EU supplies down in early 2019

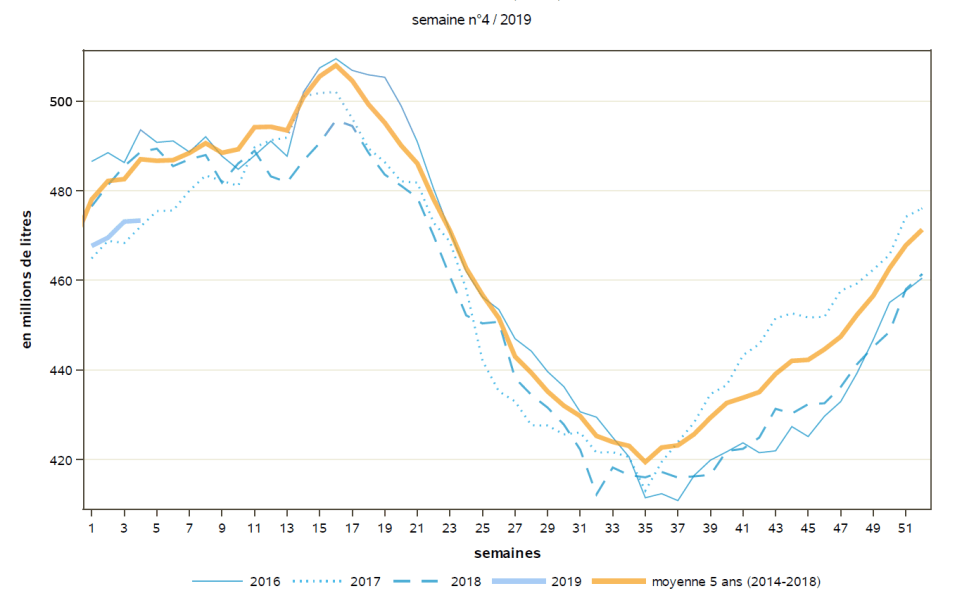

French milk supplies were down -3.1% in week 4 of 2019 (see graph right) and (most recent monthly figure available) down 3.7% in November 18 compared to November 17.

This is the continuation of an ongoing trend towards significantly lower output compared to previous year since the first week of August 2018. Also, output has been consistently below the 5-year average (yellow line in graph below) since almost this time last year.

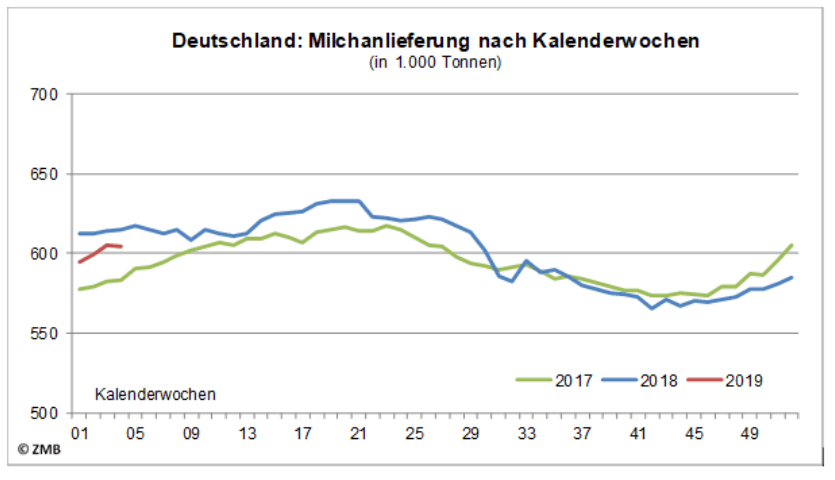

German milk output has also been below year-earlier for almost all of the same period (from August 2018 todate).

