Farm Business Council Report October 2022

Budget 2023:

- Thanks to all who participated in IFA National Budget Lobbying Day in Buswells Hotel on Sept 14th (especially Elaine for securing venue after original Budget dates changed) and all those who lobbied locally

- IFA engagement with Ministers Donohoe & McGrath (Sept 2nd); Minister McConalogue (Sept 7th)

- Overall Agri Budget increased €283m to €2.14bn [similar when once-off allocations excluded]

- Some key items from Expenditure perspective:

- €218m for Agri-Environment Schemes: €200m for ACRES (30,000 farmers); €18m for Local Env Schemes

- €105m in targeted beef and sheep supports

- Increase in TAMS budget to €90m from €80m

- Proposing 60% grant rate on farm safety equipment

- Proposed increase to 60% grant rate and a standalone investment ceiling of €90,000 for solar installation

- Farm dwellings are eligible for inclusion for solar panel investments with battery equipment also eligible

- €10m for continuation of the Tillage Incentive Scheme

- Renewal of Fodder Support Scheme for 2023 – €30m advance payment December 2022

- New €8m Liming Scheme

- An enhanced Multi-Species Sward/Red Clover scheme

- €37m for the Organic Farming Scheme

- €13.3m to extend the Farm Environmental Survey and the Soil Sampling Scheme for 2023

- Forestry budget of €112m (+12% vs. 2022)

- €3m funding for pilot anaerobic digestion investment programme

- Some key items from Taxation perspective:

- All 5 outstanding Agri Taxation measures were extended:

- Partnership stock relief (50%) & Young Farmer stock relief (100%) – extended to end 2024.

- Young Trained Farmers (<35 years old) stamp duty relief – extended to end 2025.

- Farm restructuring relief – extended to end 2025.

- Farm consolidation relief – extended to end 2025.

- No change in Inheritance Tax ceilings; Capital Gains Tax arrangement, rates or rules

- VAT Flat Rate Decline to 5% from 5.5% for non-registered farmers (costing c.€46m)

- Accelerated Capital Allowance Scheme for construction of slurry storage facilities – full capital cost may be written off over two years rather than existing seven years

- Farmers included within €1.25bn Temporary Business Energy Support Scheme

- Covers 40% increase once average unit price (gas & electricity) has increased 50% 2022 vs. 2021

- €10k monthly cap; €60k per business; Covers September 2022 – February 2023 period

- Brexit Adjustment Reserve – €238m allocated for sector (only €28m for farmers – BEEP-S replacement)

- New €500m ‘Growth & Sustainability Loan Scheme’ and Ukraine Credit Guarantee Scheme

- 10% Concrete levy from 3rd April 2023 – concrete blocks; ready-mix; certain other concrete products

- Carbon Tax: +2c/l from October offset by proposed 0% NORA levy (2/l)

- Zoned Residential Land Tax – Maps from Nov 1st. Option for farmers to appeal.

- Next steps (expected dates):

- 20 October: Finance Bill release

- 25/26/27 October: Second stage

- 10/15/16 November: Committee stage

- 23/24 November: Report stage

- 29 November: Bill sent to Seanad for hearing (and second Stage)

- 7/8 December: Seanad Committee Stage

- 13/14 December: Seanad Report Stage

- 25 December: Bill signed by the President

- IFA Submission on Finance Bill to focus on:

- The Zoned Residential Land Tax;

- The 10% Concrete Levy;

- The need for an adequately funded, nationally financed BEEP-S scheme for 2023 and beyond;

- That no farmers (if desired) should be left without an Agri Environment Scheme in 2023; and,

- Financial supports to promote increased on-farm investment in renewable energy sources should be independent of TAMS and financed by the Department of Environment, Climate & Communications.

Banking

IFA meeting (online) with Central Bank re Account Migration challenges – 14/09/2022

Key IFA points:

- UB exit significant loss to agri market – limited competition, lesser footprint, lost tradition etc.

