Livestock Reports

Livestock Council Report October 2022

- Market Report

- Beef Price: Steers are generally making €4.65 to €4.75/kg. Heifers are making €4.70/kg to €4.80/kg with higher deals for larger lots and increased breed bonuses paid. Young Bulls are ranging from €4.60 to €4.90/kg for R/U grades. Cows are making €4.30 to €4.70/kg.

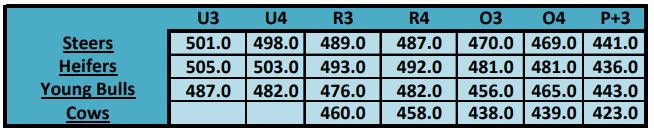

- DAFM Reported Prices week ending 09/10//2022: R3 steer prices for the last week were back 5c/kg on the previous week at €4.89/kg, R3 heifer prices were back 5c/kg at €4.93/kg. R3 young bull prices decreased by 4c/kg to €4.76/kg. P+3 grade cows were back 8c/kg to €4.23/kg, O3 grading cows were back 8c/kg to €4.38/kg, R3 grading cows were back 7c/kg to €4.60/kg.

- Beef Market Tracking: For the week ending October 1st, 2022 the average reported R3 steer price dropped marginally by 3c/kg on the previous week at €4.68/kg while the Irish R3 heifer price reduced by 3c/kg to €4.72/kg. This downward pressure on deadweight prices is in response to weaker demand due to higher inflation levels and external pressures.

- Composite prices: The Irish prime composite cattle price and the prime Export Benchmark for week ending October 1st, 2022 were equivalent to €4.62kg and €4.89/kg deadweight respectfully.

- GB Cattle Prices as reported by AHDB: Prices in GB for R3 steers increased by £1.8p/kg in the latest week bringing the price to £4.47/kg. R3 Heifers have also increased by £1.1p/kg to £4.45.9/kg to week ending October 8th 2022.

- Supply Figures as Reported by DAFM – Week 40 (03.10.2022)

| Animal | Number | Change prev. wk. | % of total | YTD | YTD Change |

| Y Bull | 1,587 | ▲- 30 | 4% | 104,125 | ▲5724 |

| Bull | 399 | ▼- 111 | 1% | 22,620 | ▲1,204 |

| Steer | 18,839 | ▼ – 643 | 47% | 549,494 | ▲31,282 |

| Cow | 7,684 | ▲- 871 | 19% | 303,584 | ▲40,172 |

| Heifer | 11,069 | ▲- 1,023 | 28% | 384,217 | ▲20,472 |

| Veal – V | 62 | ▲- 45 | 0% | 28,141 | ▲7,338 |

| Veal – Z | 58 | ▲ – 41 | 0% | 1,329 | ▲107 |

| Total | 39,698 | ▲ – 1256 | 100% | 1,393,510 | ▲106,299 |

- Supplies: Total throughput is running 106,299/head ahead of the same period last year A revised supply forecast for 2022 indicates a recovery in total cattle slaughtering’s for the year in the region of 110,000 to 120,000 with a higher cow kill and lower exports to Northern Ireland contributing to a slight increase in the supply outlook.

- Market Conditions: Cattle prices at factory level have come under pressure in the past fortnight as numbers of finished stock coming to market have increased significantly. High levels of inflation in some key export markets have resulted in some reduction in demand as consumer spending comes under pressure. Demand for manufacturing beef remains strong and as the Christmas trade is just weeks away and demand for beef should improve to help underpin the trade in this period.

- Live Exports: The live export trade has remained firm so far in 2022 with total cattle exports operating 8% ahead of 2021 levels. There have been over 230,000 cattle exported from Ireland up to the week ending September 24th 2022.

- CAP

Suckler Carbon Efficiency Programme

- IFA met senior DAFM personnel on October 6th to discuss the proposed terms and conditions for the new Suckler Carbon Efficiency Programme set out in the CAP strategic plan.

- Specific issues raised in the context of the proposed 2023 Suckler Carbon Efficiency Scheme include;

- €300/cow must be provided in targeted support to suckler farmers from 2023 onwards.

- The reference number per farm must allow new entrants to the sector and existing farmers develop their enterprise while contributing to the objectives of the scheme to receive payment for all of their cows. The reference period must include the most up to date year available (2022).

- The monies allocated to the scheme must be ring fenced for suckler farmers

- SBLAS membership must not be a compulsory eligibility condition for the scheme.

- Compliance with the Replacement Strategy cannot be based on the status of the sires of calves born in 2023, this would require an action on farms in May and June 2022 when no scheme has been agreed or available for application.

- The 80%, 85% and 90% targets for calves born sired by 4 or 5 star bulls must be reduced and simplified.

- The Dam requirement targets of 50%,60% and 75% must be reduced.

- The genotyping measure should be based on genotyping calves at birth when tagging with a reasonable minimum target that allows for empty samples, mortalities and issues with testing.

- The % target requirements for the Replacement Strategy must be based on the last full animal number.

- The facility allowing reduced numbers without sanction must be aligned with reduced targets in these years for the Replacement Strategy and genotyping targets. Payments must be

- Budget

- €28m announced in Budget for suckler scheme to run parallel to the SCEP.

- Details of the scheme have yet to be finalised

- The Minister did not provide a rearing and finishing scheme for cattle farmers that will return €100/animal to support farmers in meeting the higher environmental production requirements.

- Food Vision Beef Group

- The final report is due to be submitted to the minister in late November 2022.

- The next meeting is scheduled for Monday 24th October where it is intended to sign off on the ‘Interim Report’

- Presentations on potential measures have been given by Teagasc, ICBF, AHI and DAFM

- IFA have put forward the following key points;

- The target for the sector should be to continue to produce beef from one of the most environmentally sustainable production systems in the world, based on our suckler herd.

