Market Report

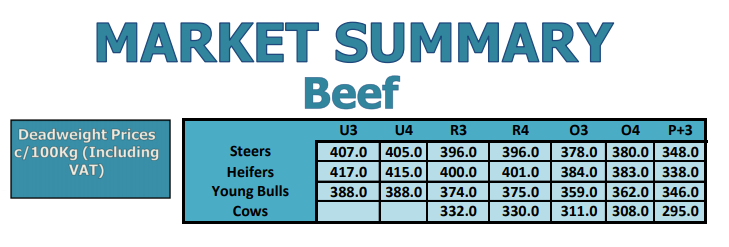

- Beef Price: Prices have started to edge upwards in the past week. Steers are generally making €3.75/kg base price. Heifers €3.80/kg with higher deals for larger lots and increased breed bonuses paid. Young Bulls are ranging from €3.60 to €3.85/kg for O/R/U grades. The cow trade strengthened during the week, P grades are making €2.90 to €3.00/kg, O grades €3.00 to €3.20/kg, R/U grades €3.30 to €3.50/kg.

- DAFM Reported Prices w/e 21/2/21; Prices for last week dropped by 4c/kg to €3.96/kg for R3 steers.

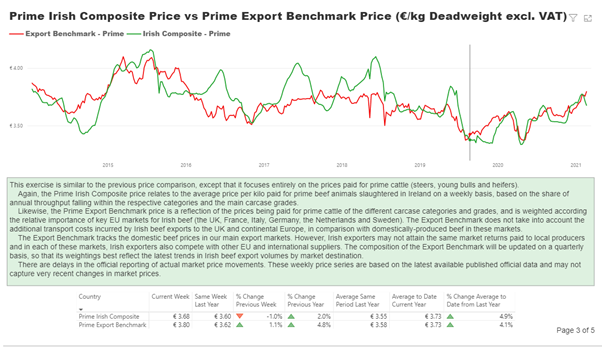

- Beef Market Tracking: The Prime Irish Composite Price for last week dropped by 3c/kg to €3.68 with the Export Benchmark Price increasing by 4c/kg to €3.80/kg

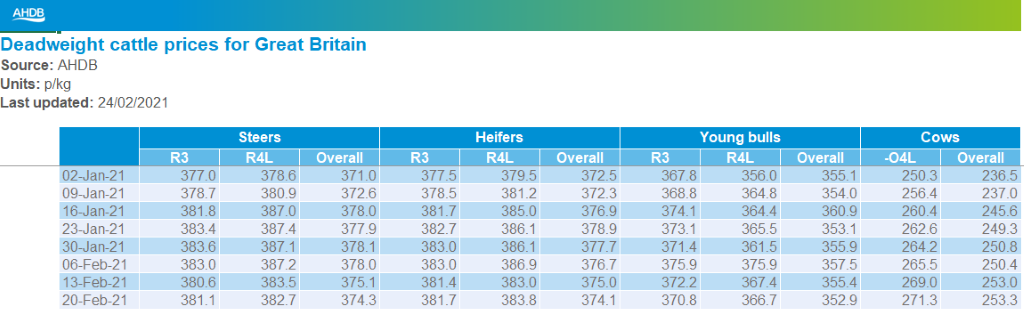

- GB Cattle Prices as reported by AHDB; Prices in GB for steers overall dropped for the third week in a row, R3 steers eased over the previous 2 weeks but strengthened slightly last week increasing by .5p/kg

- Sterling; Sterling strengthened since the beginning of the year reaching 86p/€ in midweek but has weakened to 87p/€ by w/e.

- Supermarket trade; The supermarket trade in the UK continues to perform strongly for beef. The 3 key measures of volume, price and spend show growth in the 52- and 12-week period analysis.

- Supplies; Supplies of cattle are predicted to be tight for the year in Ireland and the UK. Bord Bia predict Irish supplies to be back 60,000 to 80,000 head compared to last year with UK supplies predicted to be back 5% for the year.

- Latest DAFM Kill figures;

- Market Conditions; The current market conditions do not justify the price cuts imposed by meat factories. The Export Benchmark Price has strengthened further showing the demand for beef in our key export markets. Supermarket demand for beef is strong and supplies are tight. Over the course of the past week prices have started to edge upwards with 5 to 10c/kg more paid than the lower quotes offered by some factories.

