Farm Business & Inputs Reports

Farm Business Council Report July 2022

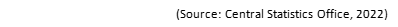

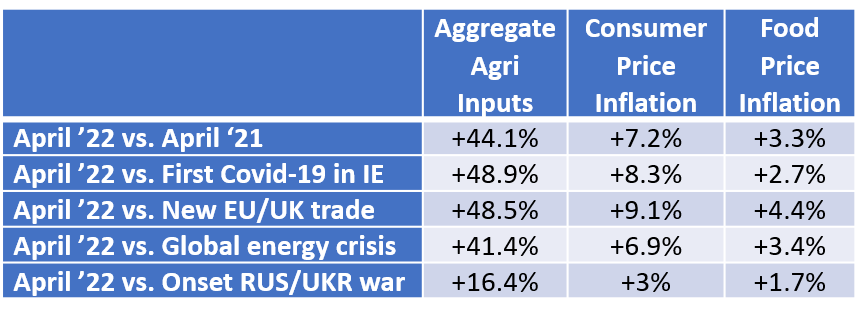

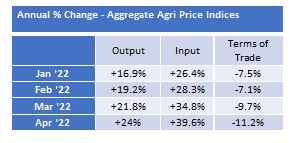

Agri Inputs

- Successive negative terms of trade through 2022, with downward output price pressure across many sectors currently compounding situations

- Some contraction in fertiliser prices but remain at elevated levels. Hesitant demand from farmers & retailers likely (i.e., why buy now if prices drop further – added cost/risk) but bigger concerns re possible rebound in prices as EU natural gas supplies from Russia diminish post planned Nord Stream Pipeline maintenance and no notice re cessation of Chinese export ban (was due to cease end June 2022). At existing natural gas prices – production costs per tonne of Urea estimated $1,000/t, well above existing prices!

- Sharp downward drop in feed spot prices reflect hedge money getting out of commodities. Harvest prices are currently forecasting further drops BUT the market is very sensitive – virtually ‘all-on-spot’ – so any hiccup could see the price spike €50-€60/tonne in days. Other key unknown, with higher energy & transport costs how much will result in a lower price reduction to the producer

- Overall, continued volatility in markets at elevated prices likely in months ahead

- County Executive presentations: Donegal; Waterford; North Cork

Commission on Taxation & Welfare

- Virtual meeting with Secretariat for Commission on Taxation & Welfare June 21st and again expressed concerns re lack of representation on the Commission; the lack of engagement re our submission and what ultimately what may be derived in terms of future direction etc.

- Given time (report due for Minister of Finance in July; published likely September) they were not open to having additional representation on the COTW, but highlighted that the IFA submission had been received and reviewed, with interests of Agri very much championed by a number on the CoTW

- Invitation to engage/discuss in greater detail once report issued to Dept of Finance but unable to divulge any specifics given confidential and ongoing preparation of final report until then

- Reading between the lines, reliefs re asset transfer etc likely to be protected, however may be proposals re increasing PRSI contributions and progressive removal of reliefs not fully aligned re climate ambitions – all TBC.

Retail Banking Review

- Retail Banking Review Dialogue was held on 16 May, during which Minister Donohoe launched a public consultation seeking stakeholder views on the Retail Banking Review

- IFA representatives participated in SME & Future Retail Banking Model break-out sessions with summary points made including:

- Existing Retail Banking model including governing parameters/regulations underpinning same are not fit for purpose – evidenced by Ireland now effectively only having 3 remaining retail financial institutions (down from 12 in 2008). Footprint/presence of 3 remaining Banks are also far removed from previous positions, and their retraction in the market is having a significant impact on many rural towns and villages where they close branches. The Bank is typically a fundamental asset to business activity and communities.

- Big concern re lack of Competition in the market

- Feedback regularly received re increasing information requirements; delays in decision-making, etc.

- Highlighted considerable Rural vs. Urban divergence in B&A findings which needs to be taken into consideration in future reviews, with increasing digital offering/trajectory not attractive to all – demographic; vulnerable customers; connectivity issues etc.

