Livestock Reports

Livestock Council Report July 2023

1. Market Report

Market Report

- Beef Price: Steers are making from €4.85 to €4.95/kg. Heifers are making €4.85/kg to €4.95/kg with higher deals for larger lots and increased off season breed bonuses paid. Young Bulls are ranging from €4.95 to €5.15/kg for R/U grades. Cows are making €4.00 to €4.60/kg.

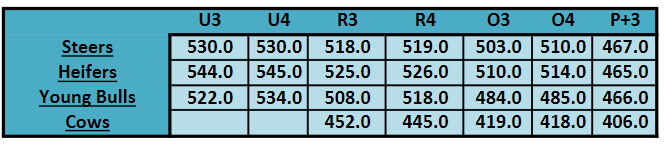

- DAFM Reported Prices week ending 09/07//2023: R3 steer prices for the latest week decreased by 6c/kg to €5.18/kg, R3 heifer price decreased by 5c/kg to €5.25/kg. R3 young bull prices decreased by 6c/kg to €5.08/kg. P+3 grade cows were back 3c/kg to €4.06/kg, O3 grading cows were back 6c/kg to €4.19/kg, R3 grading cows were back 15c/kg to €4.52/kg.

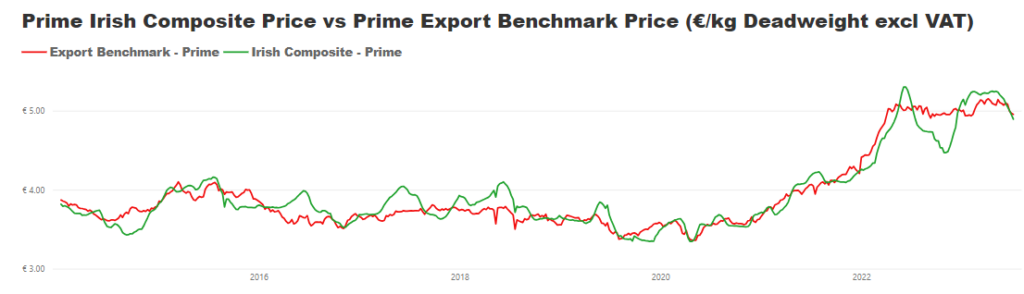

- Composite prices: The latest Irish prime composite cattle price and the prime Export Benchmark on July 8th, 2023 were equivalent to €4.89kg and €4.95/kg deadweight respectfully.

- GB Cattle Prices as reported by AHDB: Prices in GB for R3 steers decreased by £0.09p/kg in the latest week bringing the price to £482.7/kg. R3 Heifers have also increased by £0.08p/kg to £481.6/kg to week ending April 8th 2023.

- Supply Figures as Reported by DAFM – Week 27 (02.07.2023)

| Animal | Number | Change prev. wk. | % of total | YTD | YTD Change |

| Y Bull | 2,703 | ▼359 | 8% | 73,158 | ▼7,585 |

| Bull | 530 | ▼205 | 2% | 14,728 | ▼73 |

| Steer | 11,550 | ▼141 | 35% | 319,555 | ▼10,775 |

| Cow | 8,503 | ▼ 215 | 26% | 206,208 | ▼7,314 |

| Heifer | 9,301 | ▲547 | 28% | 254,037 | ▼8,309 |

| Veal – V | 6 | ▲3 | 0% | 30,424 | ▲2,513 |

| Veal – Z | 48 | ▲ 30 | 0% | 1,065 | ▲12 |

| Total | 32,981 | ▼340 | 100% | 899,175 | ▼31,531 |

- Supplies: Total throughput is running 31,531/head behind of the same period last year. Total steer kill is back 10,775/head, heifer kill is back 8,309/head and Y Bulls are back 7,585/head from the same period last year. Cow throughput is back 7,314/head from the same period last year.

- For week ending 09/07/2023 the National average cold carcass weight for Y Bulls was 373kg, steers 348kg, heifers 313kg and cows 303kg.

