Farm Business

Resolutions

None

Activity since last National Council

Ulster Bank

- After conducting a strategic review of its operations, NatWest announced on 19th February that it is winding down Ulster Bank in the Republic of Ireland.

- NatWest cannot disadvantage its Ulster Bank customers and must facilitate their transition to another fully-serviced lender in the State. IFA has made strong calls that NatWest cannot sell Ulster Bank’s loan book to vulture funds. IFA has called on the Government to intervene and prevent such an outcome if necessary.

- The bank’s exit will further erode the diminishing level of competition in the sector.

- It is estimated that there are 10,000 farmers with borrowings from Ulster Bank and a further 10,000 availing of current account facilities.

- Ulster Bank’s mortgage book is valued at €14 billion, holds €22 billion in deposits and accounts for 20% of SME lending.

- Ulster Bank has said that no farm loans will be sold before the end of 2021.

- Early reports suggest that Ulster Bank and AIB are working on a Memorandum of Understanding.

- It is expected that larger agri-loans (> c. €200k) will be sold to AIB while Ulster Bank is in talks with Permanent on smaller agri-loans (< c. €200k).

- Agri-loans under SBCI-backed schemes such as the FGLS/CCGS cannot be sold by Ulster bank without approval from the Department of Enterprise, Trade and Employment and the SBCI.

- Ulster Bank executives confirmed on Tuesday that the bank’s 88-strong branch network in the Republic forms part of discussions with Permanent TSB.

- In November, IFA held a meeting with UB to discuss Covid-19, Brexit and the future of the bank. IFA highlighted the importance of UB to Irish agriculture and competition in the banking sector. UB maintained that the remain open for business and that in the short-term services will not be affected.

SBCI Schemes

- IFA met with SBCI to discuss current and future products.

- The mainstream lenders participating in the Future Growth Loan Scheme have fully drawn down their allocations. €500m was made available last year under the scheme with a maximum of €200 million being allocated to primary agriculture. The agri-sector accounted for 40% of the loans under the scheme and 24% of the loan values. Funds remain available with Close Brothers.

- Under the Covid-19 Credit Guarantee Scheme, across all sectors, only €177 million or less than 10% of the €2 billion available has been drawn down. Of this €177 million, agriculture accounts for c. €23 million or 13% of the loan value. The agri-sector accounts for 20% of the loans applied for under the scheme. The number of lenders participating in the Covid-19 CGS has increased with many credit unions coming on board.

- There will not be another tranche under the FGLS. SBCI is unable to transfer funds from the Covid-19 CGS to the FGLS.

- The criteria to draw down money from the funds has proven extremely prohibitive. It’s understood that the lack of interest in the scheme has been compounded by the uncertainty caused by the pandemic and Brexit. The scheme runs until June 2021 and is expected to extended until December 2021.

Budget 2022

The Tax Strategy Group Papers are being prepared by the Department in the 1st half of the year and these will inform the Minister for Finance’s decision on which measures are included in the Budget.

The committee is finalising a submission for the Department of Finance highlighting the key tax relief and measures that must be included in Budget 2022.

It will focus on reliefs under the stamp duty code: consanguinity, consolidation, forestry, young trained farmer ceiling; CAT agricultural relief: favourite successor, solar, tax-free thresholds, forestry; and CGT reliefs: entrepreneurial, retirement.

Debt Support Service

- The IFA Guide to Personal Insolvency Arrangements (PIA) was published before Christmas.

- The DSS committee met on February 26th 2021.

- In light of the success of Gary Digney (PIP – Personal Insolvency Practitioner) and Keith Farry BL in obtaining PIAs for several farmers in court, the DSS will advise all DSS-users to meet with a PIP to review the suitability of their case for a PIA.

Accelerated Capital Allowances for Farm Safety Equipment

In the Finance Act 2020 the Government announced it would introduce a scheme to accelerate a claim for capital allowances on the purchase of certain farm safety equipment subject to an annual total equipment cost of €5 million (excluding VAT) per annum.

The proposed scheme is subject to a Ministerial commencement order which is expected to be issued in the coming weeks.

Currently, capital allowances are available at 12.5% per annum over eight years for agricultural equipment.

The proposed scheme will allow “eligible persons” to claim accelerated capital allowances of 50% per annum over two years for certain safety equipment in the period 1 January 2021 to 31 December 2023. The eligible person must have obtained a “qualifying certificate” in respect of the safety equipment.

The claim will be made when completing the relevant annual return for the sole trader, partnership, limited company etc.

Qualifying farm safety equipment:

- Hydraulic linkage arms mounted tractor jacking systems

- Big bag (equal to or greater to 500kg) lifter, with or without integral bag cutting system

- Chemical storage cabinets

- Animal anti-backing gate for use in cattle crush or race

- Quick hitch mechanism for rear and front three-point linkage to enable hitching of implements without need to descend from tractor

- Provision of access lift, hoist or integrated ramp to farm vehicle, including modified entry when required.

- Wheelchair restraints

- Wheelchair docking station

- Modified controls to enable full hand operation of farm vehicle

- Modified seating to enable operation of a farm vehicle

- Additional steps to farm vehicle or machinery to provide easier access

- Modified farm vehicle or machinery controls to enable control by hand or foot

- Hydraulically located lower three-point linkage arms.

Upcoming issues

- Close monitoring of Ulster Bank as it proceeds towards winding down its operation and the sale of its loan book.

- Reform of the Personal Insolvency Act.

- Submissions to Budget 2022.

- National Farm Business committee meeting.

Inputs

Activity since last National Council

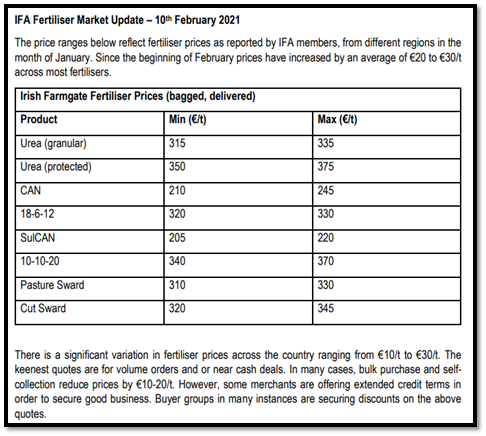

- The committee led a survey in January of fertilisers with the help of the Grain and Dairy committees (attached below).

Expiry review of anti-dumping duties on Russian Ammonium Nitrate

The European Commission has renewed the anti-dumping duties on the import of Russian Ammonium Nitrate for another 5 years.

Upcoming issues

- Fertiliser prices will be watched closely in the coming months.

| Rose Mary McDonagh Farm Business Chair | Donal Sheehan Policy Executive |