Dairy Council Report October 2022

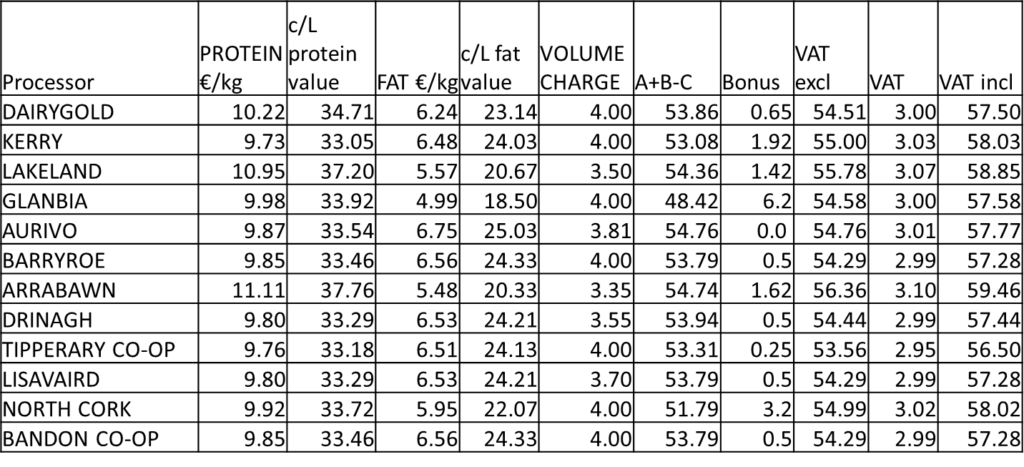

Farmgate Prices –September 2022

Ornua PPI – September 2022

Below are the last four months prices, including VAT. The PPI has stabilised over the past 3 months with indications that it is becoming difficult to get further price increases in the market currently. The processing cost has increased from 8.3 cent in June to 10.1 cent in September.

| Jun | Jul | Aug | Sep | |

| Ornua PPI | 179.4 | 184.4 | 184.6 | 184.5 |

| Ornua PPI (c/L) | 56.0 | 57.0 | 56.9 | 56.0 |

| Ornua Value Payment | €10.4m | €7.45m | €7.79m | €8.3m |

| Adjusted PPI (c/L) | 58.33 | 59.13 | 59.37 | 58.33 |

Milk supply -August 2022

- Domestic milk intake by creameries and pasteurisers was estimated at 925.6 million litres for August 2022. This represents an increase of 0.9% on August 2021 2021.

- Fat content increased from 4.19% in August 2021 to 4.21% in August 2022. Protein content decreased from 3.54% to 3.53% over the same period.

- Domestic milk intake by creameries and pasteurisers was estimated at 6,586 million litres from January to August 2022. This represents a decrease of 0.3% on the same period in 2021.

Latest Commodity prices

GDT 4th October

| Price | Trend | |

| GDT | €3,911 | -3.5% |

| Butter | €4,983 | -7.0% |

| Cheddar Cheese | €4,966 | -3.8% |

| SMP | €3,497 | -1.6% |

EU Spot Commodity Prices 9th October

| Butter | Price /tonne | Trend | |

| Butter | €7166 | -0.7% | |

| Whey | €1089 | -2.86% | |

| SMP | €3712 | -0.3% | |

| WMP | €4858 | -1.07% |

European Futures Market

| EEX | Period | Price/ tonne | Trend |

| Butter | Oct 22 – May 23 | €6719 | -0.7% |

| SMP | Oct 22 – May 23 | €3616 | -1.2% |

| Whey | Oct 22 – May 23 | €1046 | -3.8% |

Dairy Market Summary

• EU dairy prices are at record levels. While skimmed milk powder and whole milk powder prices remain relatively stable while others continue to rise. This has seen EU raw milk prices reach record highs.

• Despite this, farmers’ margins remain tight due to higher input costs. Dry and warm weather conditions in spring affected grass quality and the availability of other feed ratio components, which could see milk yield development being lower than expected in 2022.

• This, along with a smaller dairy herd (-1%), combine to result in an expected decline of 0.6% in EU milk deliveries in 2022. The lower grass quality and lower feed use are also likely to decrease the milk fat and protein content, thus reducing the availability of milk solids for further processing.

• The supply picture has been weak so far this year. While flows will improve in the second half of the year, it is unlikely to weigh on the market.

• The demand picture has been less clear in comparison, but there is growing evidence that current high prices are affecting affordability.

Dairy Committee Meetings

- The Dairy Committee had a meeting with the EPA , LAWPRO and ASSAP in Laois in September which included a visit to a local river.

- Items discussed included how farmers can help improve water quality on their farms. Simple measures such as ensuring no direct land run off to drains and waterways by incorporating riparian margins was highlighted on the visit to the local river.

- Agreement that such meeting will become a more regular occurrence so all can work together to improve water quality.