- Market Conditions: Cattle prices have come under significant pressure in recent weeks. Demand for beef remains firm as beef supplies tighten across the EU, however inflation related impacts continue to influence markets with consumers consuming less beef and trading for other cheaper protein sources. Cattle supplies remain tight and poor weather conditions this spring followed by spells of delayed grass growth in many parts of the country will push out finishing dates for grass cattle impacting average carcass weights.

- Live Exports: Live exports have been moving very strong to date with particular strong exports for calves to Spain, holland and Poland. Up to week ending 24th June 195,308 calves were exported. An increased number of finished cattle have been exported to NI in recent week brining the total to 22,997. Over all 248,605 animals have been exported to date an increase of 19.2% for the same period in 2022.

2. Activity since last National Council

- IFA held a series of Suckler Carbon Efficiency programme meeting on May 4th, 8th, and 10th.

- Livestock committee meeting convened on May 17th.

- Attended the Meat Market Observatory expert group online on Tuesday 6th June.

- Attended the Bord Bia Meat & Livestock meeting on 12th June.

- Livestock Management committee meeting convened on June 21st.

- Attended the Calf stakeholders group meeting on Friday 23rd June.

- Met with the Food Vision Beef group on June 26th.

- Met the DAFM in June on the newly proposed €28m suckler scheme.

- Attended meeting of the Suckler Brand Group

- Attended the Copa Working Party meeting on Breeding Livestock on July 4th.

- Livestock Budget submission.

- Weekly publication of IFA cattle price updates.

3. Upcoming issues- Upcoming events

Budget

Suckler Carbon Efficiency Programme

- All farmers in the scheme must be paid in full on all of their eligible animals. The Minister for Agriculture in his mart meetings on CAP committed publicly that all farmers taking part in the SCEP would be paid in full on all of their eligible animals. The funding allocation of €52m a year is not sufficient to provide this. With approx. 500,000 cows applied on from over 20,000 farms there is an additional funding requirement of €18m which must be provided to pay all farmers in the scheme.

- Genotyping costs in the scheme must be reduced. The roll out of the National Genotyping programme has created a two-tier system for farmers genotyping costs. Suckler farmers in the SCEP are charged directly €18/20 for genotyping while farmers involved in genotyping in the National programme will only incur a cost of approx. €6. This imbalance in costs must be addressed by reducing the costs for suckler farmers in the SCEP programme for genotyping in line with the national programme costs

- New entrants to suckler farming. The SCEP must facilitate and accept new entrants to the sector into the programme and provide flexibility to build their herd while participating. Arresting the decline in suckler cow numbers will require new entrants to the sector. However, the current economics are such that the sector is not economically viable without meaningful supports, farmers choosing to enter suckler farming must be fully supported through SCEP.

Beep-s Replacement scheme

- Funding of €28m has been committed for this scheme for 2023. This level of funding when combined with the SCEP payments will not deliver €300/cow to suckler farmers participating in both schemes. The funding must be increased to €70m.

- The scheme that will be provided must be practical, reflect and support existing good practice on farms and avoid unnecessary leakage of the monies for actions that are new to farms, cost prohibitive and do not add any value in real terms for suckler farmers.

- The costings of measures in the scheme must reflect the real time costs of the actions required and recognise the full extent of farmers time and labour in carrying out these actions.

Calf Welfare Scheme

- The Dairy Beef Welfare Scheme is an important component of supporting farmers developing best practices and efficiencies in developing calf rearing businesses on their farms. The scheme must be continued for 2024 and the level of supports increased to reflect the costs, labour and standards required to maximise performance and viability of the process.

- Farmers who follow best practice in this area and who focus on high CBV calves must be supported.

- A payment of €100 per calf should be provided to these farmers for the rearing phase of these animals

Beef Sustainability Scheme

- Farmers feeding animals for beef production will be required to play a pivotal role in achieving the climate target ambition for the sector

- These farmers will be required to maximise production efficiencies on their farms to deliver on these objectives.

- The sector is a low-income vulnerable sector that has also had a significant reduction in CAP payments in the CAP.

- Capacity and resources are not available on these farms to deliver the changes required to achieve the climate ambition for the sector.

