Dairy Council Report May 2022

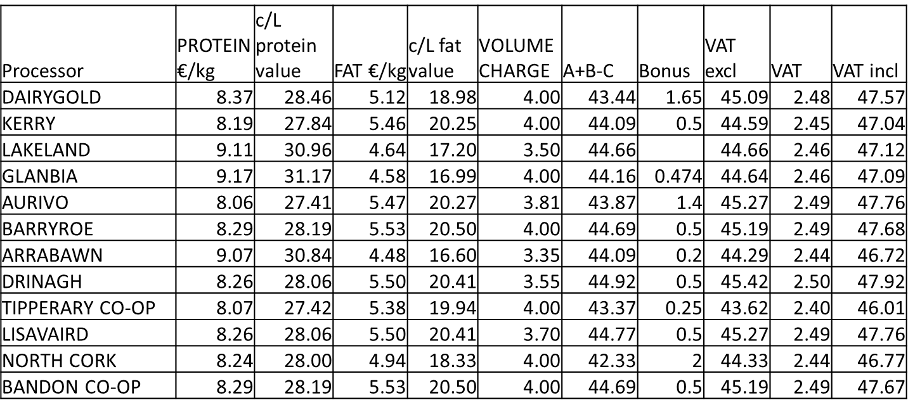

Farmgate Prices – March 2022

Ornua PPI – April 2022

Below are the last four months prices, including VAT. From April 2021 to April 2022 the PPI has increased by close to 60%, but from April 2021 to March 2022 the milk price has only increased by 36%. Questions need to be answered by all processors on this. Is it that the products they are selling outside of Ornua are not making the same return as Ornua are getting for their products or is it that they are not returning the full market value they are receiving in their milk price to suppliers?

| Jan | Feb | Mar | Apr | |

| Ornua PPI | 147.2 | 152.3 | 164.3 | 177.6 |

| Ornua PPI (c/L) | 45.8 | 45.8 | 49.1 | 54.4 |

| Ornua Value Payment | €0.33m | €0.47m | €5.55m | €6.64m |

| Adjusted PPI (c/L) | 46.44 | 46.9 | 51.71 | 57.09 |

Milk supply -March 2022

Domestic milk intake by creameries and pasteurisers was estimated at 802.4 million litres for March 2022. This represents a decrease of 3.2% on March 2021.

The Protein content increased from 3.33 % in March 2020 to 3.34% in March 2022.

During the period January to March 2022, domestic intake was estimated at 1,353 million litres, a decrease of 0.1% when compared to the corresponding period for 2021.

Latest Commodity prices

GDT 3rd May

| Price | Trend | |

| GDT | €4419 | -8.5% |

| Butter | €5807 | -12.5% |

| Cheddar Cheese | €5652 | -8.6% |

| SMP | €4130 | -6.5% |

EU Spot Commodity Prices 4th May

| Butter | Price/Tonne | Trend |

| Butter | €7233 | +.01% |

| Whey | €1390 | -2.5% |

| SMP | €4198 | +0.3% |

| WMP | €5262 | -0.03% |

European Futures Market

| EEX | Period | Price/Tonne | Trend |

| Butter | May 22 – Dec 22 | €6955 | -2.0% |

| SMP | May 22 – Dec 22 | €3886 | -0.1% |

| Whey | May 22 – Dec 22 | €1348 | -5.7% |

Dairy Market Summary

Dairy prices have largely stabilised over the past month.

Global milk flows improved gradually through quarter one but are still weaker year-on-year.

High input costs have ensured that there has not been a significant supply reaction to record global milk prices.

The Russia-Ukraine conflict is unlikely to be resolved in the near-term. This will affect input costs and supply chains for the foreseeable future.

Retail sales appear to be slowing with higher prices potentially dampening demand.

EU and US output as well as Chinese buying will be key over the next three to four months.

Overall, lower supply should continue to support the market despite some weaker demand signals.

Nitrates Action Programme

- Met the DAFM, along with other IFA committees, on the new Nitrates Action Plan.

- Permanent Grass Land can only be ploughed between 1 March and 31 May on derogation farms. These farms can reseed after these dates but not by means of ploughing.

- The Nitrogen density in slurry is now set at 2.4kgsN per 1,000 litres down from 5kgsN per 1,000 litres. DAFM have agreed to monitor results on slurry being tested on sign post farms with a view to getting this figure increased again. DAFM would not commit to allowing farmers to individually test slurry and use these results in place of the 2.4kgsN per 1,000 litres.

- If water quality has not improved in catchments with significant N and P issues by 2024 then the 250kg N/ha livestock manure nitrogen limit on derogation farms will be decreased to 220kg N/ha.

Food Vision Dairy Group

- First Draft of Food Vision Dairy Group report received on 7th April and detailed response submitted by IFA on 25th of April.

- Main points in IFA response;

- Significant concerns around the proposal on a retirement scheme. We do not believe this is a scheme that should be considered at this time.

- Not in favour of a Cap-and-Trade methane-focused emission model.

- The measurement and monitoring of carbon production at individual farm level is an issue that affects all farmers and merits a wider multi-sectoral discussion before being progressed.

- The proposed 35% reduction in Chemical Nitrogen usage is totally unworkable at farm level.

- We were broadly supportive of the other proposed measures, but responded with many queries on how these would work and also highlighted the need for significant funding requirements for most of these proposals.