Livestock Council Report May 2022

Market Report

Beef Price: Steers are generally making €4.90 to €5.05/kg. Heifers are making €4.95 to €5.10/kg with higher deals for larger lots and increased breed bonuses paid. Young Bulls are ranging from €4.90 to €5.10/kg for R/U grades. Cows are making €4.30 to €5.00/kg.

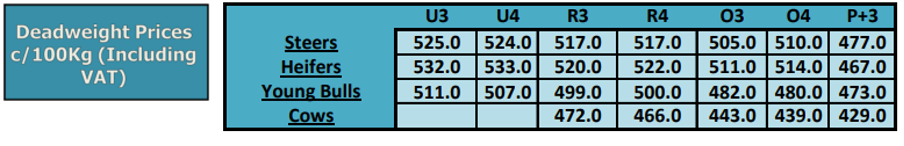

DAFM Reported Prices week ending 25/02/2022: R3 steer prices for the last week were up 5c on the previous week at €5.17/kg, R3 heifer prices were up 5c at €5.20/kg. R3 young bull prices increased by 2c to €4.99/kg. P+3 grade cows were up 7c/kg to €4.29/kg, O3 grades were up 5c/kg to €4.43/kg, R3 grades were up 6c/kg to €4.72/kg.

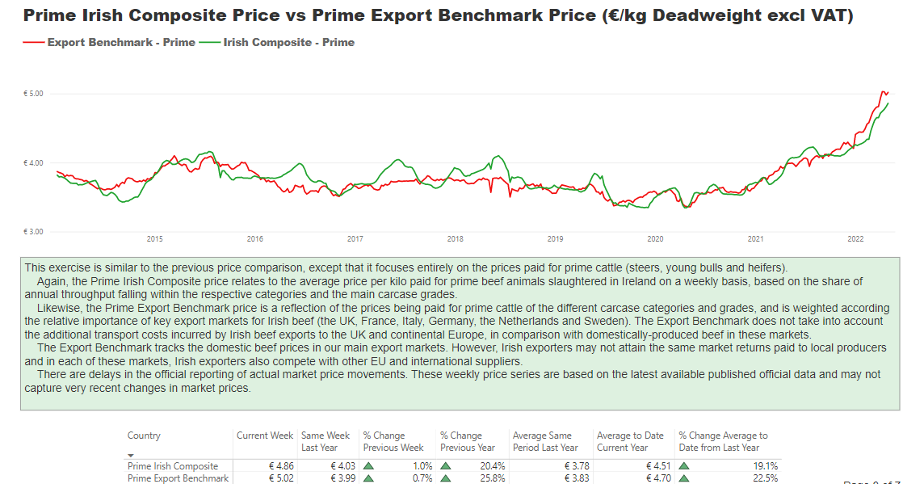

Beef Market Tracking: The latest available data shows the Prime Irish Composite Price for week ending April 30th is at €4.86/kg with the Export Benchmark Price at €5.02/kg.

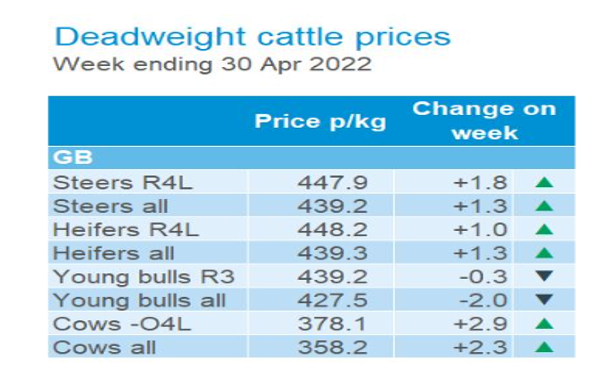

GB Cattle Prices as reported by AHDB: Prices in GB for R3 steers increased by 0.4p/kg in the latest week bringing the price to £4.48/kg

Supply Figures as Reported by DAFM – Week 17 (01.05.2022)

| Animal | Number | Change prev. wk. | % of total | YTD | YTD Change |

| Y Bull | 2,622 | ▲653 | 7% | 47,662 | ▲1,187 |

| Bull | 818 | ▲210 | 2% | 8,468 | ▲1,250 |

| Steer | 13,829 | ▲1201 | 37% | 198,838 | ▲17,143 |

| Cow | 8,558 | ▲316 | 23% | 122,232 | ▲22,498 |

| Heifer | 10,668 | ▲1191 | 29% | 164,712 | ▲11,613 |

| Veal – V | 891 | ▲446 | 2% | 26,967 | ▲6,874 |

| Veal – Z | 39 | ▼-1 | 0% | 680 | ▼-17 |

| Total | 37,425 | ▲4016 | 100% | 569,549 | ▲60,548 |

Supplies: Total throughput is running 60,548/head ahead of the same period last year.

Market Conditions: Market conditions for Irish beef remains strong. Tight supplies and strong market demand for beef in our key export markets creates positive conditions for Irish producers. Demand for beef in the UK and EU is extremely strong.

Live Exports:

- For the week ending April 23rd, total live cattle exports reached 285,374/head up 9.5% on the same period in 2021.

