Farm Business & Inputs Council Report November 2023

IFA Submission on Finance (No. 2) Bill 2023

Executive Summary:

- Extension of agri-taxation measures and supports in Budget 2024 acknowledged.

- Deferral of Residential Zoned Land Tax noted, but essential matched with required legislative change to provide full exemption for active farmland.

- Remove age limit of 70 and have one Retirement Relief threshold of €750,000.

- Flat rate VAT addition needs to be maintained at 5%.

- Similar to the VAT 58 refund process a means for those involved in agriculture to reclaim the levy paid under the defective concrete products levy should be enacted.

Budget 2024

Framed within the context of supporting Irish citizens against the challenges of today, while putting in place a long-term plan for the future, Budget 2024 announced on the 10th of October, from a farmer’s perspective it was extremely disappointing.

Budget 2024 espoused multiple missed funding opportunities, through Brexit Adjustment Reserve (BAR) / National Exchequer, to more fully address the significant challenges experienced by farmers, across all sectors, both now and into the future. Despite continually emphasising the vulnerabilities of relying on a highly concentrated revenue stream, namely ‘windfall’ Corporation tax receipts, as has occurred in recent years, the Government instead of better supporting agriculture, our oldest and largest Indigenous sector, ironically chose to reduce its budget allocation (€1.94bn in 2024 vs. €2.14bn in 2023).

In many respects, other than the welcome retention of existing agri-taxation measures (Consanguinity Relief; Accelerated Capital Allowances for Farm Safety Equipment); a boost to aggregate lifetime stock relief and an increase to very low sheep payments, Budget 2024 offered little more than what had already been committed to the sector for the majority.

Key schemes (e.g. National Liming Programme; Fodder Support Scheme etc) which, despite proving hugely popular among farmers and often encompassing environmental, animal welfare and economic benefits, were discontinued, with their loss amplified by the VAT Flat Rate Refund Decline from 5.0% to 4.8%, estimated to cost farmers an estimated €18m in the forthcoming year.

IFA’s key areas of concern on the Finance Bill (No 2) 2023 and our proposed amendments:

Long Term Land Leasing Income Tax Relief

It was announced in Budget 2024 that the Land Leasing Income Tax relief will be amended to ensure it only becomes available when the land has been owned for seven years to better target active farmers. A subsequent DAFM1 press release stated that the change related to ‘purchasers of land’. However, this has not been stated in the current draft of the Finance Bill. It is imperative that this amendment is worded to ensure it only applies to purchasers of land. Otherwise, it will have significant unintended consequences, most particularly regarding inheritance / transfer of land from one generation to the next. which must be avoided at all costs.

IFA Proposal:

- Any amendment to the Land Leasing Income Tax Relief should only relate to purchasers of land who have not actively farmed in their own right for at least the first seven years post-acquisition.

Residential Zoned Land Tax

IFA is fully aware of the current housing challenges and indeed the rationale underpinning the Residential Zoned Land Tax (RZLT), however we have continually opposed the inclusion of land which currently forms an integral part of existing farm operations within its remit.

The tax is unjust, inequitable and penal on farm families. It fails to realise that:

- the farming of agricultural land is NOT land speculation or land hoarding. In most situations the land has been owned by the same family for generations, used to earn a living and provide for their family. It was never purchased for, or intended, to be used for housing development.

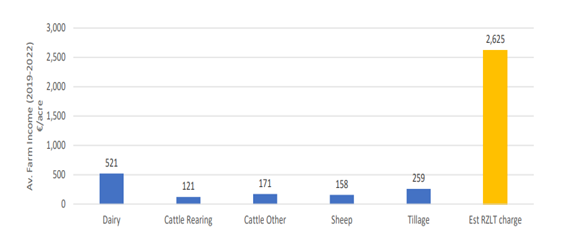

- the RZLT is disproportionate to the income generation potential from farming and will make farms unviable (see Figure 1).

