Livestock Council Report June 2021

Market Report

Beef Price: Steers are generally making €4.10 to €4.15/kg base price. Heifers are making €4.15 to €4.20/kg with higher deals for larger lots and increased breed bonuses paid. Young Bulls are ranging from €4.10 to €4.30/kg for R/U grades. Cows are making €3.35 to €3.80/kg.

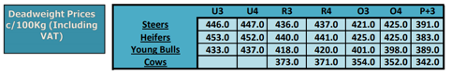

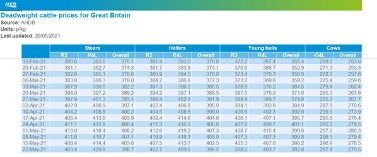

DAFM Reported Prices w/e 23/05/2021: R3 steer prices for the last week dropped by 1c/kg to €4.36/kg, R3 heifer prices remained the same as the previous week at €4.40/kg. R3 young bull prices dropped by 1c to €4.18/kg. The cow trade was back last week, P+3 grades were back 3c/kg, O3 grades were back 4c/kg, R3 grades were back 6/kg.

Beef Market Tracking: The Prime Irish Composite Price for last week remained equal to the previous week at by €4.07 with the Export Benchmark Price dropping by 2c/kg to €3.97/kg

GB Cattle Prices as reported by AHDB: Prices in GB for R3 steers dropped by 5p/kg in the latest week bringing the price to £4.03/kg

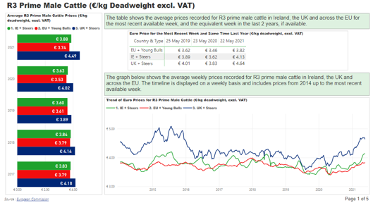

The latest Commission reported R3 male cattle prices show Steers in Ireland excl. vat €4.13/kg, UK Steers €4.64/kg and EU Young Bulls at €3.82/kg.

Latest DAFM Kill figures;

Supplies: Supplies for the year to date are back 37,417 on the same period for 2020.

| Supply Figures as Reported by DAFM – Week 21 (30.05.2021) | |||||

| Animal | Number | Change prev. wk. | % of total | YTD | YTD Change |

| Y Bulls | 3,555 | ▲738 | 11% | 60,533 | ▼-13,019 |

| Bull | 717 | ▼-7 | 2% | 10,445 | ▼-2,538 |

| Steer | 10,865 | ▼-102 | 35% | 234,929 | ▼-7,688 |

| Cow | 7,808 | ▼-172 | 25% | 136,180 | ▲9,674 |

| Heifer | 8,091 | ▼-476 | 26% | 194,846 | ▼-18,109 |

| Veal-V | 8 | ▼-3 | 0% | 20,474 | ▼-5,831 |

| Veal-Z | 32 | ▲2 | 0% | 843 | ▲94 |

| Total | 31,076 | ▼-20 | 100% | 658,250 | ▼-37,417 |

Market Conditions: Retail continues to perform strongly with increased food sector demand anticipated for the summer months.

Live Exports

- For the week ending May 15th, live cattle exports reached 7,993 head.

- For the first 5 months of 2021, the number of animals exported is running 6.8% ahead of the same period for 2020, with 154,858 head of cattle exported.

- The Irish calf exports YTD figure sits at 113,285, a 0.8% increase on the same period for 2020.

- On a per head basis, Spain has been the most popular destination for Irish cattle exports in 2021. 51,934 have been exported to Spain so far this year which is a 16.4% increase on the same period for 2020.

- The movement of cattle to Northern Ireland has continued to perform strongly with the YTD figure sitting at 32,934 which is a 117.3% increase on the 2020 figures.

- The UK and NI experiencing tight supplies has influenced demand and the exchange rate has made Irish cattle more competitive in NI.

- The live exports of animals to Northern Ireland for direct slaughter is expected to remain strong as prices remain more favourable in NI compared to the south.

- IFA have raised the issues with live exports to GB with the Minister for Agriculture and senior DAFM officials

Food Regulator

- IFA has long called for greater market transparency at all levels in the food chain, so that margins and profitability of processors and retailers are clearly visible. This move by the Commission is welcomed and must be implemented in Member States.

