Grain Market Update 26th September

Domestic Market

The harvest is virtually finished with growers making significant progress in Donegal after the fine spell last week. The beans are finished up in most places, however, yields have proved to be a little disappointing.

The first of the official Irish grain prices have been released with Glanbia offering a very poor price below €130/t to non-members but most green barley prices are averaging somewhere between €140 to €145/t. With harvest pressure now eased across the UK and Europe prices have settled.

The final price of the Boortmalt 2019 malting barley pricing model was last week with the final average price for malting barley not forward sold finishing at €174/tonne.

Irish Native/Import Dried Prices

| Spot 26/09/2019 | Nov 2019 | |

| Wheat | – | €177/t |

| Barley | – | €167/t |

| FOB Creil Malting Barley (Av) | €174 | |

| Oats | – | €170 |

| OSR | – | €375 |

| Maize (Import) | €177 | €177 |

| Soya (Import) | €328 | €330 |

International Markets

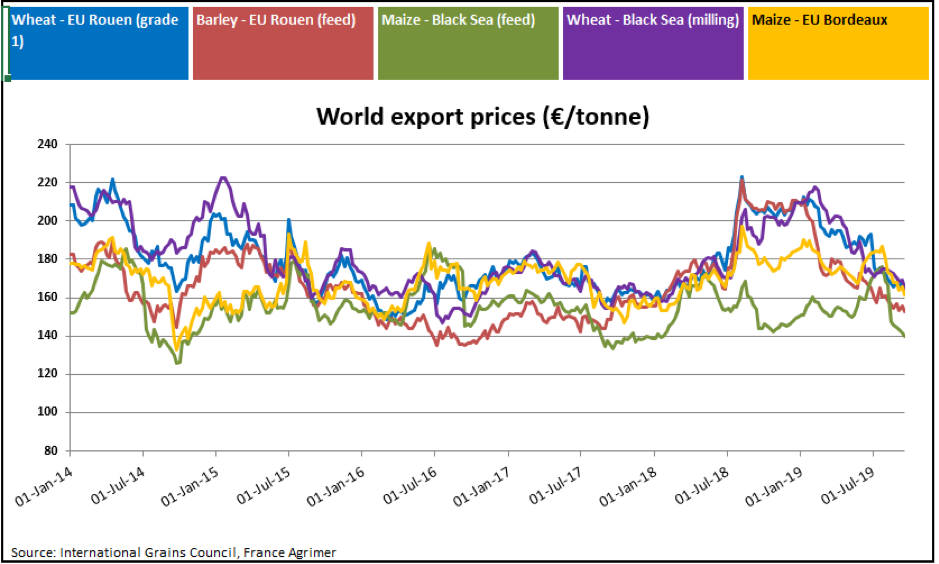

European wheat prices have strengthened in recent days with the Matif Dec 19 now at a six-week high. It has been helped by the weaker euro along with good demand from countries such as Egypt and Morocco who have committed to large supplies of French wheat in the coming months. Saudi Arabia has just released a tender for 1 million tonnes of feed barley which has added confidence to the European barley market. In its most recent report, the International Grains Council (IGC) lowered its wheat production figure for Australia by 3 million tonnes due to continued drought, however, this was balanced by the upward review to EU Figures. Winter crop planting is well underway with some reports stating that they are almost finished in parts of the US, while they are over a third of the way in the Ukraine.

Corn (Maize) futures have continued to trade in a narrow range, as poor export demand for US corn is weighed against the ongoing possibility of lower yields of the current crop. The corn harvest has started in the US but they still haven’t completed 10% of the area, so it is still too early to make any calls on yields. The possibility that oil refiners in the US may have to blend more corn-based ethanol has also offered support to the market, however, in recent days president Trump has parked the talks on the issue. Due to the possibility of lower corn yields in the US and Argentina the IGC has reduced its overall forecast for world corn production.

Some positive signals from the US/China trade dispute have boosted the soybean market, with the Chinese also importing significant quantities of the crop from the US in recent days. The IGC have also downgraded world soybean production in their report due to the prospect of lower US production due to late planting.