- Highlighted only 4% experienced in Switching and huge difficulty that is having currently with Ulster Bank / KBC exit – including significant delays in arranging meetings to open up new Business current accounts (up to 2/3months in cases); and that existing Bank switching offer isn’t really fit for purpose given doesn’t cover a lot of inward transactions. Welcomed Banks going to increase resources and staff numbers to switching process, and that Central Bank are going to keep under review.

- IFA submission made to Retailing Banking Review made 8th July – enclosed for info

- Review will be conducted by the Department of Finance, with the assistance of other relevant Government agencies and Departments, and report to Minister Donohoe in November 2022

Irish Banking Culture Board (IBCB) Survey

- IBCB Éist Public Trust in Banking Survey results published 11th July

- Acknowledged and thanked IFA for support in survey design and securing farmer participants

- Results stark – negative sentiment towards Banking sector considerably higher among farmers vs. General population/other SME’s – lack understanding of farming/farm challenges; lower levels of trust; high level of pessimism re economic outlook in next 12mths (79%)

- Press release issued (enclosed)

- Anticipated IBCB co-ordinated roundtable discussions involving Senior Bank Officials – date TBC

Industry Engagement:

Bank of Ireland, 22nd April [& 8th June online]

- No significant increase W/C requests. Expect increase in months ahead. O/D utilisation at only 10% – lowest in 5yrs.

- Significant staff training & new BoI Agri Dev Manager joining team in June.

- Encourage: Engage early – quantify W/C need for 9-12mths rather than come in with multiple applications.

- Above expected (+150%) queries re transition from Ulster Bank. Delighted to welcome new customers. Will however look at cases on case-by-case basis and look to support existing customers rather than acquire new customers (context pig farmers). Will devote increased staff resources to support switching – call centres in last 3-4mths; in branches; and dedicated support line. Understand can be challenging from customer point of view, however range of support guides also available. BoI have Agri Switching Product there – c.€1k – to support in part associated legal fees or some in making the transition to BoI from other financial institution.

- Discussion re typical turnaround times for account opening – suggested 4-6weeks generally but may be longer for more complex cases involving release of security etc. Understanding is opening Business c/a may be somewhat more difficult than opening personal a/c however thought Business O/D was part of overall package and available from Day 1.

- Discussed CAP, likely direction; NSP feedback & BoI approach re CAP payments in repayment capacity analysis. In previous CAP, BOI stressed CAP payments by 25% (Pillar 1 & Pillar 2). Policy re treatment under the new CAP not yet finalised given overall CAP infrastructure still under review.

- Discussed Fixed Milk Price schemes – still have a role, but need to evolve more towards Fixed Margin schemes by including key inputs as well as milk price.

- Discussed Sustainability and Bank approach – key focus. Increased investment re slurry storage and renewables likely in short-term. FGLS and CGS complete in BoI. BILS well received and good uptake among farmers. Emphasised need for replacement finance offer to support continued on-farm investment in absence of SBCI products.

- Discussed Electronic Funds Transfer & online payment options for farmers – e.g., 2 farmers trading calves in farm yard. Welcome move to same and will investigate re options available re more remote financial transactions.

New BOI €100m Agri Assist Loan

- €100m to finance the additional costs of energy, animal feed and fertiliser either already purchased or planned for this season

- Loan amounts up to €100,000 (amounts greater than this will be considered on a case-by-case basis)

- 3.86% variable

- 6mths – 3 yr term

- No arrangement fee

- Repayments tailored in line with cash flow

- Security: Normal security requirements apply

- Offer available until 30 November 2022

FBD, The Bridge Hotel, Tullamore, May 10th 2022:

- Discussed Farm Business Committee feedback re uncompetitive FBD pricing (even on relatively small premiums) and not rewarding loyal customers. Need to offer ‘best price’ from the start. Price comparisons time consuming. Noted effort on customers to avail of Member discounts (some not profiled enough). Fall off IFA Member discount (ditto Macra) at request of IFA (& Macra) to ensure paid membership and affording discount to non-Members. Improved since live link (4yrs in operation) between both. Noted need for ‘whole family approach/offer’ – car/home etc of children etc. IFA volunteer officers promote FBD offer at Branch meetings – reward for efforts needed. IFA not within ‘Friends of FBD’ discount.

