Impact of the Russia/Ukraine Conflict

Summary

Russia and Ukraine are an integral part of the global agricultural and food commodity trade.

Conflict realised this morning is deeply regrettable and, coupled with introduction of strong retaliatory economic sanctions, both directly and indirectly, could seriously affect agri-food trade; cost of production (in particular energy; fertiliser), and ultimately global food availability & price.

From an Irish perspective, the key concern/threat is further input commodity price rises on top of already elevated levels, which are depressing on-farm margins to unsustainable levels across a number of farm systems.

Keep reading or click on a link below to jump to a particular section.

State of Play

Russia launched war attack on Ukraine last night, with troops landing at Southern ports; strategic strikes and an Eastern onslaught expected on what some Security analysts have suggested is a play on Russia establishing a buffer zone on the Eastern Ukraine region

European Commission President UVDL has came out strongly suggesting Russian attack is not only an attack on Donetsk / Ukraine but very much at the heart of Europe, and a series of strong targeted economic sanctions will follow. Proposed sanctions are being brought forward to Council for agreement later today.

This follows those previously announced – EU, US, UK and some Member States have implemented sanctions to individuals linked to Russia State, trade with Donetsk and Luhansk, Russian banks linked to the regime and the military, Russian sovereign bonds and suspension of Nord Stream 2.

Concern around sanctions is that it could lead to an escalating tit-for-tat situation, and market displacement, that could have knock on-effects across a range of sectors. Consequences beyond desired destinations are inevitable. Europe will suffer too. Sanctions or disruption to oil/gas supply would cause further jumps in already soaring wholesale markets. The downstream effects, as we have seen recently from a jump in oil/gas prices, is that not only will it be felt in energy/electricity prices, but also in many other products that are produced using the resource, like food and consumer goods

Markets have reacted immediately to the conflict, with oil breaching $100/barrel mark ($105/barrel); and natural gas, after dipping in January, rising +34% again today. Naturally all will have potential consequences on input supply balance and prices.

Agri-food Trade

Since the early 1990’s and the collapse of the Soviet Union, increased foreign direct investment, coupled with significant structural change (small scale operations replaced with larger more efficient/progressive operations) has seen both countries increase their global export footprint considerably.

% of Total world trade (combined)

| Early 1990’s | Currently | |

| Wheat exports | 1.5% | c.30% |

| Feed grains | <2% | >30% |

| Rapeseed oil | 0 | 15% |

| Sunflower oil | <8% | >75% |

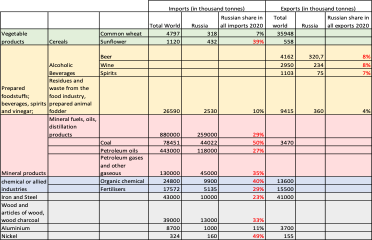

Russia

Russia, in general, is a net purchaser on the world’s agricultural market

In 2013, Russia was the second most important destination of EU agri-food exports after the USA, representing 10% of all EU Agri-Food exports (c.€11.8bn). Since 2014, and Russian imposed ban on EU exports following EU imposed sanctions following illegal annexation of Crimea, EU lost market share and directed increased agri-food exports to other markets.

Today, Russia is the EU’s 6th largest agri-food trade partner (c.€6.8bn in 2020), and a key import market for essential inputs (i.e. energy; fertiliser; etc.).

From an Irish perspective, Russia isn’t a key agri-food trade nation, typically outside the top 20 import/export destinations. Of most concern, from a Russian perspective, is the potential impact on availability and price of key commodities. In 2021, Ireland imported fertilisers from Russia valued at c.€134m.

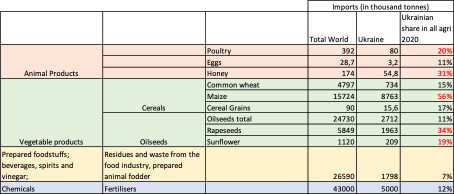

Ukraine

Ukraine is a net exporter of agricultural and food products, following upward trend in recent years

Ukraine makes up just 4.9% of the EU’s total agri-food imports. It is however the EU’s fourth biggest external food supplier, and provides the bloc with c.25% of its cereal and vegetable oil imports, including almost half of its corn.

