Livestock Reports

Livestock Council Report March 2023

Market Report

Market Report

- Beef Price: Steers are generally making €5.20 to €5.30/kg. Heifers are making €5.25/kg to €5.35/kg with higher deals for larger lots and increased breed bonuses paid. Young Bulls are ranging from €5.10 to €5.50/kg for R/U grades. Cows are making €4.50 to €5.20/kg.

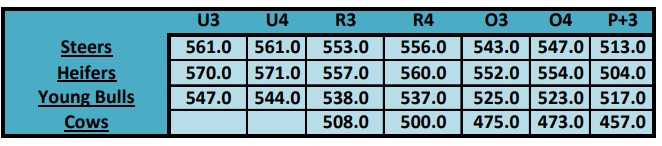

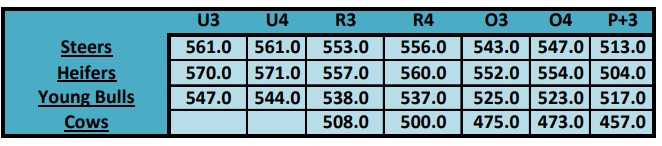

- DAFM Reported Prices week ending 19/02//2023: R3 steer prices for the last week increased by 1c/kg to €5.53/kg, R3 heifer prices decreased by 1c/kg at €5.57/kg. R3 young bull prices increased by 1c/kg to €5.38/kg. P+3 grade cows were back 1c/kg to €4.57/kg, O3 grading cows were up 1c/kg to €4.75/kg, R3 grading cows were up 2c/kg to €5.08/kg.

- Composite prices: The latest Irish prime composite cattle price and the prime Export Benchmark on February 18th, 2023 were equivalent to €5.24kg and €4.63/kg deadweight respectfully.

- GB Cattle Prices as reported by AHDB: Prices in GB for R3 steers decreased by £0.8p/kg in the latest week bringing the price to £4.81.4/kg. R3 Heifers have also decreased by £0.4p/kg to £4.81.5/kg to week ending February 18th 2023.

- Supply Figures as Reported by DAFM – Week 7 (13.02.2023)

| Animal | Number | Change prev. wk. | % Of total | YTD | YTD Change |

| Y Bull | 2,806 | ▼130 | 7% | 23,521 | ▼3,270 |

| Bull | 505 | ▲113 | 1% | 2,653 | ▲229 |

| Steer | 13,289 | ▲1216 | 34% | 80,690 | ▼2,160 |

| Cow | 7,717 | ▼ 322 | 20% | 55,725 | ▲6,058 |

| Heifer | 11,149 | ▲74 | 29% | 72,594 | ▼1,737 |

| Veal – V | 3,308 | ▲16 | 9% | 5,080 | ▼111 |

| Veal – Z | 66 | ▲ 37 | 0% | 367 | ▲14 |

| Total | 38,840 | ▲693 | 100% | 240,620 | ▼987 |

- Supplies: Total throughput is running 987/head ahead of the same period last year. Total steer kill is back 2,160/head, heifer kill is back 1,737/head and Y Bulls are back 3,270/head from the same period last year. Cow throughput is running high with the overall kill 6,058/head above the same period last year.

- For week ending 19/02/2023 the National average cold carcass weight for Y Bulls was 385kg, steers 343kg, heifers 308kg and cows 296kg.

- Market Conditions: Cattle prices have been relatively steady over the past three weeks as numbers of prime cattle have tightened on the ground but have experienced some downward pressure in the past 7 days. Total supply figures are forecasted to decline by 5% and 6% in the first and second quarter of 2023. Over all cattle supplies are forecasted to decline by 50,000/60,000/head in 2023. Total EU beef production is forecasted to decline 0.7% with beef consumption also to decline 1%. Decreasing trends are impacted by green policies, costs of production and lower consumer spending.

- Live Exports: There is a positive outlook for Irish live exports to European markets in 2023. Steady demand is expected for calves, weanlings and store cattle throughout the year. Calf exports have started strongly in 2023 with exports operating 45% ahead of 2022 levels based on the latest data available. During the week ending February 17th 2023 there were 9,483 cattle exported out of the country taking live exports for the year to date to 16,267 head.

2. Activity since last National Council

- Met DAFM officials on November 28th and January 25th to discuss the €28m funding for a new suckler scheme and the Suckler Carbon Efficiency Programme terms and conditions.

- Livestock committee meeting convened on February 15th. Bord Bia provided an update on the Quality Assurance scheme.

- Met with Connacht marts on January 17th.

- Attended the MII launch of their Beef Sector Sustainability report on Thursday 9th February.

- Attended the working party on Breeding livestock in Brussels on December 15th.

- Met with the French Livestock breeders association on February 1st.

- Met the Farm Animal Welfare Advisory Council (FAWAC) in December.

- Attended the Charter of Rights meeting on January 26th.

- Committee members met with their local processing plants to discuss prices and markets.

- Attended the Calf stakeholder’s forum on December 17th.

- Weekly publication of IFA cattle price updates.

3. Any EU/COPA developments

- IFA will attend the working Party and Civil Dialogue Group on Beef and Veal on March 30th and 31st.

4. Upcoming issues- Upcoming events

Suckler Carbon Efficiency Programme

- IFA met senior DAFM personnel on November 28th and January 25th to discuss the proposed terms and conditions for the new Suckler Carbon Efficiency Programme set out in the CAP strategic plan.

- Issues raised with DAFM on the new proposed scheme included;

- SBLAS membership must not be a compulsory eligibility condition for the scheme.

- Compliance with the Replacement Strategy cannot be based on the status of the sires of calves born in 2023, this would require an action on farms in May and June 2022 when no scheme has been agreed or available for application.

