Horticulture Council Report October 2022

Market Report

Demand for fresh produce has plateaued the past number of weeks, it is estimated that sales are roughly around pre-pandemic 2019 levels. Retail demand for horticulture is back on average 10% year-on-year, matching pre-covid 2019 levels. Over the season, demand matched pretty well with Irish production which was down around 10% on last years figures.

Input costs are to the fore for growers again at this point as they begin to plan for next season. The last set of input price figures from Teagasc in March seen increases up to 50% and these figures have undoubtable risen again. The roll-out of the Horticulture Exceptional (HEPS) Payment Scheme payment and the announcement of the Temporary Business Energy Support Scheme (TBESS) are welcome; however, support is highly variable among sub-sectors. The fact that soft fruit growers remain excluded from the HEPS payment is very disappointing.

Growers will soon begin retail negotiations for next year. Price increases achieved last year in the region of 5-15% were not enough to cover increased input costs and the situation has deteriorated significantly since.

Some consumer retail prices increased in retailers, which is a positive sign that there may be a possibility of growers receiving a margin for their produce in the future. Retails and packers will need to engage closely with growers over the coming months or many growers will simply not be in a position to commit to supply produce next year.

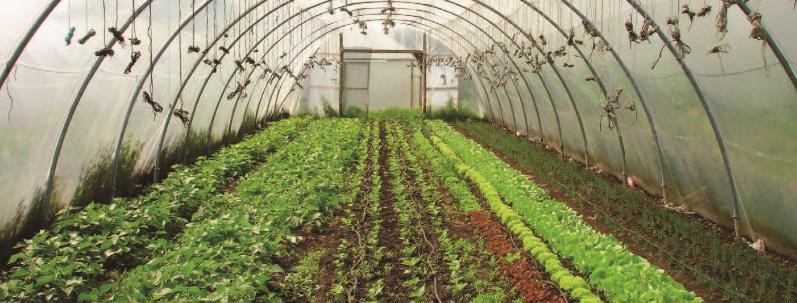

The soft fruit and protected crops season are wrapping shortly with a good growing year reported by most with favourable conditions. The soaring cost of energy, gas in particular, will continue to have a detrimental effect on glasshouse growers’ margins in 2023.

In relation to apple growing, the indications are pointing to a high yield this year due to the favourable conditions, although due to the Russian-Ukraine war, prices are expected to take a hit across the EU as the largest producing country of apples. Due to current restrictions set out across EU member countries, this market may be shut off leading to a higher quantity of apples across Europe.

Root crops are reported to be yielding well to date and harvest conditions are favourable so far.

Temporary Business Energy Support Scheme (TBESS)

The Temporary Business Energy Support Scheme (TBESS) will provide qualifying farms/businesses with up to 40% of the increase in electricity or gas bills up to €10,000 per month and will be administered by the Revenue Commissioners. Subject to State Aid approval, once legislated for, it is expected that the scheme will be backdated to September 2022 and will run until February of next year. The scheme will be operated on a self-assessment basis. It is aimed at farms/businesses whose average unit gas or electricity price has risen by over 50% compared with their average unit gas or electricity price in 2021. The credit will be calculated as 40% of the excess of the 2022 bill over the 2021 bill, capped at €10,000 per trade per month.

Work Permits

The introduction of the proposed seasonal work permit scheme still remains extremely important and will be very important for the sector moving forward and IFA continues to lobby to get this over the line. IFA appreciate any help that can be assisted, such as providing sufficient evidence of the lack of available labour in the country.

Activity since last National Council

- An amalgamated Field Vegetable and Protected Crops committee meeting was held on 11th of October in the Kilashee Hotel Naas. The main discussion items were – markets, input costs, TBESS, labour and peat.

- Budget 2023- following extensive lobbying it was announced that the Horticulture budget will increase to €10 million with support continuing under Brexit Adjustment for the Mushroom and Seed Potato sectors.

- Three IFA organic farm walks took place in Donegal, Meath and Tipperary during the month of October. The events were supported by Teagasc, DAFM, Bord Bia and the organic certification bodies. The events were held ahead of the scheme re-opening this month. All events were well attended.

- IFA continues to meet with all retailers on an ongoing basis to highlight the reduced margins that all growers are experiencing due to spiralling input costs.

- IFA continues to liaise with the Department of Enterprise, Trade and Employment on processing work permits and the establishment of a seasonal work permit scheme.

- Activities under the Green Cities Promotions continue as part of the European funded initiative. The campaign aims to promote green landscaping in building projects in Ireland, while encouraging the use of locally-grown planting stock. The promotion is 80% funded from the E.U. with 20% coming from the industry. Growers are reminded to contribute to the promotion.

- The IHNSA AGM will take place in the Killeshin Hotel on Thursday November 3rd. All INHSA members are encouraged to attend.

EU/COPA Developments

- IFA has continued contact with both the EU Commission and COPA in relation to the impact of spiralling input costs on the Horticulture sector.

Upcoming Events / Issues

- IFA will continue its lobbying campaign in relation to the harvesting of peat for the horticultural sector.

- IFA will be lobbying to include the sectors of horticulture affected by Brexit in the Brexit Adjustment Reserve (BAR) fund announced by the EU.

- The EU promotional campaign for Fruit and Veg is now underway. More information can be seen here https://fruitnveg.ie/. The promotion is 80% funded from the EU with the remaining contribution from growers.