- Our €2.5bn beef sector is built on the production standards and image of the world-class beef produced from our suckler cow farms.

- Suckler cow numbers are in serious decline and we are at a critical stage, with less than 50% of our beef animals now coming from suckler herds.

- Since 2018, there has been a significant reduction in suckler cow numbers, leading to a reduction of over 20% in suckler beef production.

- Suckler farming is an extremely vulnerable sector.

- Suckler and beef farmers will play our part on climate action. Measures that are practical to implement; have the potential to add value on our farms; and contribute to the climate objective will all be considered.

- The level of ambition for the sector will be determined by the level of Government and industry ambition to directly support farmers in the process.

- We do not have the economic capacity for extra investments or changes of practice on our farms.

- Measures include age at slaughter; genomic testing, animal health and targeted medicines usage; soil health and fertility; alternative crops; and support for generational renewal.

- We cannot ignore the fact that our beef sector, which is the largest farming enterprise in the country, is most exposed to the impact of Brexit, our more productive suckler and beef farmers are most exposed to inputs inflation and these are the very same farmers hit hardest in the flawed Common Agriculture Policy and reduced targeted support commitments from Government.

- There is a real opportunity for Government now to come forward with a funding package to support suckler and beef farmers to ensure as a country we continue to produce beef at a time of real food security and food sovereignty concerns.

- The tools are not yet available/proven that can guarantee specific emissions reduction at a national level.

- We cannot move faster than the science, technology and tools by setting arbitrary figures for the sector that have the potential to undermine food production, food security, food sovereignty and the socio and economic viability of our rural towns and villages.

- The suckler herd and beef originating from it has reduced by over 20% since 2018.

- The plans for the sector must take this into account and set about protecting this critical national resource.

Climate Target Supports- New Funding

- The measures outlined to the Beef Food Vision Group for the sector to achieve emission reduction targets are not new.

- The level of ambition for the sector in implementing some of these measures will be directly correlated to the level of funding ambition from Government for beef and suckler farmers to support these changes and new practices on farm.

- NAP

- The proposed NAP is exposing lower stocked suckler and beef farmers to unnecessary additional costs of compliance in areas such as LESS and outwintering.

- The reduced thresholds at which these measures become applicable impacts directly on low stocked suckler and beef farms who are not in a position to incur the additional costs associated with these unnecessary changes.

- Input Crises

- IFA continue to seek immediate direct financial support for Suckler and Beef farmers to offset the increased costs feed, fertiliser and fuel on farms based of their levels of production.

- IFA wrote to Minister for Agriculture Charlie McConalogue seeking immediate direct financial support for Suckler and Beef farmers.

- Following IFA demands the Minister announced a €55m silage support package providing farmers with a €100/ha payment for all silage cut up to a maximum of 10ha.

- IFA successfully secured a rollover of the fodder support scheme for 2023 in the recent budget.

- An advance payment for the 2023 scheme will be issued in December

- The recent Teagasc report found the impact of increased input expenditure will exceed output growth for the year. The production costs on suckler and finishing farms are projected to increase by 24% and 30% respectively.

- Teagasc have estimated that cattle finishers will require €5.84/kg to breakeven over the upcoming winter period.

- Guaranteed support for farmers investing in beef production for the remainder of the year and into 2023 is required.

- Brexit Adjustment reserve (BAR)

- IFA have made a detailed submission on the Brexit Adjustment reserve setting out potential Mitigants and support measures for livestock farmers impacted through Brexit.

- The BAR fund must be utilised to directly support suckler and beef farmers to safeguard their farm income situation from the potential impacts of Brexit which looms over the sector.

- Direct / compensatory aid for revenue lost, paid direct to impacted farmers. €337m lost because of weakened sterling; C.€101m lost revenue Sept ’18-Mar’19; €8.3m mid Oct-19 to end Jan ’20; €12.5m end Jan ’21-Apr ‘21 because of depressed prices.

- Subventions on added cost of production.

- Evidence of reduced capital investment on beef farms must be addressed. Measures, including direct-aid to support improved performance, efficiency and/or sustainability of the agricultural holding and therein support improved income resilience.

- Measures to reduce reliance on inputs by directly supporting farmers to implement measures that improve soil health and animal health leading to higher production efficiencies, recognising time, labour and management commitments of farmers to achieve same.

- Measures to promote On-Farm Diversification.

- Measures to support Intergenerational Renewal / Collaboration type supports/models.

- Measures to promote transitional arrangements involving new and experienced operators.

- BEEP – S

- All weights must be submitted to ICBF between 1st January 2022 – 1st November 2022.

- BDGP

- 50% of the applicant’s reference number of cows must be 4 or 5 star on October 31st 2022.

- Electronic Payments from factories

- IFA have met MII and demanded that EFT be provided as an option of payment to all beef farmers.

- Events/Activity

- Food Vision Beef and Sheep group meetings

- €300 Suckler cow payment, €100 rearing and finishing payment.

- Met DAFM officials on October 6th to discuss the Suckler Carbon Efficiency Programme.

- Committee members met with their local processing plants to discuss prices and markets.

- Livestock Budget submission.

- Ongoing contact with DAFM regarding SCEP and BEEP-s schemes.

- Hosted Bord Bia Paris office meat manager on beef/suckler farm in Sligo highlighting the standards of production on typical beef suckler farms.

- Weekly publication of IFA beef price updates.

- Ongoing contact with Bord Bia.

- Brexit Adjustment Reserve.

- Livestock committee meeting convened on July 12th, September 12th and October 14th.