- Farmers rearing and finishing weanling and store cattle of all breed types must be directly supported for this phase of the process with a minimum of €100/animal to support measures that maximise the performance of these animals

- Young Bull finishers have the potential to positively impact on average age of slaughter of all prime cattle and must be supported in this high-cost specialist production system

- Introduce a native grain use incentive scheme to support livestock farmers who prioritise the use of quality assured grain in their feed choices.

Brexit Adjustment Reserve (BAR)

- The BAR fund must be utilised to directly support suckler and beef farmers to safeguard their farm income situation from the potential impacts of Brexit which looms over the sector.

- Direct / compensatory aid for revenue lost, paid direct to impacted farmers. €337m lost because of weakened sterling; C.€101m lost revenue Sept ’18-Mar’19; €8.3m mid Oct-19 to end Jan ’20; €12.5m end Jan ’21-Apr ‘21 because of depressed prices

- Subventions on added cost of production

- Evidence of reduced capital investment on beef farms must be addressed. Measures, including direct-aid to support improved performance, efficiency and/or sustainability of the agricultural holding and therein support improved income resilience

- Measures to reduce reliance on inputs by directly supporting farmers to implement measures that improve soil health and animal health leading to higher production efficiencies, recognising time, labour and management commitments of farmers to achieve same – e.g:

- Soil Health programmes (incl incentives/supports for use of Lime / MSS etc)

- Supports for grass measuring equipment – better utilisation of grass; helps alleviate winter fodder costs

- Reseeding and over sowing supports

- Improved Animal Health and Performance measures such as supporting more targeted use of antibiotics and antiparasitics

- Supports for animal performance measuring and recording leading to more efficient beef production systems

- Measures to promote On-Farm Diversification

- Grow your own inputs (self-sufficiency / improved protein utilization)

- Scale up renewable energy (RE) sources and adoption on smaller scaled farms – e.g. anaerobic digestion, biorefining, biomass supply, and solar PV; focus on energy efficiency; examine barriers to the roll-out of RE at farm level, including necessary support for microgeneration and grid access.

- Agrotourism; farm building renewal, etc

- Measures to secure/develop in the context of reduced UK market reliance new high value markets and/or viable niche/premium products to deliver the highest possible beef price and increase operator resilience

- Measures to support Intergenerational Renewal / Collaboration type supports/models

- Measures to attract, sustain & diversify skills/expertise in Irish beef sector

- State-funded mentorship type programme

- Measures to promote transitional arrangements involving new and experienced operators

- Development of specific volatility and risk management measures

Climate Target Supports- New Funding

- The measures outlined to the Beef and Sheep Food Vision Group for the sector to achieve emission reduction targets are not new.

- The level of ambition for the sector in implementing some of these measures will be directly correlated to the level of funding ambition from Government for beef and suckler farmers to support these changes and new practices on farm

- The majority of these measures have already been proposed by IFA to Government for inclusion in targeted support schemes for suckler and beef farmers, but government have refused to support them

- Significant meaningful direct support for suckler and beef farmers will be required

- Government must come forward with the New Funding and announce the extinct of this funding to allow the sector consider the additional measures and practices that may be feasible on suckler and beef farms.

- The objective of these measure must be to arrest the decline in our suckler herd and facilitate rebuilding that supports generational renewal within the sector.

Food Vision Beef Group

- The final Food Vision Beef group report was submitted to the Minister in November 2022.

- DAFM have failed to provide a detailed impact assessment of the measures proposed in the report.

- IFA have sought further detailed discussions and levels of support available for implementation of the enabling factors in the report submitted to the Minister at the recent Food Vision Beef abd Sheep Group meeting

On-going events

- IFA Livestock Management committee will meet with the IFA Dairy Management committee on July 20th.

- IFA Livestock Management committee will meet with Meat industry Ireland on July 20th.

- On-going contact with DAFM regarding suckler schemes.

- Livestock Budget.

- Weekly publication of IFA beef price updates.

- On-going contact with Bord Bia.

- Brexit Adjustment Reserve.

- On-going contact with MII.