- Protracted/extended timelines, plus divergent detail re individual AIB/PTSB loan sales, made proactive communications to members difficult. Example provided re 1mth remaining for those with original UB engagement

- Concern farmers won’t have functional bank accounts – must be avoided at all costs – particularly given seasonality of cashflow and DP receipts. Timing less than ideal and worthy of future consideration

- Extended delays re a/c opening (particularly in early stages); with Banks limiting manual account opening / ceasing entirely to cope with demands. Divergent experiences within counties noted. Drive to online account opening not suitable for all

- Information requested & subsequent additional requests re a/c opening frustrating. Comms of key info needed

- Limited/lack of switching experience among farmers a challenge & ‘switching package’ not fit for purpose

- Discussions re O/D facilities – concerns re not being involved in PTSB sale. Noted PTSB solution/work-around

- Frustration among farmers at not being able to switch to Bank of choice following UB exit (i.e. to BOI) without incurring financial cost in terms of releasing security etc. Exit not of farmers making, and with lower AIB & PTSB footprint nearest branch may be beyond nearest BOI branch

- Highlighted legal fees & costs re releasing security and frustrations in retrieving physical deeds held by UB

- Central Bank welcomed feedback & offered invitation for future engagement/feedback as required

IFA meeting (online) with AIB – 16.09.22

Loan sales to Everyday Finance:

- IFA expressed serious concern & fear among members involved in sale of loans to Everyday Finance. Given level of security held for level of exposure, real concern among farm families that their land/farms will be sold if they experience difficulties down the road. Questioned inclusion of some within loan sales. Some may have experienced issues in the past but now back on track & performing. After engaging with Bank and agreeing restructure, now find their loans sold even though terms of agreement fully honoured. ‘Breach of faith’ on part of AIB. Outlined case – €40k owed – fully meeting rescheduled payments, yet included in the sale

- AIB noted they don’t define Non-Performing Exposure’s, provided for them, clear process & regulations in place. Considerable reduction in NPE’s in recent years, vast majority (c.90%+) following engagement and restructures. Noted Average length cases in this loan sale 9yrs in arrears. NPE’s now 1.5% of gross loans. Loans that travel with loan sales uphold same terms, conditions and protection as per existing. AIB support customers on transition, some of whom benefit also from debt write-down on transition. Happy to engage on individual cases and explain inclusion.

Farm Finance trends & loan offering:

- New money requests back in Q1 but increased demand in Q2 & Q3 (mainly increased output price driven). Pig sector being the exception – but upward price trend and outlook into 2023 welcome

- Overdraft utilisation figures down year-on-year. Dairy at 5yr low. Likely increased working capital requirements down the road. Farmer Credit Line available for working capital needs – 4.3% variable

- SBCI Energy Efficiency proposition launched (SME’s & farmers) – min €10k to €150k over 10yr term

- Possibly SBCI propositions coming down the road – SBCI Emergency Response Fund Q1 next year and new Future Growth Loan Scheme (10yr terms)

- AIB confirmed support for the Agri sector and supporting the transition to net zero.

- Queried AIB lessons/ solutions for farmers caught up with fixed price milk contracts. AIB noted internal review and proactive calls. Suggested never precondition of sanction or referenced on Letter of Offers. IFA suggested may not always have been understood by farmer as same

- AIB treatment of CAP direct payments under new programme in repayment capacity analysis still under review. Ongoing discussion with 2nd Line (Credit) on how to incorporate. P2 payments haven’t to date been included in long term assessments however given likely trajectory of CAP funding something will have to consider.

AIB branch presence & service provision

- IFA noted anger and frustration among farmers, with reduced service provision and continual push to online banking. Guidance & support needed.

- AIB said got it wrong and reversed decision. Off the agenda now.

Ulster Bank migration

- 5.5k customers moving across in monthly tranche basis. Started June. Likely end March

- Picking up 50% non-loan movers. Want as many as possible. Recruiting 700 & redeploying 300 to cope with switching/account opening. Huge challenge.

