Feed demand has dropped off considerably as we near the end of April however the cool April has ensured a steady demand as grass growth struggles. The continuing spell of dry weather has ensured that planting of the main cereal crops is almost finished apart from in the north west.

Due to the recent spike in world grain prices because of renewed weather concerns, Irish new crop prices have followed suit. In the past three weeks alone, forward prices for barley and wheat have jumped by almost 15%. Green harvest prices of over €180/t for barley and €200/t for wheat are being offered. In comparison to this time last year, forward prices are €40/t higher. While there may be further upside in the market, growers may now consider forward selling a small percentage of their crop.

Maize continues to be the main driver of the positive grain markets. This is a major turnaround from April last year, where an EU import duty was introduced on maize imports, due to the low-price level. New crop maize for import is €70/t or 40% higher than last year, trading at a €30/t premium to barley.

Meanwhile, Irish November rapeseed prices have been pushing higher to €475/t and with soymeal imports at €440/t, this leaves native beans prices in a positive position.

The FOB Creil July 2021 malting barley price, is trading above €220/t, as the Chinese make further commitments to French grain. The pricing tracker for those supplying Boortmalt started on April 15th and is currently averaging €218/t.

Irish Native / Import Dried Feed Prices 27/04/2021

| Spot €/t | Nov 2021 €/t | |

| Wheat | 245 | 230 |

| Feed Barley | 225 | 212 |

| FOB Creil Malting Barley | (July 2021) 221 | |

| OSR | 475 | |

| Maize (Import) | 270 | 245 |

| Soymeal (Import) | 440 | 440 |

International Markets

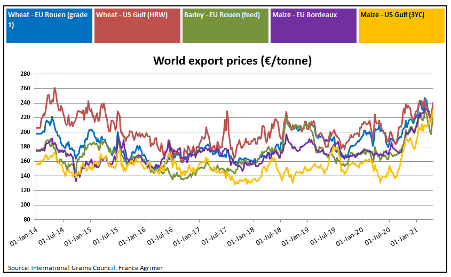

Matif wheat front month prices have spiked to €247/t while December is now at €226/t. A combination of weather issues, maize prices and Chinese demand have contributed to the recent market moves. Agricultural commodities are also part of what may be a commodity super cycle. This is attracting interest from managed money funds and is contributing to the bullish sentiment. Crops in Europe and the US are generally fine; however, the recent cold and dry weather is raising drought concerns and yield potential has been revised downwards. Nonetheless, at this stage, yield potential in Europe is expected to be above 2020 levels.

Maize prices are now on a par or higher than milling wheat. This is causing Asian countries which account for 30% of global maize imports, to reduce the maize percentage in feed rations. As a consequence, they have upped their orders for European wheat and barley as a replacement.

The dry conditions in the Mato Grosso region of Brazil are continuing to affect the Safrinha crop, with production estimates now reduced from 85 to 79 million tonnes. Corn planting in the US is over 20% complete which is behind the five-year average. There is some concern that cold weather may have damaged some of the first plantings.

Soybean plantings in the US are on track, however like maize, stocks are at historic lows which has driven prices to seven-year highs. The progress of the US soybean crop will have a major influence on the direction of the protein and oilseed markets.

Market sentiment for oilseeds remains bullish with production of oil seed rape in the EU/UK downgraded again, while expected canola plantings in Canada have underwhelmed.