Livestock Council Report July 2022

- Market Report

- Beef Price: Steers are generally making €4.90 to €5.05/kg. Heifers are making €4.95/kg to €5.10/kg with higher deals for larger lots and increased breed bonuses paid. Young Bulls are ranging from €4.90 to €5.10/kg for R/U grades. Cows are making €4.60 to €5.00/kg.

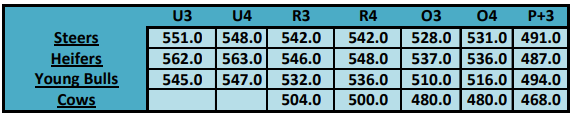

- DAFM Reported Prices week ending 03/07/2022: R3 steer prices for the last week were back 9c on the previous week at €5.42/kg, R3 heifer prices were back 8c at €5.46/kg. R3 young bull prices decreased by 7c to €5.32/kg. P+3 grade cows were back 10c/kg to €4.68/kg, O3 grading cows were back 8c/kg to €4.80/kg, R3 grading cows were back 7c/kg to €5.04/kg.

- Beef Market Tracking: For the week ending July 2, 2022 average R3 young bull prices in the EU have experienced falls in prices over the last number of weeks, however, increased by 4c/kg the week of July 2, 2022 to reach €4.91/kg (excluding VAT). The latest reported Irish R3 steers has crept up to surpass this figure at €5.23/kg. The UK R3 steer decreased marginally last week by 2/kg, equating to €5.18/kg, which also lies beneath Irish R3 steer prices.

- Composite prices: The Irish prime composite cattle price and the prime Export Benchmark for week ending July 2, 2022 were equivalent to €5.19kg and €5.03/kg deadweight respectfully, the EU export benchmark (excluding UK) is €5.00/kg. These prices exclude VAT.

- GB Cattle Prices as reported by AHDB: Prices in GB for R3 steers increased by 1.7p/kg in the latest week bringing the price to £4.50/kg.

- Supply Figures as Reported by DAFM – Week 26 (27.06.2022)

| Animal | Number | Change prev. wk. | % of total | YTD | YTD Change |

| Y Bull | 2,834 | ▼- 200 | 9% | 78,001 | ▲2571 |

| Bull | 517 | ▼- 118 | 2% | 14,210 | ▲1122 |

| Steer | 11,497 | ▲168 | 36% | 317,567 | ▲27,469 |

| Cow | 8,470 | ▼- 522 | 26% | 205,580 | ▲33,412 |

| Heifer | 8,743 | ▲272 | 27% | 253,347 | ▲16,498 |

| Veal – V | 2 | ▼- 1 | 0% | 27,905 | ▲7,337 |

| Veal – Z | 13 | ▼- 10 | 0% | 1,040 | ▲62 |

| Total | 32,076 | ▼ – 411 | 100% | 897,650 | ▲88,471 |

Supplies: Total throughput is running 88,471/head ahead of the same period last year.

Market Conditions: Market conditions for Irish beef remains positive. Tight supplies of finished cattle, strong market demand and strengthening UK beef prices is underpinning the trade. Supplies are predicted to tighten further and improved demand for beef over the course of the summer should help prices.

Live Exports: Total cattle exports in 2022 is running 12% ahead of 2021 levels at 211,032 head for the week ending 2 July 2022. Calf exports continue to move upwards with 163,409 head exported, almost a 20% increase on 2021 levels.

- Input Crises

- IFA wrote to Minister for Agriculture Charlie McConalogue seeking immediate direct financial support for Suckler and Beef farmers.

- IFA continue to seek immediate direct financial support for Suckler and Beef farmers.

- IFA is seeking financial supports for suckler and beef farmers to offset the increased costs for feed, fertiliser and fuel on farms based of their levels of production.

- Guaranteed support for farmers investing in beef production for the remainder of the year and into 2023.

- All lands must be utilised to produce fodder including lifting restrictions on land under schemes such as traditional hay meadow and Low input grasslands.

- Following IFA demands the Minister announced a €55m silage support package providing farmers with a €100/ha payment for all silage cut up to a maximum of 10ha.

- The scheme announced has to have the maximum flexibility to help farmers deal with the input’s crisis.

- The cap of €1,000 will have to be re-visited to reflect the needs of those farms with higher stocking levels. The research undertaken by Teagasc, which underpinned the scheme, will have to be taken into account.

