Farm Business Council Report March 2023

Fertiliser:

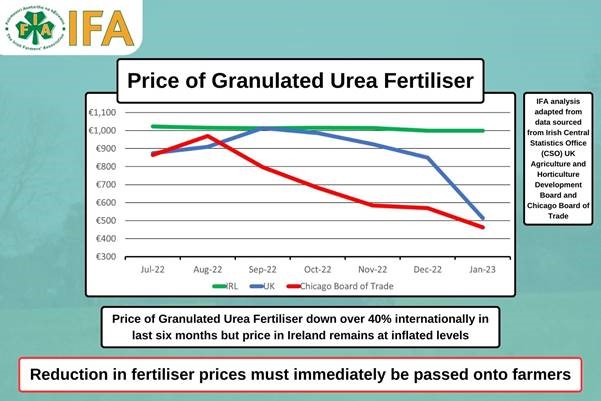

- Price of fertiliser has dropped by over 40% to farmers in markets such as the UK and Germany.

- Very little movement in price in Ireland.

- Recent report shows that profit per ton of fertiliser for suppliers rose from c.€50 a ton in 2021 to up to €250 in 2022.

- Price of EU Gas has fallen from a high of c.€340 per Mega Watt hour (MWh) in late August 2022 to under €50 MWh at end of February 2023.

- Production returning to normal levels after curtailments in 2022, so price in International Markets looks set to remain at significantly reduced levels to inflated 2022 prices.

- Merchants and Co-op must pass on these price decreases to farmers immediately and not attempt to have another windfall profit year in 2023 similar to what they had in 2022.

Residential Zoned Land Tax (RZLT)

- Detailed submission made in late December to Department of Finance and Department of Housing & Local Government.

- Meeting organised with these Departments for mid-March on submission.

- Information session held online by IFA available to be viewed back on website.

- Meetings being organised with a number of Ministers to follow up on the issue.

- Legal advice being sought to see if this legislation can be challenged.

- Increasing number of queries being received by potentially impacted farmers.

- Clarification received by IFA on recent press article on RZLT, only exemption for farmed land which is zoned and serviced is if that land is zoned mixed use. No exemption if zone residential and serviced in the Legislation.

Temporary Business Energy Support Scheme (TBESS)

The TBESS was introduced to support businesses (including farmers) with increases in their electricity or natural gas (energy) costs.

- Who Can Make a Claim

Yor can make a claim under the scheme if you are:

- Tax compliant

- Carry on a Case I trade (farming) or Case II profession.

- Have experienced a significant increase of in your electricity and/or natural gas average unit price. Originally this was a 50% increase but this has now been reduced to a 30% increase.

- How Much Can You Claim

You can claim for 40% of the increases in your energy bills for the period 1 September 2022 to 28 February 2023, from 1 March 2023 to 31 May 2023 this increases to 50% of the increase. The increase in energy bills must be between the ‘claim period’ and the ‘reference period’.

- Claim Period and Reference Period

A claim period is a calendar month from September 2022 to May 2023. A reference period is the corresponding calendar month in the previous year. For example, September 2021 is the reference period for the September 2022 claim period. Claims must be made within 4 months of the end of the claim period, therefore, a claim for September 2022 must be submitted by 31 January 2023. However, this deadline for the first claim period has been extended past 31 January 2023 to the end of February 2023. This may have to extend further for the fact that the threshold for qualifying has been reduced from a 50% increase in unit cost to a 30% unit cost (awaiting confirmation).

| Claim Period | Time Limit for making a claim |

| September 2022 | 28 February 2023 (date to be extended) |

| October 2022 | 28 February 2023 (date to be extended) |

| November 2022 | 31 March 2023 |

| December 2022 | 30 April 2023 |

| January 2023 | 31 May 2023 |

| February 2023 | 30 June 2023 |

| March 2023 | 31 July 2023 |

| April 2023 | 31 August 2023 |

| May 2023 | 30 September 2023 |

- Single Meter for House and Farm

If the one electricity meter (MPRN) supplies both your farm and household then you need to allocate how much is wholly and exclusively used by the farm. This allocation will be on the same basis as used when preparing your accounts and tax returns each year.