- Price vs. Discount vs. Cover balance – correlations evident

- Discussed inflationary prices and importance to review ‘re-build’ & ‘Sums-Insured’ at next review to protect cover. May marginally increase premium but significant return/added value in terms of added protection if required to draw upon.

- Discussed importance of cover when using contractors. Don’t assume if they are insured you are covered. Need coverage to avoid liability

PTSB – May 10th

- Appetite to increase market share in Agri – 20% market share target; currently c.12%

- No dedicated Agri Advisor team currently, but in process of recruiting a number in Kerry/Tipperary/Midlands region. Big internal focus on staff training. Collaborating with Teagasc to facilitate. Target Business Banking; Branch & Credit Risk staff. 54 through programme to date; further 25 from Sept-Nov.

- Plan more visible in market in H2 – new proposition

- Considerable discussion re Ulster Bank transition. Decision likely before Sept. Transfer likely early next year (Feb/March). Half PTSB acquisition involves Agri (c.5k farmers will loans; c.13k c/a plus O/D). Although not formally part of agreement, in process of agreeing process with Ulster Bank re Overdraft facilities for well managed facilities, where on receipt of 2/3 key pieces of KPI’s (e.g., Days credit; DPD; etc.) overdrafts with same terms/limits would also transfer across with loans. UB to provide data. Keen to make transition as seamless as possible. Adopting centralised process re account opening, with priority given to online opening given internal & customer efficiencies (open c/a within 10mins). 54 dedicated staff for switching, with 50 UB staff also transferring across. [Also acquiring 25 UB branches]. Already seeing significant uplift in account opening (last year x 10). Initially uplift involving older cohorts who held higher deposit levels and received UB letters sooner. In Q1 was typically 1/3 switcher; 2/3 proactive. Now 20% switcher; 80% proactive. From Bank perspective switching process is relatively straight-forward – regulated. Huge volumes however with 8-10 standing orders/direct debits per customer. Un-regulated entities big unknown in process and unless they increase resources will cause backlog and delays. All Banks meeting Central Banks and Oireachtas next week.

- Typical rates offered 4.5% Commercial Market perspective to 6.5% unsecured. Can be more flexible re individual loan arrangements as required on case-by-case basis. e.g., bridging finance. Open, but not proactively seeking Purchasing Groups.

- Big and increasing focus on Sustainability. Understand Irish Agri unique competitive advantage but huge internal training requirement. Welcome IFA support in providing some metrics/KPI’s. More information/generic questions likely form part of future assessments (e.g., grassland management; slurry storage; stocking rates; feed reliance/usage etc). Keen to support the transition.

- Securities: have tight panel of solicitors with negotiated low rates to protect customer.

AIB – May 19th

- Ulster Bank transition:

- Lot of negotiations ongoing and trying to map transfer across (incl c/a – TBC).

- Initial transfers (larger scale & size) Q2, with remaining occurring by way of subsequent tranches (could be 8/9 overall) through Q3 and into Q1 next year. Agri customers overall small and likely to be in later tranches.

- Highlighted issues re delays hosting initial meetings and also limitations of Switching offer. AIB planning transfer by way of dedicated Centralised Team, with increased allocated resources planned.

- Important customers are aware of distinction between Standing Orders and Direct Debits and to have all sorted before closing accounts. Recommended to leave existing c/a in place for a period to manage switching and to ask for full list of all standing orders and direct debits from Bank when switching. Helps manage process. Also, important to be careful re cheque resolutions – cheques written not drawn and potential issues for all parties involved. Committed to offer chequebook to new customers if required.

- Will try match UB staff transferring across with customers as best as possible but still finalising transition – by size or geographical region etc.

- General Agri Markets:

- Understand current challenges. Had seen uplift in w/c requests from pig farming customers Q4/Q1 but drop in recent weeks. May be case adequate supports secured. Overall overdraft utilisation at lowest levels in 5yrs

- Credit Guarantee Scheme closed for new applications. Brexit Impact Loan Scheme likely to be extended beyond June 30th but relabelled/rebranded to support other/additional challenges currently experienced.