- The Department of Agriculture must frame the scheme to ensure the full drawdown of funds.

- Payments must be proportionate to the area claimed. The payments should reflect full hectares, and any part of a hectare, claimed.

- The Minister’s announcement is a first step, but more will be needed.

- The recent Teagasc report found the impact of increased input expenditure will exceed output growth for the year. The production costs on suckler and finishing farms are projected to increase by 24% and 30% respectively.

- CAP

- IFA met senior DAFM personnel on 25th April and again set out the demands of the suckler and beef sector in the new CAP.

- €300/cow must be provided in targeted support to suckler farmers from 2023 onwards.

- The Minister must provide a rearing and finishing scheme for cattle farmers that will return €100/animal to support farmers in meeting the higher environmental production requirements.

- The Minister has committed that all cows applied on in the new CAP Suckler Scheme will be paid at €150/cow for the first 10 and €120/cow for the remainder, this will require an increase in the €52m annual funding provided.

- The Minister for Agriculture must confirm his funding intentions for the national suckler cow scheme to run alongside the CAP Pillar 2 Suckler cow scheme.

- The funding allocation to sucklers for 2023 is €28m below current support levels.

- Specific issues raised in the context of the proposed 2023 Suckler Carbon Efficiency Scheme include;

- The allocated budget must be ring fenced for the scheme and for suckler farmers for the 5 years.

- The reference period provided must include 2022.

- The reference number per farm must allow new entrants to the sector and existing farmers develop their enterprise while contributing to the objectives of the scheme to receive payment for all of their cows.

- SBLAS membership must not be a compulsory eligibility condition for the scheme

- The targets in the scheme must be realistic and must not penalise smaller farms where the % requirement is disproportionate.

- The % target requirements for the Replacement Strategy must be based on the last full animal number.

- Compliance with the Replacement Strategy cannot be based on the status of the sires of calves born in 2023, this would require an action on farms in May and June 2022 when no scheme has been agreed or available for application.

- The genotyping measure should be based on genotyping calves at birth when tagging with a reasonable minimum target that allows for empty samples, mortalities and issues with testing.

- Food Vision Beef Group

- IFA attended The Food Vision Beef group meetings on June 16th, 30th and July 7th

- The group is focusing on Climate Targets for the sector until November

- An interim report will be provided in September with the final report due in November

- Presentations on potential measures have been given by Teagasc, ICBF, AHI and DAFM

- IFA have put forward the following key points and will be making a detailed submission for the sector;

- The target for the sector should be to continue to produce beef from one of the most environmentally sustainable production systems in the world, based on our suckler herd.

- Our €2.5bn beef sector is built on the production standards and image of the world-class beef produced from our suckler cow farms.

- Suckler cow numbers are in serious decline and we are at a critical stage, with less than 50% of our beef animals now coming from suckler herds.

- Since 2018, there has been a 12% reduction in suckler cow numbers, leading to a reduction of over 20% in suckler beef production.

- Suckler farming is an extremely vulnerable sector. Average incomes are just over €10,000 a year. Direct payments contribute 130% of FFI with new investment on suckler farms declining from €6,121 in 2016 to €4,490 in 2020, a drop of 27%.

- Suckler and beef farmers will play our part on climate action. Measures that are practical to implement; have the potential to add value on our farms; and contribute to the climate objective will all be considered.

- The level of ambition for the sector will be determined by the level of Government and industry ambition to directly support farmers in the process.

- We do not have the economic capacity for extra investments or changes of practice on our farms.

- Measures include age at slaughter; genomic testing, animal health and targeted medicines usage; soil health and fertility; alternative crops; and support for generational renewal.

- We cannot ignore the fact that our beef sector, which is the largest farming enterprise in the country, is most exposed to the impact of Brexit, our more productive suckler and beef farmers are most exposed to inputs inflation and these are the very same farmers hit hardest in the flawed Common Agriculture Policy and reduced targeted support commitments from Government.

- There is a real opportunity for Government now to come forward with a funding package to support suckler and beef farmers to ensure as a country we continue to produce beef at a time of real food security and food sovereignty concerns.

- The tools are not yet available/proven that can guarantee specific emissions reduction at a national level.