IBCB Roundtable – IFA and Member Banks 20th September 2022

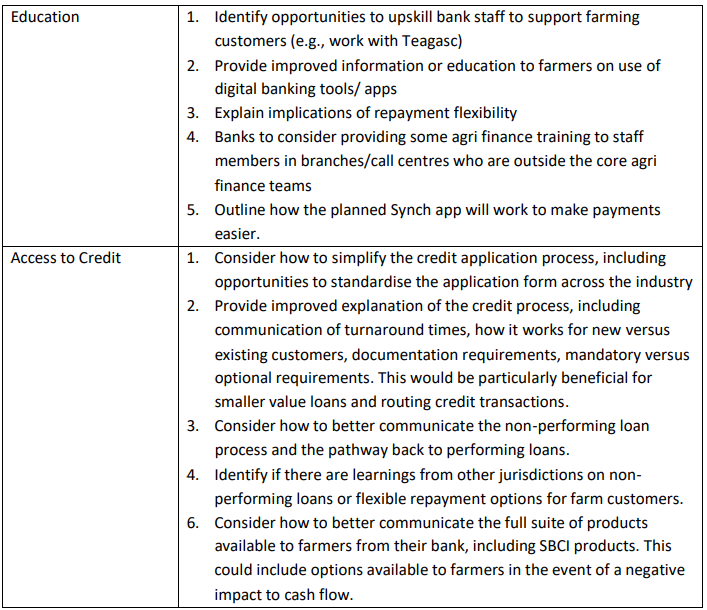

Following very stark and negative sentiment toward banks, Irish Banking Culture Board co-ordinated a roundtable discussion with representatives from the IFA and AIB, Bank of Ireland and Permanent TSB. A detailed discussion took place, focusing on a number of key issues (local presence/relationships; access to credit; digital tools; products; regulation). Potential actions (outlined below) were discussed at a high level. Next meeting early 2023.

Ulster Bank

- Ulster Bank started to issue 6mth notice periods to customers in April ‘22 to find alternative banking providers.

- These first wave of customers were set to have their accounts frozen Oct 8th, before being closed 30 days later.

- Ulster Bank has decided to extend by a month the deadline for these customers to Nov 4th

- Early October, almost two-thirds (64%) had either closed / wound down their accounts

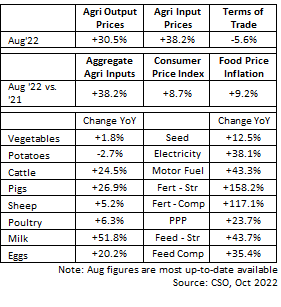

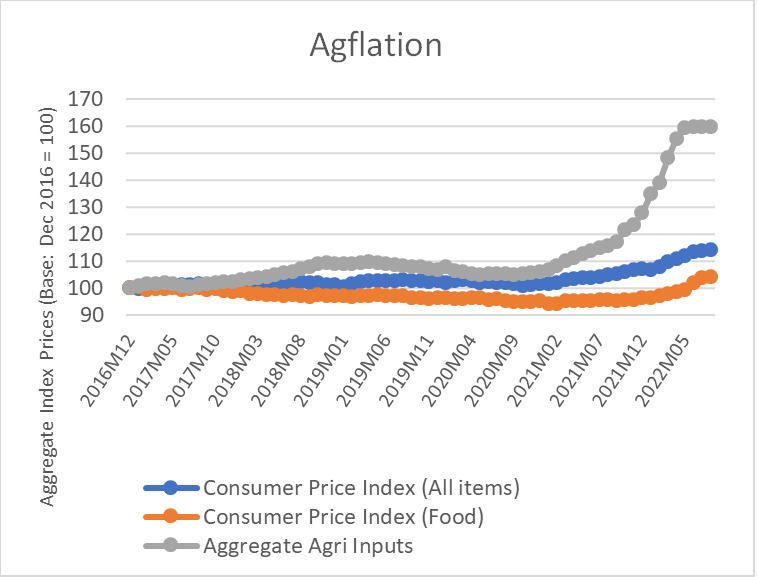

Inputs

- EU fertiliser manufacturing plants currently running at only about 30% of capacity given elevated gas prices.

- Fertiliser importers seeking support from Government and EU to secure supplies and share risk. Seeking incentives for farmers to purchase and take deliveries of fertiliser three-six months earlier than normal. They claim fertiliser imports are running at 50% normal levels.