- Discussion re inflationary pressures/outlook. AIB Treasury predict ECB move +75BP H2 2022 and +1.5% in 2023. Overall moving Cost of Funds from -0.5% to +1.5% over the next 18-24mths

- Credit demand back somewhat on years previous but holding. Sector performing strongly – credit demand for land remains strong, with a lot of cash buyers and/or those planning succession. Not as much non-agri buyers as previous years. Demand for on-farm development (buildings / infrastructure etc) back somewhat given construction costs and securing builders. Not seeing any re-applications or additional demand for TAMS investments given input price rises – contingencies & cash reserves covering if progressing

- Message re importance to plan for increased tax bill given other input increases. Facilities available (Prompt-Pay) to spread cost over year

- Fixed Milk Price Contracts: issue raised at National Council re Banks recommendation/requirement for farmers, particularly new entrants, to engage in Fixed Milk Price Schemes. Now suffering as a result.

- AIB welcomed move by Industry stakeholders in offering added payments to offset in part at least some of the income foregone given milk price differential between contracted prices and existing on-farm milk price.

- Advised, as far as they are aware following consultation with Agri Advisor Team, such a stipulation has never been included in any new money letter of offer, or annual review statement.

- Acknowledged, the merits or otherwise of fixed milk price schemes may have formed part of discussions with individual clients, but course of action was very much personal choice.

- Advised, overall, not seeing material impact or demand for working capital requests from impacted farmers, but naturally may be individual cases requiring same.

Fire.com – 1st June

- Fire.com are eMoney Institution regulated in Ireland and the UK. HQ at 7-11 Sir John Rogerson’s Quay, Dublin 2

- Support c.3.5k SME in Ireland

- No Loans/Overdrafts offered and no Physical branch network in Ireland so will limit potential/attractiveness for majority

- See themselves as possible solution to customers unable to open new current accounts with threat of UB closing accounts.

- Digital online account opening within 48hrs of online application; debit card within 7-10 working days

- Can offer personal accounts but not Strategic focus

- Revenue primarily via transaction charges (29c/transaction)

Meeting with Nick von Westenholz & Gail Soutar National Farmers Union – 7th June

- General discussion re key issues/concerns facing Irish Agriculture: lot of fear/uncertainty re input cost inflation & availability; impact of CAP Reform; Climate Change & Brexit

- Lot of parallel challenges/fears between Irish and British farmers

- Discussion re challenges (actual & potential) re Brexit. Fear Trade Deals may impact domestic producer and general perception within public and Government that impact on Agriculture (given inherent resilience – Covid etc) will be more than offset by benefits in other SME sectors. Narrative/opportunity somewhat re Food Security – strategic approach re not only securing locally but also supporting global efforts

- Expect UK Bill won’t have significant impact in short-term as wider/bigger issues at foot re RUS/UKR

- Limited RUS/UKR reliance

- Reduced cereal plantings expected – less livestock demand; input costs etc. Some specialised fruit/veg growers switching to conventional cereal production as not enough margin & labour to justify

- Phased withdrawal of Direct Payments – down 50% by 2024 – will lead to further consolidation of sector, particularly among smaller scaled operations. Net benefit of eco-schemes and requirements therein also questionable

Meeting with Sean Bell & Angela Corcoran, Dept Agriculture, Food & Marine, 24th June 2022

- Joined by Declan McEvoy (IFAC) purpose was to discuss possible IFA tax proposals for pre-budget submission

- Key IFA priorities for Budget 2023:

- Extend all existing positive taxation measures/interventions to promote agricultural activity; asset transfer and balanced rural development for at least the next 3 years – from discussions extension of Consanguinity Relief and Young Training Farmer Relief likely, at least for further 12months. Only extended 12mths in Budget 2022 because of State-Aid & Agri Block Exemption Regulations review. Longer term extensions may be possible, but largely depends on whether ABER are agreed and in place. Lack of legal certainty prevents implementation.

