Livestock Reports

Livestock Council Report March 2022

- Beef Price: Steers are generally making €4.45 to €4.55/kg. Heifers are making €4.50 to €4.60/kg with higher deals for larger lots and increased breed bonuses paid. Young Bulls are ranging from €4.40 to €4.60/kg for R/U grades. Cows are making €3.70 to €4.20/kg.

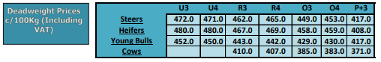

- DAFM Reported Prices w/e 13/02/2022: R3 steer prices for the last week were up 3c on the previous week at €4.62/kg, R3 heifer prices were up 6c at €4.67/kg. R3 young bull prices increased by 6c to €4.43/kg. P+3 grade cows were up 5c/kg to €3.71/kg, O3 grades were up 4c/kg to €3.85/kg, R3 grades were back 3c/kg to €4.10/kg.

- Beef Market Tracking: The latest available data shows the Prime Irish Composite Price for w/e Feb 12th to be at by €4.34/kg with the Export Benchmark Price at €4.39/kg.

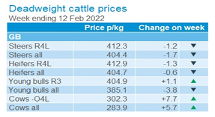

- GB Cattle Prices as reported by AHDB: Prices in GB for R3 steers decreased slightly by 0.2p/kg in the latest week bringing the price to £4.12/kg

Supply Figures as Reported by DAFM – Week 6 (07.02.2022)

| Animal | Number | Change prev. wk. | % of total | YTD | YTD Change |

| Y Bulls | 4,135 | ▲444 | 11% | 23,296 | ▲2,226 |

| Bull | 469 | ▲140 | 1% | 2,661 | ▲729 |

| Steer | 12,700 | ▲45 | 33% | 69,240 | ▲3,985 |

| Cow | 8,052 | ▲97 | 21% | 42,197 | ▲4,537 |

| Heifer | 11,051 | ▼-276 | 29% | 63,117 | ▲1,646 |

| Veal-V | 1,773 | ▲1,614 | 5% | 1,994 | ▲325 |

| Veal-Z | 40 | ▼-32 | 0% | 298 | ▲75 |

| Total | 38,220 | ▲2,032 | 100% | 202,803 | ▲13,523 |

- Supplies: Supplies are currently 13,523 ahead of supply figures ay this stage last year.

- Market Conditions: Market conditions are favorable for Irish beef. Beef prices in our main export markets, the UK and EU, are strong. The increased activity in the UK food service sector is driving demand for processed beef in particular and with reduced production forecasted for the EU, it creates positive market conditions for Irish beef

Live Exports

- For the week commencing 31st January, live cattle exports reached 2,965 head.

- Live exports for the year to date have reached 11,791, up 2,707 on the 2021 figures to the same date.

- The Irish calf exports YTD figure sits at 1,874 which is 371 calves more that at the same period in 2021.

- The movement of cattle to Northern Ireland is 1,242 behind the same stage in 2021.

Input Costs

- Feed and fertilizer cost increases alone have increased production costs on beef farms by 65c/kg, eroding the increase in beef price

BEAM

- The six-month extension to the scheme granted to farmers to meet the 5% reduction ended on 31st December.

- IFA have sought the provision of an extended period for repayment with no interest charges for farmers unable to meet the reduction requirement

- All TB restricted farms have their reduction target reduced proportionally to the period of restriction for the farm

- IFA have sought the recognition of a TB breakdown during the course of the reference period as Force Majeure and the 5% requirement to be removed.

- IFA have sought a reduction in the sanctions for participants who fall short of the 5% requirement but have recorded a reduction in their herd.

- IFA are seeking the provision of the better of the two references periods for farmers who failed to meet the 5% reduction by the end of December.

- IFA are meeting DAFM on the issue.

CAP

- The Minister for Agriculture must confirm his funding intentions for the national suckler cow scheme to run alongside the CAP Pillar 2 Suckler cow scheme.

- The funding allocation to sucklers for 2023 is €28m below current support levels.

- The Minister has committed that all cows applied on in the new CAP Suckler Scheme will be paid at €150/cow for the first 10 and €120/cow for the remainder, this will require an increase in the €52m annual funding provided.

- €300/cow must be provided in targeted support to suckler farmers from 2023 onwards.

- The Minister must provide a rearing and finishing scheme for cattle farmers that will return €100/animal to support farmers in meeting the higher environmental production requirements

Climate Action

- The sequestration on livestock farms must be fully accounted for.

- The livestock sector must be provided with the financial supports necessary to reflect our climate ambition

- The proposed NAP is exposing lower stocked suckler and beef farmers to unnecessary additional costs of compliance in areas such as LESS and outwintering

- The reduced thresholds at which this measures become applicable impacts directly on low stocked suckler and beef farms who are not in a position to incur the additional costs associated with these unnecessary changes

Brexit Adjustment Reserve (BAR)

- The BAR must be used to off set the losses beef finishers experienced in Spring 2021

Electronic Payments from factories

- IFA have met MII and sought the provision of electronic payments to farmers for cattle (ETF).