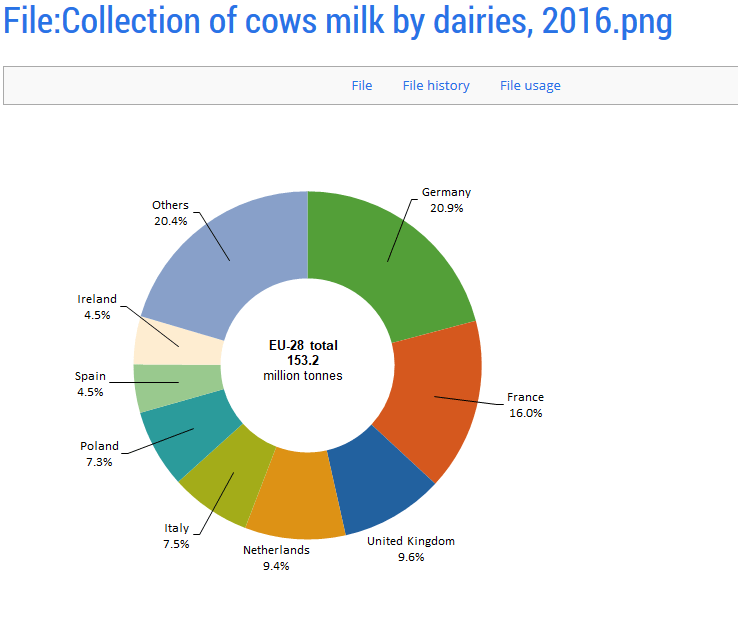

Between them, France and Germany account for 37% of all the milk produced in the EU 28.

Dutch milk production has fallen 2.92% in the January to December period according to ZuivelNL, the Dutch dairy industry organisation. This is due to the restriction on the national dairy herd imposed to reduce phosphate output. Dutch milk supplies account for a further 9.4% of EU supplies.

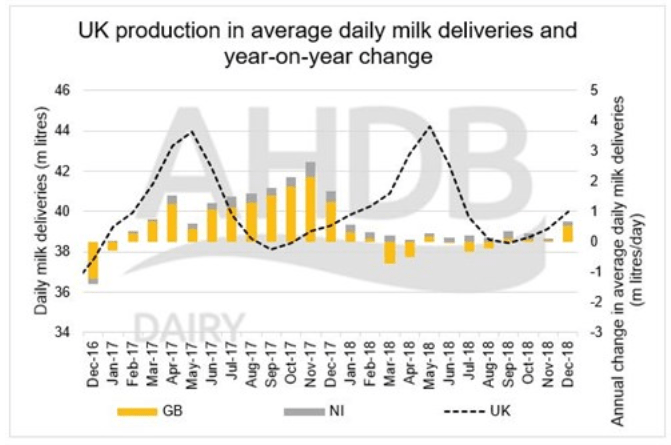

UK milk supplies have been increasing in recent months, rising above 2017/18 output since November.

December 2018 UK output was up 1.7%, but the April to year end output was level for GB, and up 2.3% for NI. The UK accounts for 9.6% of EU supplies (see pie chart below).

More dynamic countries from a milk production perspective include Denmark (up 2.5% for the full year, and 2% for December); Poland (up 2.6% for the full year, up 3% for November) and of course Ireland (up 4.3% for the full year, up 23.2% for the month of December).

Poland accounts for 7.3% of overall EU supplies, with Ireland at 4.5%, and Denmark at 4%.

So, with almost 50% of the EU’s milk output in negative growth, the EU’s milk production has been restrained in recent months, with November output down 0.8% and predictions that this trend will likely continue into spring 2019.

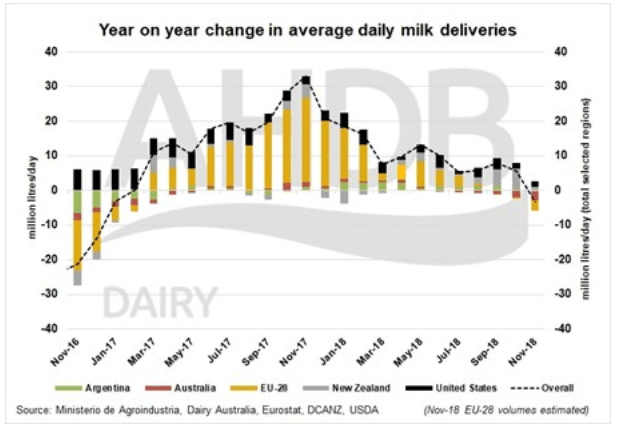

Global supplies: a mixed picture, but flat at back end

Global milk supplies were estimated to be up 1% for 2018, but flat at year end because the EU, Argentina and Australia are all well down.

US output was up moderately, 0.8% for November (no more recent figures due to Government shutdown) and +1.2% for the January to November period.

New Zealand production continued to increase strongly, by 2.3% for the year, and 4.4% in December alone. However, restrictions from environmental legislation enacted by the current Labour government will likely reduce scope for growth in the medium to longer term.