- Support against increased costs of production – acknowledged supports given to date. More needed. C.1/3 economically vulnerable. Margins eroded despite favourable output prices. Dept noted significant resources & targeted nature of supports. IFA welcomed reduced VAT rates for vaccines & non-oral medicines. Flexibility available from 2024. 2 phased process, involving EU Commission before Member States are able to legislate nationally, thus delay.

- Maximum co-financing under the CAP and securing maximum BAR funding for Irish farmers – IFA noted time challenges and need for farmers to maximise BAR allocations. Detailed IFA submission provided. Full Brexit impact not yet known but opportunity exists to utilise BAR funding to increase on-farm efficiency. Happy to work and engage with DAFM on developing suitable measures/supports, including climate dimensions as well as Brexit mitigant. Dept suggested BAR extension beyond end 2023 unlikely, however allocated Brexit funds will not be re-allocated elsewhere – IE / EU level.

- Opportunity exists, via VAT exemptions and accelerated capital allowances, to further support increased investment and adoption of more environmentally friendly practices, therein supporting climate change ambitions of carbon neutrality by 2050 – IFA called on climate sectoral target to be closer toward 22% to minimise impact on food production and economic activity in rural areas. Dept welcomed addition of Beef Forum and that decisions ultimately influenced by output from both Dairy & Beef Vision Groups. Won’t be individual effort/sector but collaborative effort required to achieve targets. IFA/IFAC discussed CAT limitations re solar panels; wind farms. Dept noted 50% threshold was there re solar panels to protect Ag Relief rather than support purely energy providers. Intended for productive agriculture. IFA suggested both not mutually exclusive (e.g., sheep graze underneath panels) but 50% somewhat arbitrary figure, means of calculation of associated area (i.e., surface area vs purely ancillary structure supports) worth considering. IFA outlined greater mass market opportunities to support the transition – VAT exemptions / accelerated capital allowances for LESS / energy efficient investments etc. IFAC commended DAFM re accelerated capital allowances afforded to ‘safety investments’ but suggested general lack of awareness of its availability (& ability to back-date). IFA raised opportunity to extend Carbon rebate/relief for protected growers who utilise carbon dioxide in production – circular economy in action, yet not being rewarded.

- Land that is actively farmed by farm families as an integral part of their farm business should be excluded from Zoned Residential Land Tax – fair discussion re inequity of proposed tax and lack of account taken for existing land use; existence or otherwise of commercial demand. Dept suggested they lobbied but Minister for Finance suggested ability to apply to change status of land provides mechanism against disadvantage. IFA gave a number of examples of difficulties & financial expense incurred by farmers getting land de-zoned, with some declined purely because Local Authorities deem housing need and land within zoned area. IFA also questioned need for ZRLT when numerous buildings lie idle in rural towns & villages, and questioned increased urban sprawl rather than upward building/increased densities in already serviced locations. Dept encouraged IFA to make submission on issue and they would review & progress issue.

- Other general comments:

- Inheritance/Succession/Next Generation access to land – extension of Favourite Niece/Nephew to ‘Farm Successor’ Relief

- Strong CAT supports/reliefs in place – focus is on retaining existing rather than introducing new ones (in context of re-introduction of previous Retirement Scheme / Installation Aid). Dept noted favoured approach via CAP of supporting new entrant was via Young Farmer top-up. IFA welcomed same but suggested only looking at one part of equation and farm owner (retiree) in many respects will be limiting factor in land mobility. Dept discussed Succession Farm Partnership and encouraged any additions/tweaks to same.

- IFAC raised technical difficulty, that where leasing to an active farmer – Revenue interpretation of ‘substantially the whole of the property 75% value threshold’ may create significant disadvantage and challenge for smaller holdings, including attributing dwelling value where lying vacant. Dept to follow-up.

- Discussed COTW & non-inclusion of Agri rep’s – remit more high level re taxation/welfare direction rather than granular individual support assessment on associated merits or otherwise. Output more medium-long term in nature, however likely available for review/inclusion for Budget 2023.