- Monthly Limit

The monthly limit on claims has increased from €10,000 to €15,000 per business or trade, where a business is carried out from more than one location and has multiple electricity/gas accounts the overall claim limit has increased from €30,000 to €45,000.

- Further Details and Making a Claim

Please follow the below link for further details on the scheme and instructions on submitting a claim.

Temporary Business Energy Support Scheme (TBESS) (revenue.ie)

Ukraine Credit Guarantee Scheme

Currently available through BOI but other banks expected to also offer in near future.

- Terms 3 months to 6 years.

- Min loan €10,000 Max €1m. Unsecured loans up to €250,000.

- Finance under the scheme must be used for 1) Working capital, including liquidity needs, or 2) Investment.

- In order to be eligible for the Scheme, the borrower must:

- Declare that costs have increased by minimum of 10% on their 2020 figures and that the loan is required as a result of difficulties being experienced due to the crisis.

- Provide eligibility letter to the Bank.

- Max of 15% of average turnover over last 3 years (or two years if only two years financials are available or one year where only one years financials available or;

- 50% of energy costs over the 12 months preceding the date of submission of the application or;

- €1,000,000

Submission on Revenue Strategy 2023 to 2025 made on 17th of February to Revenue

- Need from a policy perspective to continue to recognise farming as a high capital, low-cost business so requires all current reliefs around transfers of land etc.

- Needs to evolve policy for fact of new ways of farming, such as renewables, energy etc.

- From a technology perspective need to make access easier for those without ROS such especially if making a return such as under TBESS, also require “save” function in returns such as VAT 58 return.

- Recognise that not all have access to Revenue website etc so as with RZLT individuals need to be notified of possible liabilities, not just expected to know of a new tax.

Submission on Revenue on review of Consanguinity Relief on 28th of February.

- The reduction from the rate of 7.5% to 1% of Stamp Duty, which the Consanguinity Relief allows, promotes intergenerational farm family lifetime transfers.

- The previous removal of the age restriction of 67 for the transferor means there is no longer a barrier for older farmers availing of this relief and it acts as an incentive to the lifetime transfer of land.

- The requirement to farm the land or lease it to be farmed for a minimum of 6 years ensures that this relief is available for genuine farmers.

- The allocation of 50% of working time on the farm (equating to 20 hours/week) allows for part-time farmers to also utilise the relief.

- The option of leasing out to a farmer who fulfils the working time or qualification specification, allows for agricultural land to be released, which is critical for all farmers, particularly young farmers.

- The criteria required prevents potential abuse of the relief in terms of transference of wealth by non-farmers.

- Currently, land with woodlands growing on a commercial basis does not qualify for reliefs such as consanguinity relief and is subject to the 7.5% rate. This should change and consanguinity relief should be extended to covers transfers of forestry.

- This relief rightly recognises the high prices of agricultural land relative to the low margin it generates and helps to reduce the cost of inter-generational transfers and its IFA’s position that the relief should be maintained indefinitely.

Commission on Taxation & Welfare

- IFA delegation to attended & addressed Special Committee on Budgetary Oversight, March 8th re Chapters 13 and 15 of Commission on Taxation & Welfare report.

- Chapter 13 – Moving to a Low Carbon Economy

- Chapter 15 – Promoting Good Public Health:

Lobbying (main issues from Farm Business Committee perspective to highlight if having meetings with politicians)

- Residential Zoned Land Tax, need to have land which is genuinely farmed removed from this land hoarding tax.

- BAR Funding, primary agriculture must receive a fair allocation from BAR funding, the UK have and are signing trade deals which will have a direct negative long-term effect on farmers livelihoods.

- Input Prices, the price of fertiliser is down significantly internationally but these reductions are not been seen in Ireland, this requires political pressure to ensure farmers are not taken advantage of.

Upcoming

- Farm Business Committee meeting on Wednesday 8th of March at 11am in Farm Centre.

- Meeting with Department of Finance and Department of Housing on March 15th on RZLT.

- Meeting on March 22nd with Department of Agriculture on BAR Funding.

- Meeting on March 23rd with Department of Agriculture on Budget 2024.