EU and Global Timber Market

Disruption from the Russian invasion of Ukraine, an outbreak of spruce bark beetle in central European forests and supply chain disruptions after the Covid-19 pandemic have created extreme volatility in the global timber market over the past year.

The Russian invasion of Ukraine led to the EU placing trade sanctions on Russia and Belarus in April 2022, including an import ban on timber and restrictions on timber exports. Russia is the largest softwood timber exporter globally and ranks as the seventh largest exporter of forest products worldwide. Forest product exports from Russia have increased rapidly in the past five years. This disruption has caused major uncertainty and the loss of supply has affected the global timber markets.

An outbreak of the spruce bark beetle which has damaged central European and Alaskan forests from 2017-2021 resulted in a surge in emergency harvesting to remove

infected trees. The amount of timber damaged by bark beetle peaked in 2019 and the level of harvested trees has been falling in the years since. The decline over the past year in timber harvests in Central Europe have impacted European timber markets.

Rising costs and lower construction demand accompanied by a fall in business and consumer confidence have currently stabilised timber prices below the peak prices seen towards the end of 2021. However, with the rise in energy costs, timber retains a competitive advantage as it is relatively low energy product to produce compared to high energy and carbon intensive materials such as cement and steel.

Irish Timber Market

The last quarter of 2021 saw a strong demand in the Irish timber market driven by global demand for timber and timber products.

The forestry sector was heavily impacted by supply chain constraints from 2020-2021 during the Covid-19 pandemic. These constraints resulted in a supply imbalance. Once restrictions eased and construction returned to full capacity demand for home building and renovations increased as consumers post lockdown had more disposable income. The demand for timber exceeded supply, resulting in exceptionally strong pricing.

This combined with the forest licence crisis and the delays processing forestry licences for felling and forest roads, further increased the imbalance in the Irish market. This resulted in sawmills increasing the volume of timber imported to fulfil orders which contributed to the increase in prices. The disconnect between demand and supply, fed into the volatility and high prices in 2021.

The Irish timber market in early 2022 saw the demand for timber fall as construction demand began to decline, however timber supply was also impacted as supplies of timber in Europe were constrained due to the Ukraine war.

Russia, Ukraine, and Belarus were major distributors into the EU. A strong demand in the market remained consistent during the first half of the year because of the EU ban on timber exports from Russia and Belarus and the supply chain recovery after the Covid-19 pandemic restricted supply.

The exceptional prices in the market in 2021 which continued into early 2022 saw a decline in the second half of 2022. Economic uncertainty, due to the Russian invasion of the Ukraine, and a decline in consumer confidence due to inflation and the rising cost of living and has had a significant impact on construction levels. The CSO Production in Building and Construction Index shows that output was down 4.5% in Q2 2022.

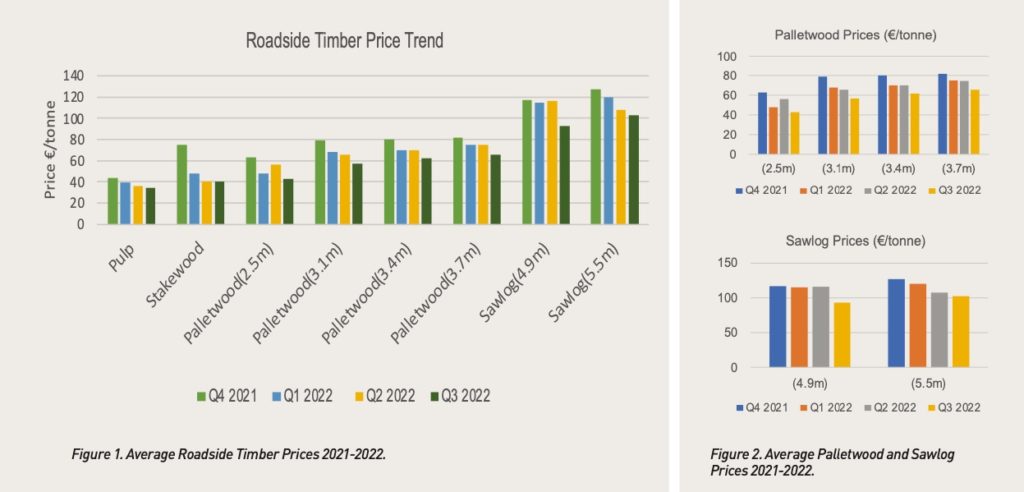

As a result, the prices for timber and sawlog in particular reduced significantly, with average prices for sawlog decreasing by 20% from Q3 2022 compared to Q4 2021 prices.

Timber Market Outlook 2023

The outlook for 2023 is difficult to predict with the current market situation however it is expected that the ongoing war in Ukraine, and continued sanctions, will reduce the supply of timber globally.

The housing demand in Ireland is set to continue and the demand for timber construction combined with lower supply should result in a rise in prices.The prices quoted are sourced from IFA Farm Forestry Timber Market reports 2021-2022 and were sourced from forest owners, forestry companies and sawmills. For more information and to keep up to date on timber market trends visit IFA’s dedicated Timber Market Reports section here.

You can also download a printable version of this report here.