- Irish calf exports have increased 19% or 36,398/head on 2021 figures to 225,248/head in 2022.

- The movement of cattle to Northern Ireland is back 26,544/head on the same period in 2021.

Input Crises

- IFA wrote to Minister for Agriculture Charlie McConalogue seeking immediate direct financial support for Suckler and Beef farmers.

- IFA is seeking financial supports for suckler and beef farmers to offset the increased costs for feed, fertiliser and fuel on farms based of their levels of production.

- Guaranteed support for farmers investing in beef production for the remainder of the year and into 2023.

- All lands must be utilised to produce fodder including lifting restrictions on land under schemes such as traditional hay meadow and Low input grasslands.

- Following IFA demands the Minister announced a €55m silage support package providing farmers with a €100/ha payment for all silage cut up to a maximum of 10ha.

- The scheme announced has to have the maximum flexibility to help farmers deal with the input’s crisis.

- The cap of €1,000 will have to be re-visited to reflect the needs of those farms with higher stocking levels. The research undertaken by Teagasc, which underpinned the scheme, will have to be taken into account

- The Department of Agriculture must frame the scheme to ensure the full drawdown of funds.

- Payments must be proportionate to the area claimed. The payments should reflect full hectares, and any part of a hectare, claimed.

- The Minister’s announcement is a first step, but more will be needed.

- The recent Teagasc report found the impact of increased input expenditure will exceed output growth for the year. The production costs on suckler and finishing farms are projected to increase by 24% and 30% respectively.

CAP

- IFA met senior DAFM personnel on 25th April and again set out the demands of the suckler and beef sector in the new CAP.

- €300/cow must be provided in targeted support to suckler farmers from 2023 onwards.

- The Minister must provide a rearing and finishing scheme for cattle farmers that will return €100/animal to support farmers in meeting the higher environmental production requirements

- The Minister has committed that all cows applied on in the new CAP Suckler Scheme will be paid at €150/cow for the first 10 and €120/cow for the remainder, this will require an increase in the €52m annual funding provided.

- The Minister for Agriculture must confirm his funding intentions for the national suckler cow scheme to run alongside the CAP Pillar 2 Suckler cow scheme.

- The funding allocation to sucklers for 2023 is €28m below current support levels.

- Specific issues raised in the context of the proposed 2023 Suckler Carbon Efficiency Scheme include;

- The allocated budget must be ring fenced for the scheme and for suckler farmers for the 5 years.

- The reference period provided must include 2022

- The reference number per farm must allow new entrants to the sector and existing farmers develop their enterprise while contributing to the objectives of the scheme to receive payment for all of their cows

- SBLAS membership must not be a compulsory eligibility condition for the scheme

- The targets in the scheme must be realistic and must not penalise smaller farms where the % requirement is disproportionate.

- The % target requirements for the Replacement Strategy must be based on the last full animal number.

- Compliance with the Replacement Strategy cannot be based on the status of the sires of calves born in 2023, this would require an action on farms in May and June 2022 when no scheme has been agreed or available for application.

- The genotyping measure should be based on genotyping calves at birth when tagging with a reasonable minimum target that allows for empty samples, mortalities and issues with testing.

Climate Action

The joint Beef and Sheep Climate Group has not yet been convened by the Minister.

NAP

- The proposed NAP is exposing lower stocked suckler and beef farmers to unnecessary additional costs of compliance in areas such as LESS and outwintering

- The reduced thresholds at which these measures become applicable impacts directly on low stocked suckler and beef farms who are not in a position to incur the additional costs associated with these unnecessary changes.

Brexit Adjustment Reserve (BAR)

- IFA are making a detailed submission to DAFM for livestock farmers from the Brexit Adjustment Reserve. The impact of the stockpiling of beef in late 2020 in the UK on beef prices in early 2021 will be part of the submission which will also focus on providing income resilience for beef farmers into the future as the full impact of Brexit has yet to be determined if/when trade deals and access issues come into play.

BEAM

- IFA met DAFM personal on March 4th and set out the following demands for BEAM scheme applicants.

- IFA have sought the provision of an extended period for repayment with no interest charges for farmers unable to meet the reduction requirement

- All TB restricted farms have their reduction target reduced proportionally to the period of restriction for the farm

- IFA have sought the recognition of a TB breakdown during the course of the reference period as Force Majeure and the 5% requirement to be removed.

- IFA have sought a reduction in the sanctions for participants who fall short of the 5% requirement but have recorded a reduction in their herd.

- IFA are seeking the provision of the better of the two references periods for farmers who failed to meet the 5% reduction by the end of December.

BEEP – S

- Applications for the 2022 BEEP-S opened with the closing date Monday, April 25th.

BDGP

- IFA met DAFM personal on March 4th and demanded all BDGP participants be paid all monies outstanding due to DAFM altercations made to the stock bull and AI requirement.

- For applicants using a stock bull, at least one animal on the holding on the 30th June 2022 must have been a genotyped 4 or 5 star bull on either the Terminal or Replacement index (on a within or across breed basis) at the time of purchase.

Electronic Payments from factories

IFA met MII on March 4th and demanded EFT to be provided as an option of payment to all beef farmers.