- In the detailed Submission to the Public Consultation on the Transposition of the EU Directive on UTPs in the Food Supply Chain made by IFA in 2019 the importance of extending the powers of the ‘Food Regulator’ to implement member state requirements under Commission Implementing Regulation (EU) 2019/1746 which applies from 1st January 2021 in relation to transparency and price reporting was set out.

- IFA have proposed that the role of this Food Regulator could be expanded to provide the European Commission with the mandatory price reporting required to comply with the transparency legislation.

- The Minister has outlined the importance of greater transparency in the supply chain to the Beef Task Force and the primary legislation must ensure the Office of the Food Regulator are resourced and empowered to provide this.

- The primary legislation must provide the office of the Food Regulator full investigative and enforcement powers for all aspects of the food production chain from farm to the end consumer which extends to all issues that impact on price.

- Starting at the primary level the office must be in a position to quantify production costs on farms, investigate these costs, the factors that influence them including detailed and thorough analysis of all input prices and the factors that influence these.

Brexit

- The revised timetable for SPS checks and controls removes uncertainty in our key export for the next number of months.

- Factories can continue to access the market without the uncertainty of the impact of additional checks and controls that were scheduled for April and July.

- Beef and suckler farmers must be first in line to have the impacts of Brexit addressed through the Brexit Adjustment Fund.

Mercosur

- IFA have highlighted the double standards applied by the commission in this trade deal compared to the standards demanded from Irish and EU beef farmers.

- IFA have called on the Irish Government to reject this deal.

- Irish beef farmers will be most impacted if this additional sub-standard beef is allowed onto the EU and UK marketplace.

- IFA are fighting a strong campaign at EU level to have the deal rejected.

- IFA have met the Commissioner for Agriculture and called for this deal to be stopped.

Chinese Market

- IFA have called on the Minister for Agriculture and Government to redouble their efforts to secure an immediate return of Irish beef to the Chinese market following the announcement that Ireland has fulfilled the criteria to attained official status from the OIE of negligible risk status for BSE.

CAP

- Livestock farmers depend on Direct Payments for 160% of Family Farm Income, this must be recognized in the new CAP

- Payments to active productive beef and suckler farmers must be protected

- The payments and/or value of payments to active productive suckler and beef farmers must not be eroded in the new CAP policy through reduced efficiencies and productivity imposed in the National Strategic Plans

- IFA demands for livestock farmers in the CAP

- Convergence and its impact on the more productive livestock farmers must be kept to a minimum

- Eco Schemes must provide farmers the opportunity to reclaim at a minimum the amount contributed by each farmer reflecting the higher environmental ambition that will be achieved and the increased production costs associated on livestock farms

- Suckler farmers must receive a payment of €300/cow

- The pilot dairy calf to beef scheme must be extended to include farmers who rear beef animals from the suckler herd including store and finishing farmers

- National co-financing must be maximized in Pillar 2

- The commitment in the Programme for Government of the €1.5b carbon tax monies must be honoured in full through meaningful Pillar 2 schemes for livestock farmers

New BEEP-S

- Applications for the new BEEP-S closed on Mon, April 26th.

BDGP

- IFA called for the cohort of farmers who participated throughout the scheme but did not qualify for payment last year to be provided with the opportunity to join the scheme for 2021.

BEAM

- A six-month extension to the scheme has been granted to give farmers more time to meet the 5% reduction.

- This offers participants the option to choose the reference period 1st January to 31st December 2021.

- Applicants will be required to apply between April and June to avail of the extended period.

- However, if applicants meet the reduction requirement by the end of June for the original reference period this will be automatically accepted as compliance.

- It is advisable that all farmers in the scheme apply for the extension.

- IFA have sought the recognition of a TB breakdown during the course of the reference period as Force Majeure and the 5% requirement be removed.

- DAFM committed to applying the same criteria as is applied in the Nitrates calculation for restricted herds but due to audit concerns are not prepared to provide this

- All TB restricted farms have their reduction target reduced proportionally to the period of restriction for the farm

- DAFM recognize TB as a Force Majeure, all farmers can make an application to DAFM to have their particular situation recognized

- IFA are pursuing a simplified system with clear parameters which maximize the opportunity for all restricted farms to be accepted as Force Majeure and have the 5% requirement removed.

- IFA have sought a reduction in the sanctions for participants who fall short of the 5% requirement but have recorded a reduction in their herd.