- the RZLT is discriminatory on farmers – is food production not a necessary service too? Why is farming not exempted similar to other businesses that provide a service to the local area or those liable for commercial rates?

- there are landowners with residential zoned land on the market for years, but there is no developer there to buy it. Farmers cannot be liable for RZLT in this scenario.

- there exists a huge lack of awareness around the RZLT – there was no legislative provision for Local Authorities to directly engage with impacted landowners while timelines to appeal were very tight.

While the deferral of the ZRLT within the Finance Bill is important and is welcome, the underlying flaws must be addressed. Numerous politicians, including Ministers and An Taoiseach recognised the unfair situation of genuinely farmed land being caught up in the RZLT. All agreed that a solution is needed, or in the words of An Taoiseach, that the scheme would be fixed.

However, the Finance Bill shows no material change. An extension on the imposition of the tax for 12 months is in place, but if any farmer wishes to have their land de-zoned, they must once again apply to their Local Authority. The majority of farmers who applied to their Local Authority at the end of 2022, to have their land de-zoned, had their applications rejected. Why would Local Authorities change their minds about de-zoning now after having already rejected it, and nothing has changed within the applicable legislation?

Once more IFA is calling on the Government, and particularly An Taoiseach, to make good on the promise to fix the legislation and make the necessary amendments in the Finance Bill to remove all genuinely farmed land from the RZLT. Farmers need legislative change not political pandering.

IFA Proposal:

- IFA priority is a for all genuinely farmed land to be exempted from this tax.

Failing this the following amendments are proposed;

- Refer to Planning and Development (Amendment) Act 2018, Section 63 whereby the Vacant Site Levy is only liable to land from date of purchase after residential zoning, so therefore the purchaser knows that they are purchasing such land. The same requirement should be linked to liability for RZLT https://www.irishstatutebook.ie/eli/2018/act/16/section/63/enacted/en/html#sec63

- Section 653B (b) TCA 1997 reads “is reasonable to consider may have access, or be connected, to public infrastructure and facilities, including roads and footpaths, public lighting, foul sewer drainage, surface water drainage and water supply, necessary for dwellings to be developed and with sufficient service capacity available for such development”. The fact that there may be a possibility of a connection or that there may be capacity should not be enough to make zoned land liable to this tax. If the idea of the tax is to free up land that can be built upon, then these services must be present and available. A suggested re drafting of this paragraph could read; “has access to, and can be immediately connected, to public infrastructure and facilities, including roads and footpaths, public lighting, foul sewer drainage, surface water drainage and water supply, necessary for dwellings to be developed and with sufficient service capacity available for all such development in that local area”.

- All impacted landowners, potentially liable to RZLT, must be directly contacted and informed of potential liability before 1 February 2024 so as to have an opportunity to seek exemption from the tax, or dezoning of their land.

Amendment of Section 598 of Principal Act (disposals of business or farm on

“retirement”)

Land mobility, and the lifetime transfer of land remains a challenge for the sector. Currently for transfers over 66 years of age the threshold reduces down from €750,000 to €500,000. This age limit is now to rise to 70. With average agricultural land values currently on the rise, even below average sized farm operations will have a value in excess of €500,000. To encourage movement of land to the next generation this reduction at age 70 should be removed.

IFA Proposal:

- Remove age limit of 70 and have one Retireemnt Relief threshold of €750,000.

Flat Rate Addition – Section 86 VATCA 2010

This rate will reduce from 5% to 4.8% in 2024. This was 5.5% in 2022. This flat rate addition is to compensate farmers not registered for VAT for VAT incurred on their inputs. While it is appreciated that a number of inputs that farmers purchase do not carry a VAT charge, a large number such as contractor charges, diesel, most veterinary products etc do. The increase in VAT paid on these due to inflationary pressures in the last number of years, combined with lower prices received for farm output in 2023 mean this reduction appears unjustified. The fact that Revenue is now allowing less capital items qualify for VAT 58 refunds, further points to the flat rate being unjustifiably reduced as more farm purchases will now be subject to unreclaimable VAT.