In 2020, about half of the agri-food imports from Ukraine were food and feed products; one-third food preparations and beverages and the rest non-edible products.

Ukraine is the 5th largest global exporter of wheat, with the export of maize also key to Ukraine – both important feed ingredients to the livestock sector.

Ukraine is among the top three exporters of organic products to the EU. Some products as poultry meat and offal are not high in value but represent an important share in quantity of specific cuts.

From an Irish perspective, in 2019 Ireland imported €86.6m (481.5k tonnes) of agri-food imports from Ukraine.

Key Agri Inputs

Energy/Oil

Any disruptions to oil flows from Russia, with low spare production capacity in other countries, could easily send prices rallying. Russia produces 11% of global oil supplies. Oil had been on gradual rise in recent weeks and Germany’s decision to halt the gas pipeline Nord Stream 2, along with other sanctions, pushed up oil prices. Oil breached $100/barrel ($105) this morning following Russian action, and back to 2012-14 levels. The challenge however, is that much of the recent price rises haven’t even fed through to the Irish market yet because it takes about five weeks for the petrol price to reflect the crude market. If continuing to rise, the impact on the global economy could be debilitating. It’s a reason many don’t expect sanctions to be so severe that oil flows are significantly affected. Saudi Arabia / others could also potentially fill some of the gap.

It’s a similar situation regarding the European wholesale gas markets. Russia is the second largest producer of gas in the world and the largest supplier to Europe, with a third of that flowing through pipelines that cross Ukraine. Natural gas prices rose 34% this morning, and were up 57% in the last week alone. A full-blown conflict could disrupt the massive volumes of natural gas that Russia sends to Europe. In 2021, 46.8% of its gas was imported from Russia. The EU also imports half of its hard coal from Russia.

Fertilisers

Russia has considerable phosphate rock / potash / oil & gas reserves and is a primary producer of all three of the main commercial fertiliser nutrients – N/P/K.

They are self-sufficient and an important global exporter of fertilisers. IHS Markit estimate they account for c.13% of global trade for key fertiliser intermediaries (ammonia; phosphate rock; sulphur) and almost 16% of global trade in the key finished fertilisers. Economic sanctions therefore could impact global fertiliser availability, tightening already tight balances.

| Russia accounts for 24% of global ammonia exports (c.4.5Mt in 2020; 2.3% of global ammonia production). IHS Markit suggest other sources can fill void created if Russian exports are sanctioned. For other N fertilisers, alternatives to Russian product are less clear. Russia accounted for c.40% of global Ammonium Nitrate trade in 2020 (3.2Mt out of 7.9Mt traded). Less alternatives – production concentrated in Russia, Europe, US and China (combined 70% of total; Russia 15%). Any sanctions on Russian nitrates in Europe would exacerbate an already very difficult supply outlook. Very high gas prices in Europe brought significant cost pressures & curtailed production in some European manufacturers. Europe accounts for c.530kT of Russian nitrates exports (9%). There are not many alternative sources – China does not export nitrates; US is at peak application time. Russia accounts for c.13% of global urea trade. China is currently curtailing any trade in urea. Along with Morocco & China, Russia is a key global provider of phosphates – a major exporter of finished phosphate fertiliser, and also the largest global producer and supplier of high-grade igneous phosphate rock. Any interruption would have an immediate and significant impact on European fertiliser production. Russia accounts for c.17% of total global trade in finished phosphate fertilisers (incl NPK). Europe accounts for c.30% of Russian phosphate fertiliser exports. Russia accounts for c.20% of world potash trade, and with Belarus accounting for another 20% of world trade, other sources are unlikely to bridge the supply. |

Ukraine not as significant global supplier of fertiliser – has no primary phosphate/potash resources. Is an important nitrogen producer (almost entirely based on imported natural gas) – urea 1.5Mt of total 1.8Mt fertilizer exports in 2020 (urea exports equivalent to c.2.7% of world trade so impact may only have modest impact on global balances).