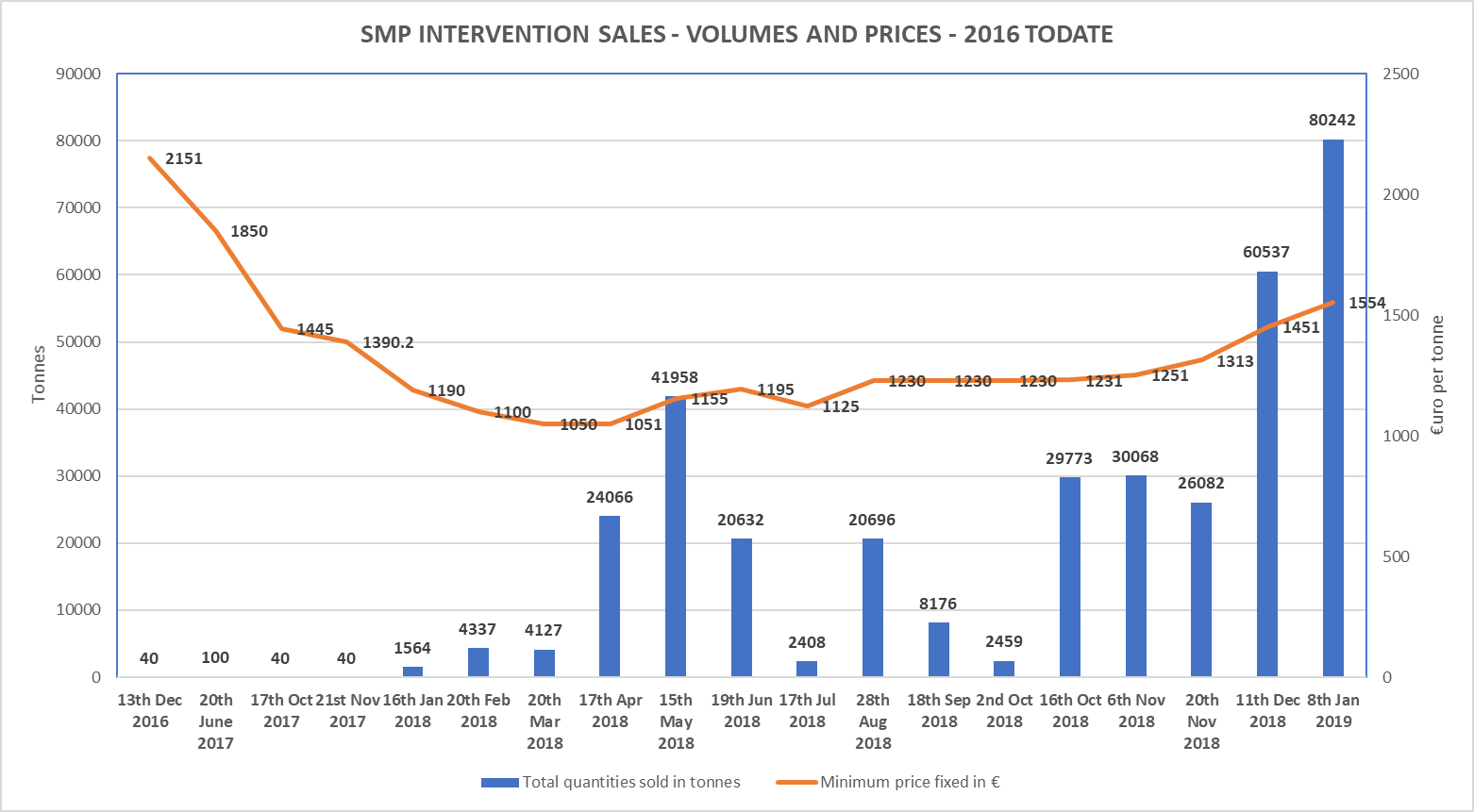

Intervention stocks depleted to almost nothing – with rising sales price

Almost all the over 400,000t of SMP sold into intervention since 14/15 have been sold out, with recent prices keeping pace with fresh feed grade prices of around €1660-1670 (German and Dutch, 6th Feb quote). The latest minimum price adjudicated for sale of intervention powder was €1622/t on 2nd February. As the range of bids was up to €1710, some product will have sold for a higher price up to that maximum.