- €300/cow must be provided in targeted support to suckler farmers from 2023 onwards.

- The monies allocated to the scheme must be ring fenced for suckler farmers.

- The 80%, 85% and 90% targets for calves born sired by 4 or 5 star bulls must be reduced and simplified.

- The Dam requirement targets of 50%,60% and 75% must be reduced.

- The genotyping measure should be based on genotyping calves at birth when tagging with a reasonable minimum target that allows for empty samples, mortalities and issues with testing.

- The reference number per farm must allow new entrants to the sector and existing farmers develop their enterprise while contributing to the objectives of the scheme to receive payment for all of their cows. The reference period must include the most up to date year available (2022).

- The % target requirements for the Replacement Strategy must be based on the last full animal number.

- The facility allowing reduced numbers without sanction must be aligned with reduced targets in these years for the Replacement Strategy and genotyping targets.

€28m funding

- €28m was announced in Budget 2023 for a new suckler scheme to run alongside the new Suckler Carbon efficiency Programme.

- IFA met senior DAFM personnel on November January 25th to discuss the newly proposed scheme.

- Terms and conditions of the newly proposed scheme have yet to be finalised and IFA continue to engage with DAFM on the new scheme.

- The Minister did not provide a rearing and finishing scheme for cattle farmers in the budget that will return €100/animal to support farmers in meeting the higher environmental production requirements.

- Committee members continue to engage and lobby local Ministers and TD’s for €100 cattle finishing and rearing scheme.

Food Vision Beef Group

- The final Food Vision Beef group report was submitted to the Minister in November 2022.

- DAFM have failed to provide a detailed impact assessment of the measures proposed in the report.

- IFA do not support the current proposals which focus solely on reducing our levels of production in the beef and suckler sectors.

- IFA do not support proposals and targets in some of the measures that will incentivise or encourage reduced production or productive capacity of drystock farms.

These include:

- Reduced age of slaughter targets that will result in reduced carcase weights.

- Reduced nitrogen usage that will reduce the productive capacity of dry stock farms.

- Proposals to provide higher levels of funding to farmers reducing or exiting a particular production system without any requirement to maintain meaningful agricultural production on the holding than is available to farmers committed to the sector and delivering on the values and benefits that the sector provides are not acceptable

- IFA have consistently put forward the following key points;

- The target for the sector should be to continue to produce beef from one of the most environmentally sustainable production systems in the world, based on our suckler herd.

- Our €2.5bn beef sector is built on the production standards and image of the world-class beef produced from our suckler cow farms.

- Suckler cow numbers are in serious decline and we are at a critical stage, with less than 50% of our beef animals now coming from suckler herds.

- Since 2018, there has been a significant reduction in suckler cow numbers, leading to a reduction of over 20% in suckler beef production.

- Suckler farming is an extremely vulnerable sector.

- Suckler and beef farmers will play our part on climate action. Measures that are practical to implement; have the potential to add value on our farms; and contribute to the climate objective will all be considered.

- The level of ambition for the sector will be determined by the level of Government and industry ambition to directly support farmers in the process.

- We do not have the economic capacity for extra investments or changes of practice on our farms.

- Measures include age at slaughter; genomic testing, animal health and targeted medicines usage; soil health and fertility; alternative crops; and support for generational renewal.

- We cannot ignore the fact that our beef sector, which is the largest farming enterprise in the country, is most exposed to the impact of Brexit, our more productive suckler and beef farmers are most exposed to inputs inflation and these are the very same farmers hit hardest in the flawed Common Agriculture Policy and reduced targeted support commitments from Government.

- There is a real opportunity for Government now to come forward with a funding package to support suckler and beef farmers to ensure as a country we continue to produce beef at a time of real food security and food sovereignty concerns.

- The tools are not yet available/proven that can guarantee specific emissions reduction at a national level.

- We cannot move faster than the science, technology and tools by setting arbitrary figures for the sector that have the potential to undermine food production, food security, food sovereignty and the socio and economic viability of our rural towns and villages.

- The suckler herd and beef originating from it has reduced by over 20% since 2018.

- The plans for the sector must take this into account and set about protecting this critical national resource.

Climate Target Supports- New Funding

- The measures outlined to the Beef Food Vision Group for the sector to achieve emission reduction targets are not new.

- The level of ambition for the sector in implementing some of these measures will be directly correlated to the level of funding ambition from Government for beef and suckler farmers to support these changes and new practices on farm.

- Government must come clean with suckler and beef farmers on the levels of funding they are prepared to provide to support adaption of the new measures.

NAP

- The proposed NAP is exposing lower stocked suckler and beef farmers to unnecessary additional costs of compliance in areas such as LESS and outwintering.

- The reduced thresholds at which these measures become applicable impacts directly on low stocked suckler and beef farms who are not in a position to incur the additional costs associated with these unnecessary changes.

Input Crises

- IFA continue to pursue immediate direct financial support for Suckler and Beef farmers to offset the increased costs feed, fertiliser and fuel on farms based of their levels of production.

- The most recent Teagasc report found that total input costs increased over 24% in 2022 with a 15% decrease in gross margins. Total input expenditures are set to increase a further 3% in 2023.

- Teagasc have estimated that cattle finishers will require €5.84/kg to breakeven this winter period with feed costs forecasted to increase by a further 10% in 2023.

- Guaranteed support for farmers investing in beef production for 2023 is essential.

Electronic Payments from factories

- IFA have met MII and meat processing plants and demanded that EFT be provided as an option of payment to all beef farmers.

On-going events

Brexit Adjustment Reserve.

- On-going contact with DAFM regarding suckler schemes.

- Weekly publication of IFA beef price updates.

- On-going contact with Bord Bia.

- €300 Suckler cow payment, €100 rearing and finishing payment.

- On-going contact with MII.