Ultimately, any cuts in supply may result in a surge in already high nutrient prices, affecting crop yields and cause further food inflation. Urea prices have risen $160 today on yesterday’s levels.

Grain/Feed

As noted above, both Russia and Ukraine are key players in global grain trade, so any disruption in production / freight into or out of the Black Sea could have consequences on ingredient availability.

Russia accounts for c.20% of global wheat exports in 20/21. Ukraine accounts for c.8% of global wheat exports, and c.13% of corn exports. Combined, they account for c.60% of sunflower production and are key sunflower oil exporters

Global wheat & maize futures rose, from concern to supply disruption from these key exporting countries

40% of wheat production takes place in the eastern oblasts of the country, with 8% for the Luhansk and Donetsk independents – where Russia currently focuses attention on.

In addition, Ukraine’s military has suspended operations at its ports after Russian invasion, as concerns grew about the flow of supplies of grains and oilseeds.

Impact – Factors to Consider

| Nature of intervention / intrusion on both will be very different – for Ukraine it is actual conflict itself and trade disruptions caused as a consequence; for Russia it’s the retaliatory economic sanctions from other nations, which yet have to be fully released. In the past, economic sanctions haven’t tended to be product / product class specific. Similar to those announced to date, they have tended to be more targeted. Financial sanctions may target/lock Russia out of the SWIFT banking system and limit the ability of Russian companies to trade internationally (i.e. they could still export but would be unable to receive international wire transfers/payment), or target high net-worth individuals/institutions with close links to the Kremlin. Location of conflict and disruption on trade/logistics – IHS Markit estimate that more than 90% of Ukraine food & agricultural commodities pass through 4 ports (Chornomorsk; Mykolayiv; Yuzhny; Odessa), all based in Southern Ukraine in Odessa & Mykolayiv regions. Any seizing of these ports or fighting around these ports could prove detrimental. Any disruption in internal transportation network could be equally as disruptive as grains and vegetable oils need to be transported from their place of harvest/storage to the ports. [Note: Ukraine wheat production (33 Mt in 2021) was mainly produced in South/Western regions; corn (c.41Mt in 2021) mainly in Northern regions; Sunseed (16Mt in 2021) mainly in Central / Southern regions]. The availability of alternatives / alternative suppliers. Plans in place / Action taken to date – for example, faced with the threat of Russian aggression, Ukraine has rushed to export grains through the Black Sea in recent weeks, as markets fret over the possibility of a disruption in supply from two of the world’s biggest cereal exporters. For Feb 1-14, Kyiv-based consultants put shipments of wheat at 548 000 tonnes, double last year’s level for the same period. The tonnage of maize shipped was 2.24 million tonnes, also double last year’s rate. [Note some of the increase is also a consequence of record Ukraine crops] |

Past Experience

Russian ban on EU food imports in 2014 – EU responded with a full campaign of farmer and market supports extending over a few years. The market disturbance created by the Russian embargo extended the impact well beyond the countries with established trade links with Russia, by redirecting and displacing product and overwhelming demand in other countries, with consequent impacts on market and farmer prices.

We know from the EU Milk Market Observatory that the dairy sector, which was the most severely affected in the embargo, saw price depression over 2 ½ years following from August 2014. There were other factors which impacted at the same time: the abrupt downturn in China’s massive import activity of 2013/14 and the rise in global milk output all contributed to the price depressing trends. However, it was the Russian embargo which motivated an extended campaign of EU supports.

Value of Irish Merchandise Trade with Russia & Ukraine, 2020/21 (€m)

| Value of Imports | 2020 | 2021 |

| Russia | 292.2 | 598.1 |

| Ukraine | 92.8 | 70.2 |

| Value of Exports | ||

| Russia | 445.3 | 627 |

| Ukraine | 71.2 | 91.7 |