Remarkably, the 3,500t which were left to sell did not find buyers, only 584 tonnes were sold. Spain, the UK, Slovakia and Finland are the countries where this left-over product is stored. All Irish stock has been sold.

For all intents and purposes, the intervention stores are now as good as empty, and with restrained fresh milk supplies, the price of powder will hopefully continue to firm.

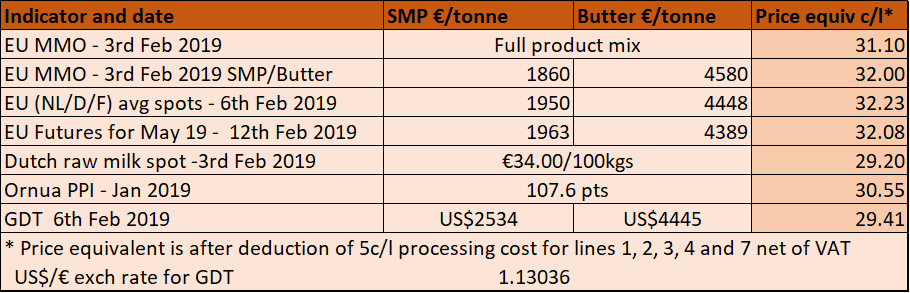

Dairy prices stable to firmer

The firming of powder and butter prices we have seen in recent weeks has continued in a more modest way.

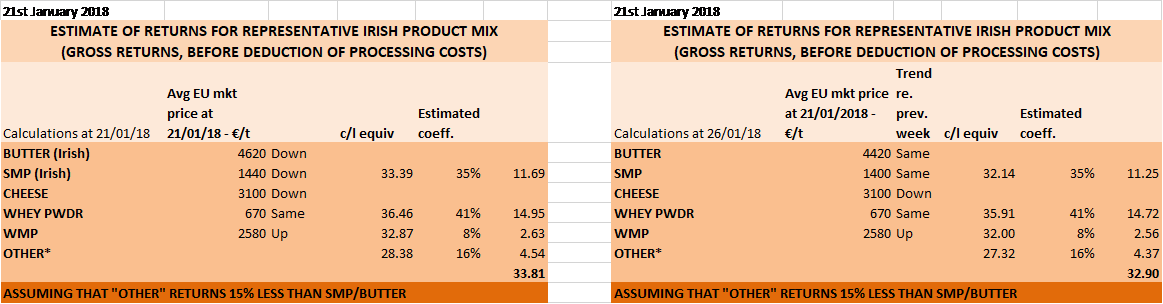

The nominal Irish product mix whose returns we follow on the basis of the EU Milk Market Observatory weekly average price reports has improved by around 1.3 cents per litre from early January to early February.

Based on the EU MMO average prices quoted for 3rd February, the representative Irish product mix would return gross 36.1c/l before processing costs. Assuming the deduction of a nominal 5c/l for processing costs, this would be equivalent to 31.1c/l + VAT, or 32.78c/l incl VAT. This is around 0.5c/l more than the average of the FJ League for milk purchased in the month of December.

Based on EU MMO data

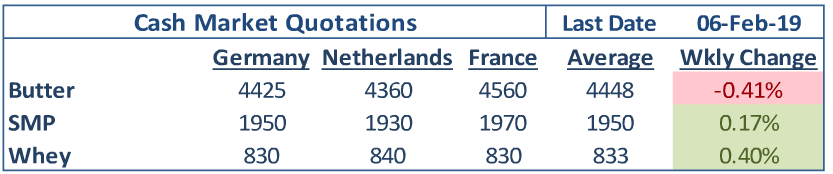

Spot quotes, which had stalled and eased in recent days, are also firming again very slightly for SMP and whey in early February (table below).

Source: INTL FCStone

Returns – improvements should help hold milk prices in short term

Most of the indicators we follow on the market place have improved by 1c/l or more in the last month to month and a half. This reflects continuous improvement in powder prices (especially SMP) and while butter prices had been easing for several months, they have been firming slightly in recent days/weeks.

The average price paid by co-ops for December milk was, based on the Farmers’ Journal milk league, 30.67c/l + VAT. The below suggests that this would be comfortably sustainable based on current (late Jan to early Feb) returns as illustrated by a variety of Irish, EU and international indicators.

Sources: EU MMO, INTL FCStone, Ornua, GDT

CL/IFA/12th February 2019