- National Fodder & Food Security Committee (NFFSC) have advised farmers to purchase 20-30% of 2023 requirements to avoid being left without product in Spring. Phorphorus fertilisers is believed to be ‘particularly acute’. c.70% of Irish P fertilisers were sourced directly from Russia/Russian-owned manufacturing plants. Morocco is now Ireland’s main supplier, but logistical issues mean shipping must start soon to have supplies in Spring. Urea likely more widely available than CAN.

- Tirlán offering dairy & grain suppliers’ option to commit in advance to the purchase of fertiliser for next spring and avail of an interest-free deferred payment model.

- Farmer agrees to a contract setting out the product, agreed tonnage, price and approximate date for delivery for spring 2023;

- Milk suppliers: deferred payment (interest free credit) spread out equally across milk supplies from the months of April, May, June and July 2023;

- Grain suppliers: deferred payment (interest free-credit) on contracted fertiliser tonnage purchased by July; or pay with interest at harvest

- Max contracted 50% annual fertiliser requirements for the deferred payment options;

- Must commit to a fertiliser contract at least eight to 10 weeks before the fertiliser is required on farm.

- Pre-Legislative Scrutiny of the Veterinary Medicinal Products, Medicated Feed and Fertilisers Regulation Bill 2022 ongoing. Bill proposes to:

- Provide for powers to make regulations on areas that recent EU Regulations on veterinary medicines left to be determined by national law such as the retailing of veterinary medicines for example, for the introduction of a National Veterinary Prescription System (NVPS) which will facilitate the electronic generation and dispensing of prescriptions of veterinary medicines for food producing animals, repeal the Animal Remedies Act of 1993 and modernise the legislation that governs the general veterinary medicine area.

- Amend the Fertilisers, Feeding Stuffs and Mineral Mixtures Act 1955 by inserting new registration requirements and related provisions into that Act to enable the collection and processing of information on the manufacture, import, sale, supply and use of fertiliser in the State.

- Under the proposed legislation, if a farmer wants to purchase fertiliser or lime, he/she must register as a Professional Fertiliser End User.

- They will have to submit opening and closing stocks of fertiliser on their farms or premises on dates to be agreed as part of the consultation process.

- Once the National Fertiliser Database is established, data will be used to confirm farmer compliance with obligations under Ireland’s Nitrates Action Programme and the Nitrates Derogation and Eco-Scheme agricultural Practices.

- Increased uncertainty on whether Russia will renew Black Sea grain initiative next month. The current deal, which was created in July for an initial four months. As of October 12, more than 7 million tons of Ukrainian grain have left the country through the secured route, according to the U.N.’s Joint Coordination Centre.

- Negotiations ongoing at EU level re measures to combat energy crisis including – joint gas purchases; coordination in filling gas storages; intensifying energy diplomacy on gas imports; developing a new liquefied natural gas benchmark to reduce the impact of the Dutch TTF index (the current EU gas benchmark); efforts to cut consumption; and boosting the deployment of renewables. The European Commission will set out a new package of legislative interventions to ease the impact of the energy crisis on October 18th.

Commission on Taxation & Welfare

- 500-page report published September 2022. Number of concerning proposals included:

- Limiting use of zero or reduced rates of VAT (with reduced rate also progressively increased)

- Reduction of Agricultural Relief to 80%

- Reduction in Class A CAT threshold (i.e. parent to child) closer to B Threshold

- Introduction of Wealth Site Levy

- Greater alignment of PRSI rates (i.e. upward movement of Self-employed rate to 11%)

- To arrange meeting with a number of COTW participants in the coming weeks

Other engagements / events attended:

- Meeting with Minister McGrath & DPER officials re IFA BAR submission, Oct 10th

- National Ploughing Championships: Sept 20-22nd

- ESRI Post-Budget Briefing: Sept 30th

- Attended/presented Galway IFA Regional meetings (Loughrea; Tuam; Oughterard); Mayo IFA Regional meetings (Ballina; Westport; Claremorris); Limerick IFA County Executive; Roscommon IFA County Executive; Dublin IFA County Executive

- Attended White Paper on Innovation & Enterprise Session, Oct 3rd

- Attended National Economic & Social Council Workshops

- Attended Teagasc Transferring the Family Farm event, Wexford: Oct 13th

- Elaine Byrne, Solicitor re Farm Inheritance & Succession, Portlaoise. Oct 14th