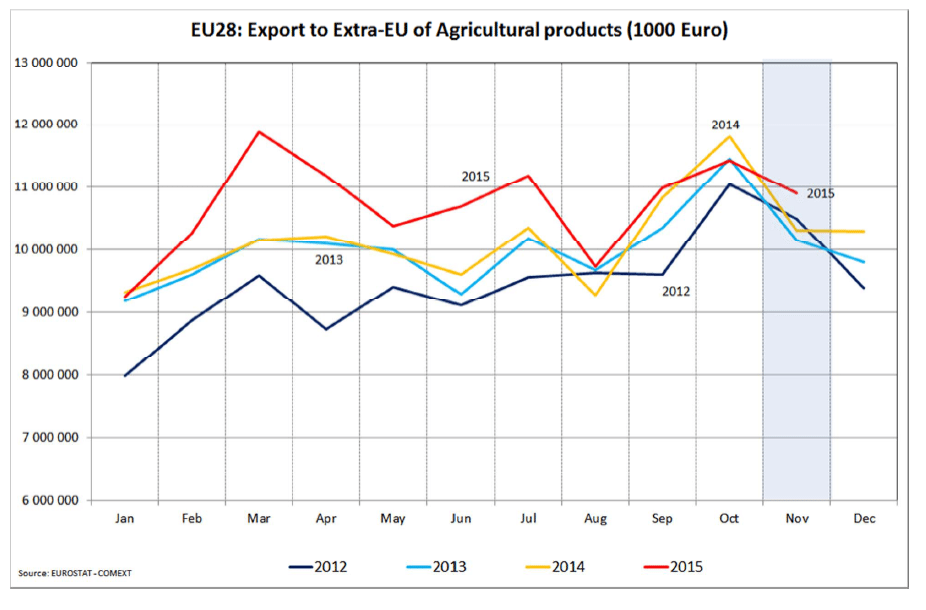

Wheat markets were under pressure over the past number of days due to favourable crop reports and high ending stocks. Yesterday the USDA raised its estimate of US and world wheat supplies following poor export demand and a good harvest in Argentina. The monthly report upped its forecast of global 2018/19 wheat ending stocks to 275.61 million tonnes, topping the highest in a range of trade expectations. The report also indicated that the Winter wheat crop was now in an improved condition from the previous report. European markets although under pressure, have fared better as the strong export trade continues, helped by the weaker euro and the reduction in Russian exports.EU soft wheat exports are down only 4% on the previous year compared with 25% in February. Recent figures from France indicate that the barley acreage will increase by 17% this year which is up 3% on the 5 year average. This is related to the reduction in sugar beet which is down 6% and Rapeseed at 18% on last year’s plantings.

Corn (Maize) has come under renewed pressure as the USDA report indicated that carryover stocks in the US could remain high due to falling export, feed and ethanol demand. However, futures prices continue to receive support due to the potential of US/China trade talks and forecasts of further wet and cold weather for the main cropping states of the US Midwest.

The soybean market remains focused on the US/China talks and continue to trade in a narrow range which are at historic lows. In relation to rapeseed, French and German farmers have been forced to plough in 18,000 ha’s of the crop due to the presence of an unauthorised GM variety found in imported seed. This is ironic considering that the EU import millions of tonnes of GMO crops every year.