- IFA Activity; Following the unjustified dropping of quotes by factories and the divergence from the Export Benchmark Price IFA called for the Beef Task Force to be convened immediately and wrote to the chairman of the Task Force. IFA met MII and left the industry representative body in doubt that undermining of the market by factories was not acceptable. IFA have continued to highlight the facts of the marketplace and provide farmers with the factual information to counter the factory narrative.

BREXIT

- Beef farmers continue to feel the impact of Brexit since the vote in 2016. The devaluation of sterling that occurred is impacting directly on the value of our beef exports to the UK. Since 2015 sterling has weakened by over 20%.

- Additional controls that will come into effect on April 1st for accessing the UK market will require veterinary certification for each consignment and pre arrival notification to UK Authorities.

- There are issues with certification of mince and other such processed meat products to be resolved before April 1st.

- July 1st physical checks on consignments will commence for products entering the UK.

- The 40-day residency requirement for live exports between the UK and the EU will have a severe impact on this trade where animals are sold through sales. DAFM figures to the end of October 2020 show a total of 8,246 animals exported. This consisted of 7,360 dairy bred animals and 886 beef bred animals.

- Beef and suckler farmers must be first in line to have the impacts of Brexit addressed through the Brexit Adjustment Fund.

Mercosur

- The Mercosur trade deal will provide access for an additional 99,000/t of sub-standard beef to our key markets if allowed progress.

- IFA have highlighted the double standards applied by the commission in this trade deal compared to the standards demanded from Irish and EU beef farmers.

- IFA have called on the Irish Government to reject this deal.

- Irish beef farmers will be most impacted if this additional sub-standard beef is allowed onto the EU and UK marketplace.

- IFA are fighting a strong campaign at EU level to have the deal rejected.

- IFA have met the Commissioner for Agriculture and called for this deal to be stopped.

Live Exports

- Live cattle exports in 2021 have picked up in recent weeks after a slow start,

- For the week ending February 13th live cattle exports reached 4,975 head

- The movement of cattle to Northern Ireland has continued to perform strongly into 2021.

- In the latest week 1,892 were exported, this included a combination of calves and store cattle for further feeding, and 353 animals for direct slaughter.

- For the first 6 weeks of 2021, live exports of cattle are back by 1% compared to the same period last year.

- 14,059 head of cattle are exported to-date with 50% of this to Northern Ireland.

- Due to recent bad weather, livestock have not been able to travel by sea and this has affected the numbers of calves exported.

CAP

- Livestock farmers depend on Direct Payments for 160% of Family Farm Income

- Payments to active productive beef and suckler farmers must be protected in the new CAP.

- The payments and/or value of payments to active productive suckler and beef farmers must not be eroded in the new CAP policy through reduced efficiencies and productivity imposed in the National Strategic Plans

- Suckler farmers must receive a payment of €300/cow

New BEEP-S

- The new BEEP-S scheme is set to open in the coming weeks with farmers who produced autumn born calves being advised to weigh animals coming near weaning and take notes of the date and weights which can be inputted into the system when it officially opens.

BDGP

- IFA called for the cohort of farmers who participated throughout the scheme but did not qualify for payment last year to be provided with the opportunity to join the scheme for 2021.

BEAM

- IFA met senior DAFM officials on the flexibilities provided by the commission.

- The key objective must be to ensure these monies are protected.

- A six-month extension to the scheme has been granted to give farmers more time to meet the 5% reduction.

- This offers participants the option to choose the reference period 1st January to 31st December 2021.

- IFA have sought the provision of a rolling 12-month period within these 18 months.

- IFA have sought a further extension to the timeframe.

- Applicants will be required to apply between April and June to avail of the extended period.

- However, if applicants meet the reduction requirement by the end of June for the original reference period this will be automatically accepted as compliance.

- It is advisable that all farmers in the scheme apply for the extension.

- More relevant and detailed monthly updates will be provided by DAFM, including the provision of an on-line calculator on Agfood.ie to project forward.

- The March and subsequent letters will also include a DAFM projected figure for the herd to the end of June.

- IFA have sought the recognition of a TB breakdown during the course of the reference period as Force Majeure and the 5% requirement be removed.

- DAFM have committed to applying the same criteria as is applied in the Nitrates calculation for restricted herds.

- IFA have sought a reduction in the sanctions for participants who fall short of the 5% requirement but have recorded a reduction in their herd.

| Brendan Golden Chair | Anna Daly/James Walsh Policy Executives | Tomas Bourke Senior Policy Executive |