- We cannot move faster than the science, technology and tools by setting arbitrary figures for the sector that have the potential to undermine food production, food security, food sovereignty and the socio and economic viability of our rural towns and villages.

- The suckler herd and beef originating from it has reduced by over 20% since 2018.

- The plans for the sector must take this into account and set about protecting this critical national resource.

- NAP

- The proposed NAP is exposing lower stocked suckler and beef farmers to unnecessary additional costs of compliance in areas such as LESS and outwintering.

- The reduced thresholds at which these measures become applicable impacts directly on low stocked suckler and beef farms who are not in a position to incur the additional costs associated with these unnecessary changes.

- Budget Submission

- Suckler and beef farms are currently experiencing excessive inflation on all key farm inputs and do not have the financial capacity to absorb this level of production cost increase. IFA is seeking direct financial supports including subsidies to offset farmers reliance on these inputs based on their level of production.

Suckler Carbon Efficiency Programme

- Government support committed to suckler farmers in 2023 is €28m less than current levels. This is unacceptable. The new Suckler Carbon Efficiency Programme must be built on to provide farmers a minimum of €300/cow payment for all suckler cows.

Cattle rearing and finishing scheme

- The Dairy Beef Welfare Scheme must be expanded to include farmers who rear beef animals from the suckler herd including store and finishing farmers, with a minimum payment of €100/animal.

Inputs Crisis – Supports for suckler/drystock farmers

- Financial supports for suckler and beef farmers to offset the increased costs for feed, fertiliser and fuel on farms based of their levels of production must be provided.

- Direct supports must be provided to farmers investing in beef production for the remainder of the year and into 2023.

Agri-Environmental scheme

- The Agri-Environmental Climate Measure scheme must provide all suckler and beef farmers a €10,000/year payment.

Climate Target Supports- New Funding

- The measures outlined to the Beef Food Vision Group for the sector to achieve emission reduction targets are not new.

- The level of ambition for the sector in implementing some of these measures will be directly correlated to the level of funding ambition from Government for beef and suckler farmers to support these changes and new practices on farm.

Brexit Adjustment reserve (BAR)

- IFA have made a detailed submission on the Brexit Adjustment reserve setting out potential Mitigants and support measures for livestock farmers impacted through Brexit.

- The BAR fund must be utilised to directly support suckler and beef farmers to safeguard their farm income situation from the potential impacts of Brexit which looms over the sector.

- Direct / compensatory aid for revenue lost, paid direct to impacted farmers. €337m lost because of weakened sterling; C.€101m lost revenue Sept ’18-Mar’19; €8.3m mid Oct-19 to end Jan ’20; €12.5m end Jan ’21-Apr ‘21 because of depressed prices.

- Subventions on added cost of production.

- Evidence of reduced capital investment on beef farms must be addressed. Measures, including direct-aid to support improved performance, efficiency and/or sustainability of the agricultural holding and therein support improved income resilience.

- Measures to reduce reliance on inputs by directly supporting farmers to implement measures that improve soil health and animal health leading to higher production efficiencies, recognising time, labour and management commitments of farmers to achieve same.

- Measures to promote On-Farm Diversification.

- Measures to support Intergenerational Renewal / Collaboration type supports/models.

- Measures to promote transitional arrangements involving new and experienced operators.

- BEEP – S

- Late applications for the scheme were accepted up to a 25-day period after the 25th of April closing date for applications.

- All weights must be submitted to ICBF between 1st January 2022 – 1st November 2022.

- BDGP

- IFA met DAFM and demanded participants be returned monies outstanding due to DAFM alterations made to the stock bull and AI requirement.

- Applicants were successfully refunded all monies due following several communications with DAFM.

- Electronic Payments from factories

- IFA have met MII and sought that EFT be provided as an option of payment to all beef farmers.

- Events/Activity

- Food Vision Beef and Sheep group.

- €300 Suckler cow payment, €100 rearing and finishing payment.

- Cattle prices.

- Meetings with meat factories.

- Budget submission.

- Met with UFU in London on June 15th to discuss challenges facing the livestock sector.

- Weekly publication of IFA beef price updates.

- Ongoing contact with Bord Bia.

- Brexit Adjustment Reserve.

- Met DAFM officials on fodder support schemes and direct payments for suckler and beef farmers.

- Livestock committee meeting on July 12th.