IFA Proposal:

- The flat rate addition must be maintained at 5% for 2024 at the very least.

Part 18E of Principal Act (defective concrete products levy)

This was announced in Budget 2023 originally at a rate of 10% and subsequently reduced to 5%. After amendments, it now applies on the first supply of “ready to pour concrete”. This tax was put in place due to defective concrete products used in construction in the State in years gone by; a problem that has also affected farmers but for which farmers had no responsibility in causing.

At a time of inflated costs and a willingness of Irish farmers to invest further to make their businesses more sustainable, such as increased slurry storage for better on-farm nutrient usage, this added cost is acting as a disincentive for these investments.

IFA Proposal:

- Similar to the VAT 58 refund process, a means for those involved in agriculture to reclaim this levy should be put in place.

Increased Cost of Business Scheme

It was announced in the budget that the minimum wage will increase to €12.70 from 01 January 2024, an increase of over 12%. In response to the affect this will have on businesses Minister Coveney announced the Increased Cost of Business Scheme to support business with this extra burden. The announced scheme will be available and based on rates paid by businesses. As agriculture is exempt from rates it will mean that in its current form no business involved in primary agriculture will be able to avail of this scheme. The below letter has been sent to Minister Coveney on this issue.

Banking

New SBCI – Growth and Sustainability Loan Scheme

Total fund of €500m, loan amounts from €25,000 to €3m with lending of up to €500,000 unsecured. Loan terms from 7 to 10 years.

This will be launched in two phases.

In Phase 1, the scheme will open for climate action and environmentally sustainable investment loan applications. This will shortly be followed by the launch of Phase 2, which will also offer loans for general long-term investment.

According to current estimates, loans for general long-term investment under Phase 2 will be available from December 2023.

The Growth and Sustainability Loan Scheme (GSLS) is established and offered by the Strategic Banking Corporation of Ireland (SBCI) and benefits from a guarantee that has been provided by the European Investment Fund (EIF), with support from the Department of Enterprise, Trade and Employment (DETE) and the Department of Agriculture, Food and the Marine (DAFM).

The scheme provides SMEs and Small Mid-Caps, including farmers and fishers, with long-term financing to either:

- encourage the growth and resilience of their enterprise or

- invest in climate action and environmental sustainability measures designed to improve their performance.

Please note to qualify under Phase 1 of this the investment must be for emission reduction purposes, for organic farmers or for those farmers who are both in Bord Bia and in ACRES. Those that qualify through this route will have a rate c.0.25% lower than those who qualify through Phase 2.

Currently only Bank of Ireland are offering this loan but in the next number of months both AIB and Permanent TSB will also have this available.

The Ukraine Credit Guarantee Scheme SBCI lending is still available.

VAT

An issue has arisen in the past month on items farmers not registered for VAT can claim VAT back on under VAT 58 claims. It has been highlighted to IFA that a number of items such as Drafting Gates, Automatic Calf Feeders, Robotic Scrapers, Slurry bags have all been refused refunds. We are highlighting this issue with the Department of Agriculture and Department of Finance. Statutory instrument 201 of 2012 lays out what items a reclaim can be made on as follows;

(a) the construction, extension, alteration or reconstruction of any building or structure which is designed for use solely or mainly in his or her farming business,

(b) the fencing, drainage or reclamation of any land intended for use for the purposes of his or her farming business, or

(c) the construction, erection or installation of qualifying equipment for the purpose of micro-generation of electricity for use solely or mainly in his or her farming business,

A further issue with this is that some items which can be claimed for under TAMS III would have had their TAMS costings calculated on a VAT exclusive figure with the expectation that VAT was fully recoverable on them. If this is no longer the case then the TAMS costings for such items needs to be increased. The letter below has been sent to Minister McConalogue highlighting this issue.

Upcoming

- Next Farm Business Committee Meeting on Thursday December 7th at 10.30am in Farm Centre.